Options Trading With The Iron Condor_1

Post on: 26 Июнь, 2015 No Comment

From the Desk of Steven Place

Dear Future Wealth Builder,

If you turn on CNBC or grab a copy of the Wall Street Journal, you’ll find that everyone is trying to find their edge by predicting where the market will head next.

But making the right call is really tough!

It’s so important, that big banks and hedge funds spend millions of dollars on analysts and research just to figure out where the markets will be in a year.

(And they aren’t always right!)

Do you really want to compete with these guys?

Would you believe me if I said you could build wealth in the stock market without playing the game?

I want to show you a simple trading strategy that can easily make you over 40% returns every year without needing to master the market.

If you are looking for better results for your portfolio, read on and I’ll show you how you can do it.

To YOUR Success,

Steven Place

Founder and Head Trader

InvestingWithOptions

The Most Profitable Asset You’ve Never Heard About

When you hear about diversification what do you think about?

Traditional Diversification

If you’ve listened to your broker or the financial media, diversification means having your money in different buckets to reduce risk. So they tell you that you need a mix of stocks and bonds, maybe a little gold on the side.

And you could diversify further by picking up some real estate, or maybe some commodities if you want to bet on wheat or corn.

All of that is well and good up to a point, but it still means you will have your head stuck in research and charts all day so you can try to optimize that portfolio.

But just recently, a new asset class became available that was once only available to hedge funds or very sophisticated traders.

This asset class is called volatility — and it reveals hidden profits in the market that you can take without having to predict the future of the market.

How to Make Money With Volatility

Most investors and traders care about one thing: whether the market is going up or down.

But with volatility, you care about how fast the market will move, and whether it will stay in a certain range.

If you are bullish volatility. you make money if the market sees a larger move than what was expected.

If you are bearish volatility. you make money if the market sees a smaller move than what was expected.

That means you can make money on the market no matter what direction it heads, as long as you get the volatility right.

The Dirty Secret About Wall Street

All those people you see on CNBC and read in the Wall Street Journal? They are directional traders.

They always expect the markets to see huge moves in their favor.

That’s because if they said the market’s going nowhere, they would lose visitors!

But here’s what we know— most of the time, investors are wrong when it comes to volatility. The market has a tendency to overprice what actually happens.

And you can make profit from that fact.

Building Wealth With This Options Trade

There is an option strategy known as an iron condor. It may seem complex at first, but all you need to know is that you profit if the market stays within a range.

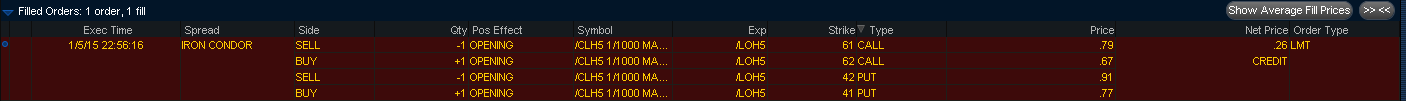

An Example of an Iron Condor

It is a high odds trade that takes advantage of investors expecting large moves all the time. This is a bearish volatility strategy that can produce consistent profits every single month.

How does this work so well?

Basically, you have these directional traders who are expecting massive moves in the market. And they will take bets using options, expecting that these massive moves will happen sometime soon.

Iron Condors allow you to take the other side of that trade. So those traders expecting huge price swings in the market pay you when they are wrong.

It’s like getting a paycheck every single month from Wall Street!

But all of this comes with a catch.

The Problem With Iron Condors

The problem most people have with iron condors is that they think these kinds of trades are set and forget, where you just put on an iron condor and are guaranteed a return.

But sometimes the market does move a lot— and if you don’t have a plan, then you can stand to lose a lot of money.

You see, Iron Condors are an active strategy. You need to know how to adjust them to manage your risk, so you can be consistently profitable throughout the year.

I know all about these problems. I have personally taught over 1000 students how to trade options, so I know the problems you face as a new trader.

What you need is a trading framework that you can use, month after month, to put on trades with full confidence.

The Iron Condor Intensive

Here’s what you will learn.