Options PutCall parityPart I

Post on: 5 Июль, 2015 No Comment

Options: Put-Call parity-Part I

by J Victor on July 15th, 2012

Is there a relationship between the value of a call and the value of a put? The guy who answered that question for the very first time was Economist Hans Reiner Stoll in his book, “The Relation between Put and Call Prices” in 1969. The theory is also known as the law of one price. According to him, the prices of a call and a similar put are tied together and when one moves the other should move and vice versa.

To understand the relationship, let’s first take a look at two investors. Both investors have Rs 60,000 with them to invest.

He buys RIL CE 600 which gives him the right to purchase 100 shares of RIL at strike price of Rs 60o. He pays a small premium for it and keeps his cash with him.

He buys 100 shares of RIL purchased at Rs 600 each. He does not have any cash left with him. However, to protect his holdings, he would buy a put option of RIL at Rs 600 strike.

WHOS STRATEGY IS BETTER?

To analyse that, lets get into detail on both these strategies.

The first investor’s idea is that he will invest his cash in a risk free investment and will wait to see how the stock prices would move. In case, the stock’s price finishes higher than Rs 600 on expiry, he will exercise the option. He will buy at Rs 600 and sell at the current market price and take home the difference. In case, the stock finishes below the strike price he’ll let the option lapse. Anyway you look at it, he protects his 60,000 bucks.

Now, what’s the other investor’s idea? He too, wants to protect his holding from further price slide. He already has Rs 60,000 invested in RIL and will wait to see how the price moves. To protect his holdings, he has already bought a put option of RIL at Rs 600 strike. On expiry date if the price moves up, he would let the option lapse and sell his holdings in the cash market for a profit. If the stock finishes on the lower side, he would exercise his option to sell at Rs 600. Either way, he also protects his capital of Rs 60,000.

That means, irrespective of the strategy employed, both the investors protects their capital and plays a risk free game.

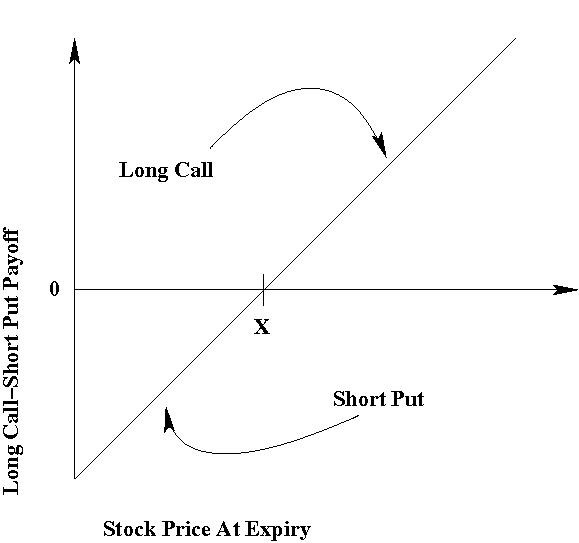

In other words, a call + equivalent cash (investor 1) was equal to a put + equivalent underlying asset (investor 2)!!

So, theoretically, RIL CE 600 June + cash =100 RIL shares + PE RIL 600 June. Both the combinations have the same value on expiry. If, that’s true, then logically, both the portfolios would have the same present value also. If there is a flaw in this relation, arbitrageurs would jump in and would go long on the undervalued portfolio and short the overvalued portfolio to make a risk free profit on expiration day. They will buy undervalued calls and sell over valued calls or will buy undervalued puts and sell overvalued puts.

This relationship between calls, cash, puts and the underlying asset is called put –call parity. The practical value of Put-Call parity always should be zero.This should be a stable at all the times. Or else, as said earlier, arbitrage opportunities will rise.

It’s also a simple test to validate the various option pricing models. Any pricing model which violates the put-call parity theory is considered flawed.

Put-Call Parity and American Options

You would have noticed that, the theory was explained with the help of European options. Put –call parity does not work in American style options since it allows early exercise. However, if they are held till expiry, the theory would work !

We will take up the formula and examples for put call parity in our next post on options.

You may like these posts: