Options Trading Buy Options For Swing Trading Profits Or Sell Options For Time Decay

Post on: 20 Апрель, 2015 No Comment

There’s no best way to trade options. Each method has its positive and negative implications, so find an options strategy that best fits the situation and then use it with skill.

Trader Sam asks:

I have heard that delta-neutral strategies are the best approach to trading options but I have less than $6,000 in my trading account and my broker’s margin requirements make it impossible for me to trade iron condors, butterflies and other income strategies. So I feel that my only alternative is to buy options utilizing my directional opinion on a stock for a 3- to 5-day swing trade. Am I correct?

This is a very good question.

First of all there is no best way to trade options. Each method has its positive and negative implications. One of the secrets to options trading is to find the options strategy that best fits the situation and then use that strategy with skill. This comes from experience and a lot of hard work.

Second, I think that you can trade delta-neutral strategies with between $5,000-$6,000 in your trading account. In fact, I would not recommend your trading any more than that in your first year of trading delta-neutral strategies, as they are full of nuances that you can learn only through experience. At my firm, our trainees normally start with a $5,000 trading account in which they trade, monthly, four or five separate income strategies including, in most cases, iron condors and butterflies.

How do we do this? It’s not that complicated. First of all, calendar spreads and butterfly spreads do not eat up very much capital compared to iron condors and other strangle types of trades such as double diagonals. Our trainees normally set aside between $500 or $1,000 for these types of trades. So there is no reason you can’t get practice trading either of those strategies immediately. As for iron condors and double diagonals, they certainly are more capital intensive, but that problem can be resolved by selecting a lower cost vehicle to trade.

For example, I just modeled a five-point strike-separation, 3-lot, SPY iron condor that you could theoretically trade in connection with this coming October expiration for $1,050 of margin vs. the equivalent trade in the $SPX index (a 3-lot, 50 point strike separation iron condor) for more than $10,000 in margin. Admittedly, the ratio of commissions to potential profit in the SPY condor is higher, but using the SPY to practice trading iron condors on the $SPX ultimately, when you are ready to trade a larger account, is an excellent idea.

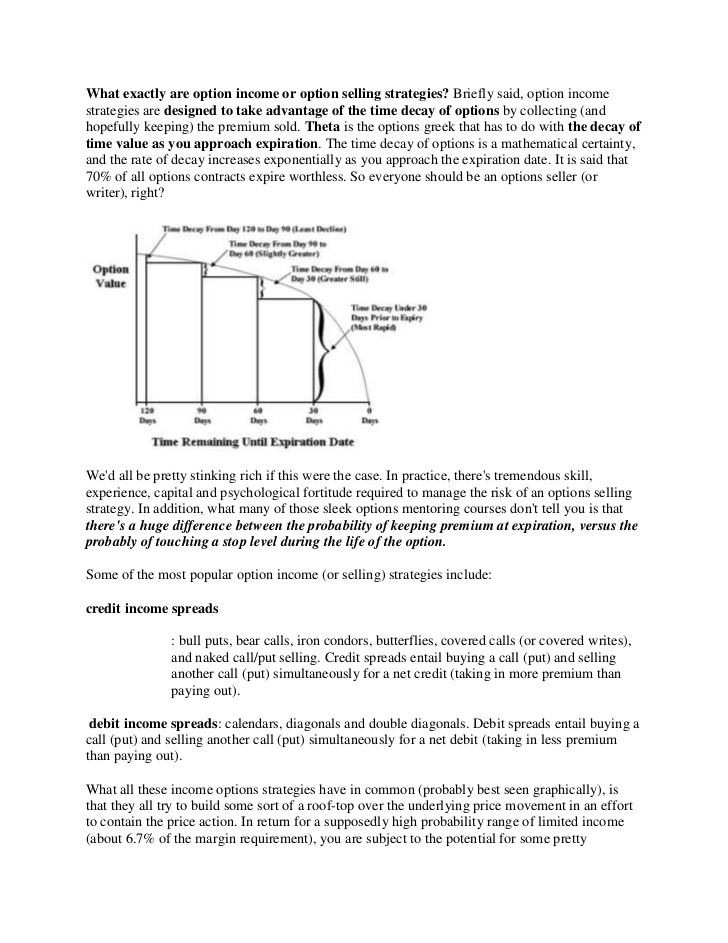

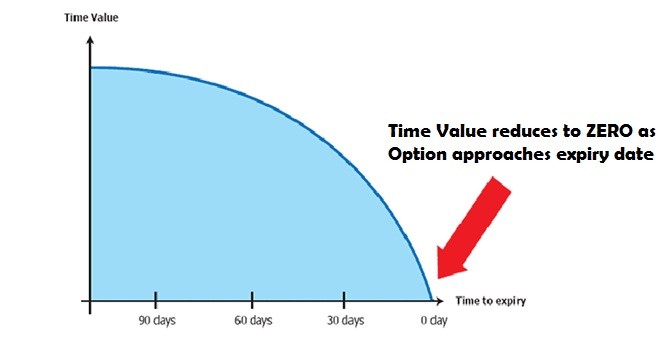

All of this is not to say that you can’t successfully buy calls and puts outright depending upon your directional opinion of a particular stock, ETF or index. However when you do so, time (and volatility) are your enemy whereas with delta-neutral strategies, in which the trader is normally net short options, time is always your friend. As time passes, the price hurdle for you to make a profit on a long call or put gets higher. If volatility drops, matters gets worse. Having said that, properly traded long calls and puts can provide spectactular gains, but equally spectacular losses. Most people who dabble in long options struggle and ultimately give up. Delta-neutral options trading, on the other hand, teaches you how to get the time decay built into options to work for you, not against you, month in and month out, without the necessity of a directional opinion.

I suggest learning more about delta-neutral strategies and continue a learning curve with those trades by using lower priced vehicles.

Editor’s Note: This post was written by Seth Freudberg of SMB Capital .

For more on options trading, take a 14 day FREE trial to OptionSmith . Get access to veteran options trader Steve Smith’s portfolio along with emailed alerts and strategy with every trade he makes. Learn more .