Options Vega by

Post on: 25 Июнь, 2015 No Comment

Options Vega — Definition

Options Vega measures the sensitivity of a stock option’s price to a change in implied volatility.

Options Vega — Introduction

Why Is Options Vega Important?

It is almost impossible to understand why Options Vega is so important without first a comprehensive understanding of Implied Volatility.

In short, the more a stock is expected to make a big move due to some important news release or earnings release in the near future, the higher the implied volatility of that stock is right now. In fact, implied volatility rises as the date of that important release approaches. This is also due in part to the higher demand for the options of those stocks as speculative heat builds up. Under such circumstances, market makers also hike implied volatility in order to charge a higher price for the higher demand. Which really means that implied volatility is largely at the mercy of market makers ‘ whims and is its effects on the price of an option is measured by the Options Vega.

Since implied volatility rises as important news releases approach and since Options Vega made sure that the price of the stock rises along with it, wouldn’t the few days running up to such events be perfect for buying options and hoping that the stock remains relatively stagnant so as to profit from the rise in implied volatility? Yes! In fact, many options traders take delta neutral and gamma neutral positions a few days before important news releases so as to profit from the rise in implied volatility safely and then closing the position just before the release.

Personal Options Trading Mentor

Just as implied volatility can float an option’s price through Options Vega, it can also erase a big chunk of value off stock options very quickly should implied volatility falls dramatically, particularly after important news releases are made. This is what we call a Volatility Crunch. When implied volatility falls, options with positive Options Vega fall in value along with it. That is why it can be dangerous to buy options on stocks with a very high Options Vega just before important news releases if you want to hold that position for the long term. In fact, the implied volatility could have floated the extrinsic value of those options so high that when the big move is eventually made, it barely covers the extrinsic value and ends up in a loss all the same.

Options Vega — Characteristics

Positive And Negative Polarity

Options Vega come in positive or negative polarity. Long options produces positive Options Vega while short options produces negative Options Vega. Positive Options Vega increases the price of options and negative Options Vega decreases the value of that position when implied volatility goes up.

Options Vega & Options Moneyness

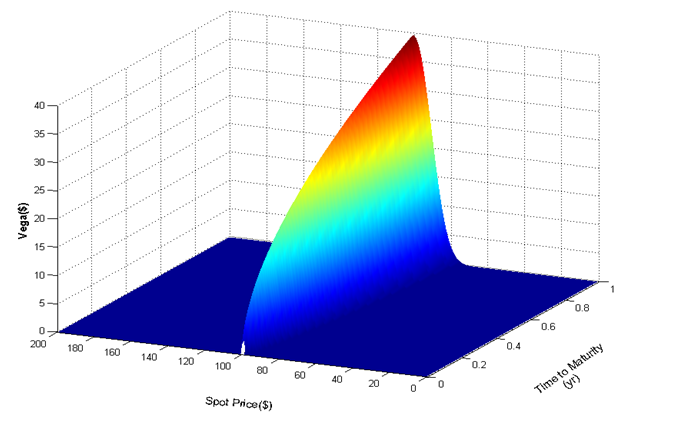

Options Vega decreases towards 0 as the option moves deeper In The Money or farther Out Of The Money. At The Money options typically has the highest Options Vega value. This also means that the extrinsic value of deep In The Money or far Out Of The Money options are less likely to change with a change in implied volatility. This is because stock options have lesser and lesser amount of extrinsic value as they move farther away from the money, and because Vega affects extrinsic value, it is natural for it to be lower at those points.

Options Vega & Time

Options Vega is higher as time to expiration becomes longer. The more time to expiration a stock option has, the more uncertainty there will be as to where it will end up by expiration, which translates into more opportunities for the buyer and higher risk for the seller. This results in a higher Vega for stock options with longer expiration in order to compensate for that additional risk taken by the seller.

Options Vega — Relationship with Options Gamma

Again, higher gains comes with higher risk. Like Options Theta. Options Vega also share a linear relationship with Options Gamma. When Options Gamma is highest, which is when options are At The Money. Options Vega is also the highest, subjecting the options trading position to a high risk of volatility crunch along with the potential of exponential, explosive gains granted by Gamma. With Vega as well as Theta working against an At The Money position, options traders need to make sure that the expected gain in the underlying stock more than covers the extrinsic value when buying such positions.