OptionsHouse Review_1

Post on: 27 Июнь, 2015 No Comment

W hat distinguishes one online discount broker from another? As more and more online brokers enter the low-fee arena, they each try to distinguish their trading services and cost structure from all the others. OptionsHouse has two features that set it apart from other discount brokers: (1) professional grade online trading tools, and (2) stock trades for a flat fee of just $4.75.

At $4.75 a trade, OptionsHouse offers one of the lowest cost discount brokers I can find. As important as cost is, though, its not the only factor to consider when selecting an online discount broker. So lets take a look at what OptionsHouse has to offer.

OptionsHouse Basics

Since 2005, OptionsHouse has been leveraging technology to make it possible for investors to make trades online. Its goal is to take professional grade software trading tools and make them accessible and efficient for traders in conjunction with Internet technologies. With OptionsHouse, investors can trade and manage accounts online with the following financial instruments:

- Equities

- Options on Equities

- Mutual Funds

OptionsHouse Features

OptionsHouse has a variety of features that make a top consideration for online investors:

- Flat-Rate, Affordable Pricing. Investors at OptionsHouse can count on a regular low fee that makes it easy to calculate commission payments. Stock trades are just $4.75 and options are $5. These affordable rates stay the same, regardless if you are making just a few trades or a massive quantity.

- Expert Training and Tutorials. Investors who choose OptionsHouse will have access to a variety of outstanding educational resources, tutorials, and even webinars with experienced traders. The goal with the expert training tools and tutorials is to transform novice investors into knowledgeable traders. Many of these educational resources are available to anybody, even if you dont have an account with OptionsHouse.

- Financial Protection. Like many other leading brokerages, OptionsHouse is a member of SIPC, which offers $500,000 in account protection. OptionHouse’s clearing firm maintains additional SIPC Insurance, which protects another $900,000 per customer.

- Streamlined Platform. OptionsHouse runs on The PEAK6 trading platform, which is popular among retail and institutional investors alike. One of the most beneficial elements of OptionHouse’s platform is its integration of trading tools, which helps traders to easily manage real-time prices with trends. In addition, the platform makes trade execution incredibly fast and easy.

Virtual Trading

OptionsHouse offers account holders the ability to try before you buy, so to speak. Called virtual trading, investors can trade with virtual money to test out OptionsHouses trading platform and their own investing strategies. Virtual trading allows investors to:

- Enter virtual orders

- Track your accounts hypothetical performance

- Use the full suite of OptionsHouse idea-generation and risk-management tools, including streaming charts and news and volatility tools

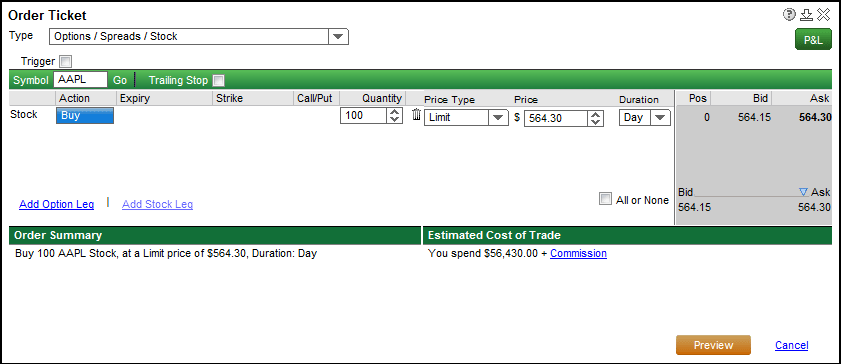

Heres a screen shot of the OptionsHouse trading platform that a virtually trader would use:

OptionsHouse Account Types

OptionsHouse offers several different account types. In addition to standard cash and margin accounts, OptionsHouse offers the following types of accounts:

- Individual

- Corporate

- Roth IRAs

- Sep IRAs

- Traditional IRAs

- UTMA/UGMA

- Trusts, Partnerships

- Investment Clubs

- Educational IRAs

OptionsHouse Drawbacks

As with any new financial management endeavor, it is important to read and understand the fine print, and OptionsHouse is no exception to this rule. There are certain limitations to trading with OptionsHouse. For example, investors may trade up to 50,000 shares or 4,000 option contracts per trade. Beyond these amounts, additional charges will apply. While OptionsHouse will cover account transfer fees associated with switching from a different broker, they will only cover a maximum of $100 in transfer fees. The minimum funding amount to open an account is $1,000. In addition, to execute a trade, you must have enough money in your account to cover the trade plus $100 to cover trading costs

From top to bottom, OptionsHouse is an excellent choice for online trading. With its low trading costs and technology platform, this online discount broker is one of the best. To complete an application online, visit OptionsHouse . Happy trading!