Options Trading explained Put and Call option examples

Post on: 29 Май, 2015 No Comment

Stock Options — what you will learn by reading this article in detail

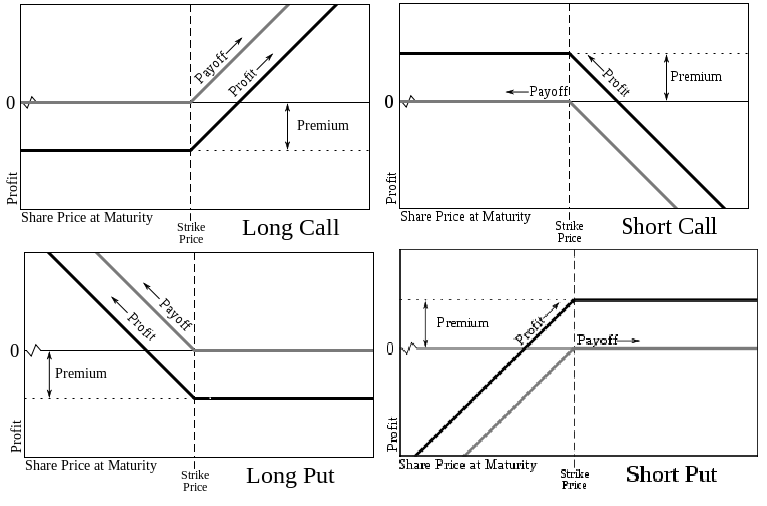

There are two derivative instruments which every investor must know of — Futures and Options. In this post I will explain the two different types of Options — Put option and Call Option starting with an example. By the time you finish reading this post, I hope you will have understood the difference and concepts underlying the following four types of options trading.

- Buying a Call Option .

- Selling a Call Option (also sometimes called as writing a Call Option ).

Whether it is stock options or commodity options, the underlying concept is the same. So let us start by understanding an example.

Simple Call Option example — How call option works?.

Suppose you are interested in buying 100 shares of a company. For the sake of this example let us say that the company is Coca Cola and the current price of its stock is $50. However instead of just buying the shares from the market what you do is the following: You contact your friend John and tell him Hey John, I am thinking of buying 100 shares of Coca Cola from you at the price of $52. However I want to decide whether to actually buy it or not at the end of this month. Would that be OK?. Of course what you have in mind is the following.

- If the stock price rises above $52, then you will buy the shares from John at $52 in which case you will gain by simply buying from John at $52 and selling it in the market at the price which is above $52. John will be at a loss in this situation.

- If the stock price remains below $52 then you simply wont buy the shares from him. After all, what you are asking John is the ‘option’ to buy those shares from him — you are not making any commitment.

In order to make the above deal ‘fair’ from the viewpoint of John you agree to pay John $2 per share, i.e. $200 in total. This is the (risk) premium or the money you are paying John for the risk he is willing to take — risk of being at a loss if the price rises above $52. John will keep this money irrespective of whether you exercise your option of going ahead with the deal or not. The price of $52, at which you would like to buy (or rather would like to have the option to buy) the shares is called the strike price of this deal. Deals of this type have a name- they are called a Call Option. John is selling (or writing) the call option to you for a price of $2 per share. You are buying the call option. John, the seller of the call option has the obligation to sell his shares even if the price rises above $52 in which case you would definitely buy it from him. You on the other hand are the buyer of the call option and have no obligation — you simply have the option to buy the shares.

Simple Put Option Example — How put option works?

Let us consider a situation where now John wants the option to sell you his 100 shares of Coca Cola at $48. He agrees to pay you $2 per share in order to be able to have the ‘option’ to sell you his 100 shares at the end of the month. Of course what he has in mind is that he will sell them to you if the price falls below $48, in which case you will be at a loss by buying the shares from him at a price above the market price and he will be relatively better off rather than selling the shares in the market. The $2 he is willing to pay you is all yours to keep irrespective of whether John exercises the option or not. It is the risk premium. In this case John is buying a Put Option from you. You are writing or selling a Put Option to John. $48 is the strike price of the Put Option. In this case, you the seller or writer of the Put Option have the obligation to buy the shares at the strike price. John, the buyer of the Put Option has the option to sell the shares to you. He has no obligation.

Difference between above option examples and ‘real life options’

The above examples illustrate the basic ideas underlying, writing a call, buying a Call, writing a Put and selling a Put. In real life you sell (or write) and buy call & put options directly on the stock exchange instead of ‘informally dealing’ with your friend. Here are some key points to remember about real life options trading.

- Options trading is directly or automatically carried through at the stock exchange, you do not deal with any person ‘personally’. The stock exchange acts as a ‘guaranteer’ to make sure the deal goes through.

- Each Options contract for a particular stock has a specified LOT SIZE. decided by the stock exchange.

Examples of Situations where Options are traded

Why buy options rather than buying the underlying stock or commodity? there are several situations where buying or writing an option can help. Here are some examples (but please bear in mind, options trading is very dangerous and unless you know what you are doing you should avoid it)

- If you speculate that the price of a stock is going to rise, you buy a call option. This is merely speculative trading in case of options.

Further reading on Options Trading

There are still some details to be explained as to how do options really work, various options trading strategies and examples, advanced concepts like Option Greeks. and some do’s and dont’s about options trading. These are explained in posts listed on the right column of this page. If you have still have questions or additional remarks, please do not hesitate to ask in a comment. You may also like to download the free option greeks calculator. a must-have-tool for every investor .