ORCL Oracle Corporation Charting Tool and Technical Analysis

Post on: 16 Март, 2015 No Comment

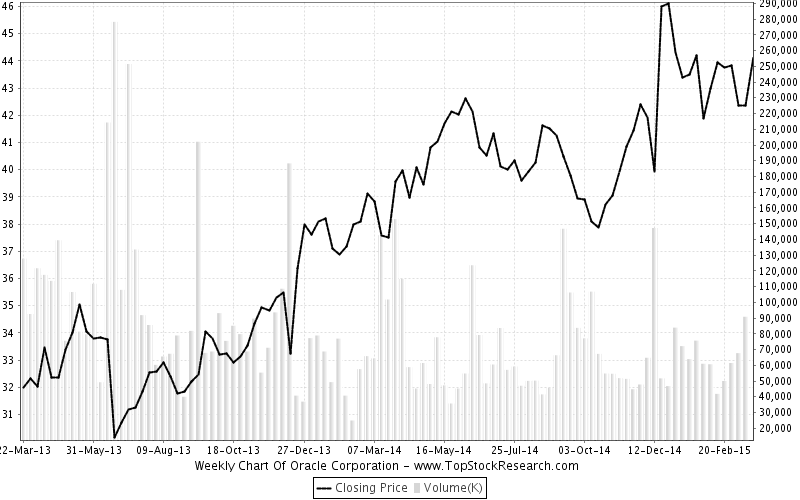

Charts for Oracle Corporation (ORCL )

How to Use the InvestorGuide Charting Tool

How to Use the InvestorGuide Charting Tool

InvestorGuide’s Interactive Charting offers you the ability to investigate historical trends of ORCL’s stock price and compare the performance of ORCL to several well-known benchmarks. We have gathered all of the important information into one simple tool so that you can research any company you like quickly and easily, whether you are an expert stock researcher or a beginner investor. Read below to learn more about how you can use InvestorGuide’s Interactive Charting to research ORCL.

Features of InvestorGuide’s Interactive Charting Tool

Chart Settings

Use one or more of the following dropdown menu(s) to build and view custom charts:

Time — Select the length of the time period the chart should cover (upto the last 20 years).

Freq — Use the frequency option to select the intervals with which the data should be displayed.

Type — Pick from 7 different chart types including line, bar, candlestick etc.

Click the ‘Build Chart’ button to see your chart.

Comparisons

Use this menu of options to compare ORCL with other tickers, indices and sectors.

Index — Compare the performance of ORCL with that of 13 major indices including the Dow Jones Industrials, NYSE Composite, Dow Jones Transportation etc.

Sector — Compare the performance of ORCL with 17 sectors such as airlines, internet, biotech, utilities etc.

The sector and index tools allow you to see how ORCL matches up with a more diversified index portfolio.

Compare — Compare ORCL with upto 10 other tickers and view all the charts at once to get a quick overview of how all these stocks have performed relative to each other in the past.

Click the ‘Build Chart’ button to see your chart.

Upper Indicators

Use this menu of options to calculate the moving average of ORCL’s stock price so that you can predict future movement as accurately as possible. You can use either the Simple Moving Average (SMA) or the Exponential Moving Average (EMA), the difference between them being that EMAs reduce the lag (moving averages are lagging indicators) by applying more weight to recent prices relative to older prices. The shorter the EMA’s period, the more weight that will be applied to the most recent price. You can use any number of days as the period. If you’d like to see multiples of the period, simply select the number of multiples (2 or 3) you’d like.

You can also see corporate events such as stock splits, earnings and dividends and the impact they have had on the stock. Use the upper indicator drop down menu to see additional information such as Bollinger Bands, MA envelopes etc.

Click the ‘Build Chart’ button to see your chart.

Lower Indicators

Pick from 13 additional data points (e.g. volume, momentum, MACD) and map them in (upto) 3 additional mini-charts that will be displayed below the main chart.

Click the ‘Build Chart’ button to see your chart.

Save Settings

Use the ‘Remember Chart Settings’ button to save your chart design, specifications and mapped data points. This will ensure that all future stock charts that you see on InvestorGuide.com will have the same settings and have the same data points mapped on to them. Use the erase chart settings button to clear your saved preferences.