Options On Gold And Silver ETFs

Post on: 25 Июнь, 2015 No Comment

The advent of the exchange-traded fund (ETF) has ushered in a new era for investors. In the old days, if an investor wanted a portfolio of small cap stocks or large cap stocks or growth or value plays, the only choice was to identify a basket of stocks that appeared to fit the desired criteria and to buy as many of those stocks as one’s capital would allow. Likewise, individuals who wanted to trade currencies and physical commodities had little choice but to venture into the realm of futures trading. Today, via the purchase of the proper ETF, an investor can gain exposure to investments in a wide variety of investment vehicles and styles. In fact, a vast array of commodity products can now be traded as easily as one would buy or sell an individual stock.

Two of the most heavily traded metals market ETFs are SPDR Gold Trust and iShares Silver Trust (in this article, we will be using their prices from 2008-2009 as examples.) Both of these ETFs are designed to track the price of the underlying precious metal in their names. GLD tracks the price of gold bullion (divided by a factor of 10). SLV tracks the actual price per ounce of silver bullion. In other words, if gold bullion is trading at a spot price of $800 an ounce then we can expect GLD to be trading at approximately $80 a share, like it did in 2008-2009.

Likewise, if silver bullion is trading at $12 an ounce, we can expect SLV to be trading at approximately $12 a share. So a bullish investor who wanted to hold a long position in gold could buy 100 shares of GLD for $8,000 (100 x $80). A bullish investor who wanted to hold a long position in silver could buy 100 shares of SLV for $1,200 (100 x $12). For most investors this is a much simpler process than buying the physical metal (which involves additional storage and insurance costs) or buying futures contracts. (To learn more, see The Gold Showdown: ETFs Versus Futures .)

A Quick Primer on Options on ETFs

Many popular ETFs — including GLD and SLV — now have call and put options available for trading. A call option gives the buyer the right but not the obligation to buy 100 shares of the underlying security up until the time the option expires. A put option gives the buyer of the option the right but not the obligation to sell 100 shares of the underlying security up until the time the option expires. A call option will typically rise in price as the price of the underlying security rises; a put option will typically rise in price as the price of the underlying security declines.

Option trading strategies open up a wide array of possibilities for traders. The primary advantages to trading options is that doing so can allow a trader to enter into a bullish, bearish or neutral position (i.e. positions that make money when the underlying security remains in a particular price range) depending on a given trader’s market outlook. Option trading also offers traders the potential opportunity to speculate on price direction at a fraction of the cost of buying the underlying security itself. (For a background on options, see our Options Basics Tutorials .)

The primary risk associated with buying call or put options is that they have a limited life and an expiration date, after which they cease to exist. If the underlying security fails to move in the anticipated direction prior to option expiration, it is possible that an option that you purchased may expire worthless or the strategy that you are using may run out of time to reach its objective.

Playing a Rise in the Price of Gold Using Call Options

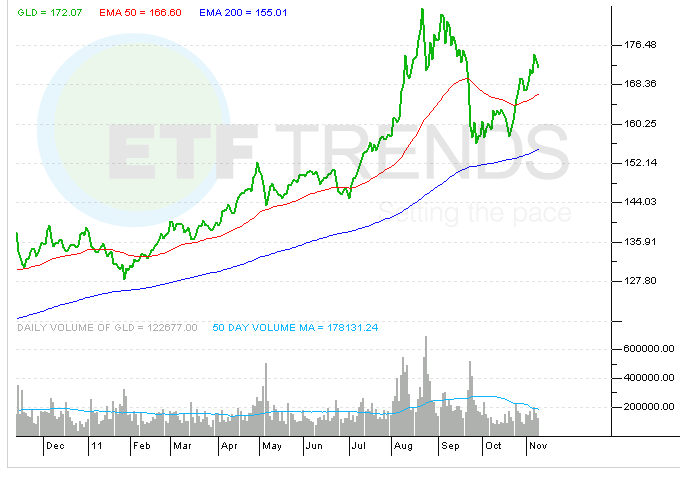

Let’s look at a bullish option trade using options on the ETF ticker symbol GLD. As you can see in Figure 1, on the date indicated by the upward pointing arrow, the 10-day moving average for GLD crossed back above its 30-day moving average. In addition, GLD had just recently moved above its 200-day moving average. A simple analysis might conclude that gold was re-establishing a bullish trend and that the price of gold may soon move higher.