Options Traders Watching Puts Volatility for Signs of a Bottom

Post on: 16 Март, 2015 No Comment

Exclusive FREE Report: Jim Cramer’s Best Stocks for 2015.

Options traders will surely be happy just to have Tuesday over with. But come Wednesday, they’ll be back checking those put -buying and volatility readings, trying to find the bottom.

While the turmoil Tuesday was unsettling, there are some soothing signs in the tumult, according to those with a contrarian bent.

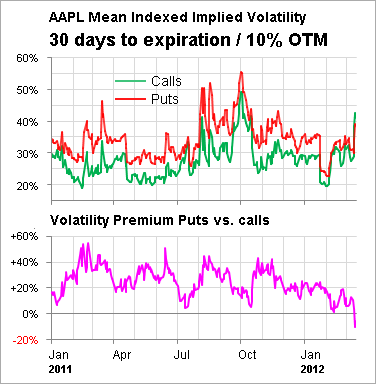

Joe Sunderman, manager of research and development at the Schaeffer’s Investment Research options-trading and research firm in Cincinnati, pointed out that the Chicago Board Options Exchange volatility index, a leading measure of investor fear, made a very significant move Tuesday. The VIX soared as high as 35.44 intraday, its highest level since Oct. 15 — which was a high that preceded the market’s October bottom.

We’re definitely seeing some fear reflected in the VIX, Sunderman said. That could mean a bottom is at hand.

One floor trader at the American Stock Exchange echoed that sentiment: This is the worst of what I could imagine, the trader said around midafternoon on Tuesday. It’s really, really bad.

Sunderman said further put-option buying over the next few days would be encouraging, as would stabilization in the price action. Sunderman said he also wants to see some of the 10-month moving averages hold on the key indices. He pointed out that the 10-month moving average on the S&P 100 is around 740, while for the Nasdaq Composite Index it’s at about 3500. The S&P 100 fell 7.33, or 0.9%, to 813.29, while the Comp fell 74.79, or 1.8%, to 4148.89.

Of volatility, one options strategist at a New York firm said investors have to get used to it. The strategist suggested using close stops on stock positions, or using options to protect themselves.

The bottom line, the strategist said, is that there shouldn’t be anyone whining or complaining about the market’s tumble, considering how fast and far it has gone up.

Tuesday’s Market Action

The volatility index soared intraday to levels not seen since October. The VIX eventually closed up 8.7% to 27.90, far below its intraday peak of 35.44.

The S&P 100 bottomed out around 1:10 p.m. EDT at 770.38. The VIX rises when S&P 100 index put buying increases. The VIX peaked at around 1:15 p.m. EDT.

As for the Nasdaq Composite Index. it traded in a whopping 634.34-point range, falling as low as 3649.11 and trading as high as 4283.45. The Comp’s intraday low coincided with the time the fear in the options market was the highest.