OPTIONS IDEA Using LEAPS With Collars

Post on: 16 Март, 2015 No Comment

By: Staff at Investopedia.com

Todays election results will hopefully resolve one of the uncertainties plaguing the markets, but with many others still unresolved, the staff at Investopedia.com detail a strategy that can provide great protection in an uncertain market by limiting losses while locking in healthy, predictable profit.

Many investors have been in a situation where they wish to lock in profits while keeping their existing upside potential. For example, employees who have most of their 401(k)s invested in company stock may want to hedge against any sudden downturn in the company, while investors lucky enough to have struck gold with a solid stock may want to reduce some of their risk and lock in profits. Traditionally, this has been done by purchasing put options. The problem is that this strategy costs money. This article will cover how to lock in profits using a different and more economical strategycollars.

Collar Basics

A collar is a stock option strategy in which an investor purchases a put while simultaneously writing a call against the stock position. The most common collars are constructed by purchasing one put and writing one call for every 100 shares of underlying stock that you own. The put provides downside protection, while writing the call finances the purchase. The end result is a free way to lock in profits in which the only downside is the fact that your upside is limited. After all, the written calls will force the investor to sell his or her underlying stock position if the stock price rises above a given price before expiration.

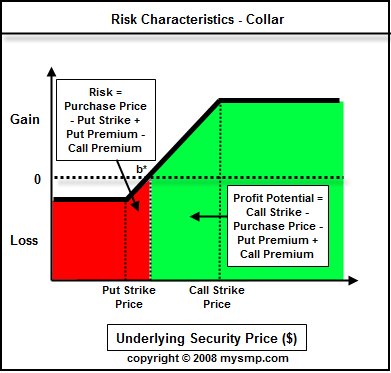

Here’s what the option’s profile looks like:

Click to Enlarge

Here are the key calculations for this strategy:

- Maximum Risk = Cost of Put — Credit from Call

- Maximum Profit = Differences in Strike Prices — Net Debit Paid

- Breakeven Point = Current Stock Price + Net Debit Paid

Using these calculations, you should be able to quickly calculate all of the possibilities for your stock position. Note that there is no real breakeven for this strategy because it is a neutral strategy, but the above calculation will tell you how much you need to make up to break, even on the cost of setting up the trade in the first place.

Example 1: Creating a Collar

Let’s say you own 100 shares of a stock that trades at $50 per share. To create a collar, you can sell a call option with an exercise price of $60 and buy a put option with an exercise price of $40. The call options sell for $1.20 each while the put options sell for $1.10 each. The position results in a positive credit to your brokerage account of $10!

Now, if the stock moves below $40 you have the ability to sell the stock for $40 with the put option you purchased, no matter how low the stock goes. If the stock rises to $60, however, you may be forced to sell at $60. While this is still a nice profit, you are not able to capitalize on any larger moves to the upside. Many consider this a small price to pay for the peace of mind that comes with full protection.

The dynamics of a collar can vary greatly depending on the situation. Investors have the option of writing zero-cost collars, in which writing calls fully offsets the cost of purchasing the puts (or may even result in a premium). Other investors may wish to increase their profit potential while just seeking disaster insurance, which can be accomplished by loosening the collar, or writing calls that are more out-of-the-money. In the end, investors must decide whether they wish to preserve their capital or increase their room for profits.

In general, the longer the collar is, the better the risk-reward profile of the entire position will be. The longer-term hedges are cheaper to establish and, therefore, result in a less risk (cost) for the same reward (strike prices). The problem is that a longer time frame means you are locked in and can only get out by unwinding the position. This becomes a problem because attempting to unwind a position in a bullish time frame will rarely allow you to profit from the end trade. If the position becomes more volatile, however, the risk-reward proposition improves dramatically.

NEXT PAGE: LEAPS Index Collars