Options Strategy #2 Protective Put

Post on: 16 Март, 2015 No Comment

Last week, I did a brief introduction to an options strategy that can be used to get additional returns with little downside risk. Today, I will take the time to look at another very popular strategy, the protective put. As discussed in the introduction to options, these derivative instruments can be used in most portfolios if they are used in a smart and disciplined way. Like almost any product, if options are used without a clear and disciplined plan, things can go awry.

What is a protective put?

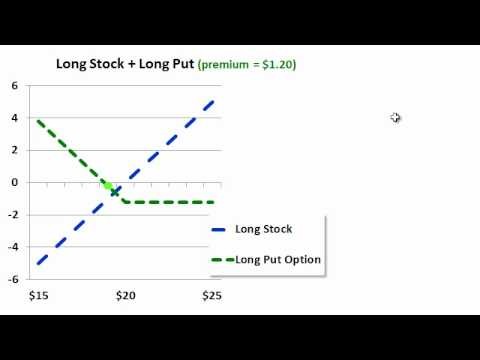

This strategy involves holding shares of a specific company, index or basket of stocks and also holding a put option on the underlying position. This put option will make money if the stock(s) lose value and becomes a hedge, that will be able to offset a loss on the holding. It is in fact a type of insurance in case of a declrease in value for your position.

When can it be used?

It can be used in many circumstances. The general reasoning is that the investor wants to keep his stock and is concerned about a possible decline in the stock. There could be a few reasons behind this situation. Here are some examples:

- Belief that the market will rise but that there is a smaller probability of a major decline from which he wants to be protected

- The investor believes there is a good chance that the stock will decline but does not want to sell them because it will create capital gain and thus important tax implication.

- The investor wants to keep the income flow from dividends without assuming too much risk if the stock price declines

- An investor holds some stock that he believes in but he determines a maximum amount he can afford or is willing to lose given a decline.

- An investor wants to protect against downside risk without selling his entire portfolio of stock (thus incurring major transaction costs)

In all of these cases, the protective put would be a very good strategy for the investor involved.

How do I determine what put to buy?

If you want to implement this strategy on a specific stock or portfolio, then you can simply buy a put option with that underlying stock. However, if you hold many stocks in your portfolio, it might be more effective (although imperfect) to hedge through one or two puts. For example, if your portfolio is heavily invested in financials as well as in the general stock market, you could buy put options on XLF (financials) and SPY (S&P500). This would give you protection on these broader indices.

Positive impacts

Depending on the reason behind your trade, the protective put can give you upside potential if your stocks climb and a limited loss if the stocks decline.

Negative impacts & risk involved

Like any other insurance, there is a cost associated to this strategy. The cost of course is the premium that you are paying when buying this insurance.

Earlier, I also discussed how you could hedge your entire portfolio with one or two put options. The risk involved is mainly if something exceptional happens to one of those stocks in your portfolio. If the company was involved in a fraud or had negative earnings while the industry in generally was still performing, the protective put would not be of much help.

I believe that as a portfolio grows, the potential use of a protective put becomes greater as there are many different uses for it. There are many different aspects to consider before entering into this strategy but it can be a very effective and cost efficient way of hedging downside risk for a limited period of time.

Please feel free to ask any questions regarding this strategy or options in general:)