OPTIONS IDEA How to Trade Apple into Earnings Using Options

Post on: 30 Май, 2015 No Comment

By: Joseph Hargett

Financial Analyst, Schaeffer’s Investment Research, Inc.

Gadget guru Apple Inc. (AAPL ) is slated to release its quarterly earnings report after the close of trading tomorrow (Tuesday, Jan. 18). Wall Street is currently expecting a profit of $5.34 per share from Apple, a 45% improvement over the same quarter last year. Historically, the Cupertino, California-based company has bested the consensus estimate in each of the prior four reporting periods by an average of 35.5%.

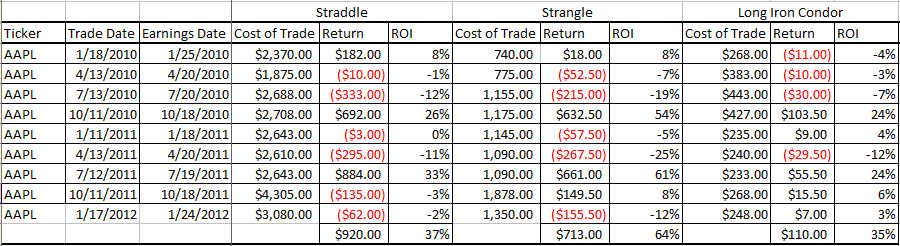

Naturally, with earnings just over the horizon, options traders are rushing to place their bets ahead of the event. Typically, traders enter volatility plays such as straddles and strangles to take advantage of earnings events, but today’s trading example shows how to turn a typically neutral options strategy into a bullish one. By carefully selecting your options, it is possible to turn a basic call condor into a bullish call condor. Here’s how:

The Anatomy of a Bullish Apple Inc. Call Condor

When an options trader enters a typical condor spread, he sells one in-the-money call and buys one in-the-money call at a lower strike, while simultaneously selling one out-of-the-money call and buying one out-of-the-money call at a higher strike. However, in a bid to benefit from a post-earnings rally from Apple, the trader in today’s example utilized all out-of-the-money calls. As a result, he needs the stock to rally into the sweet spot, whereas a standard condor trade hinges on the shares remaining stagnant.

In order to initiate the Apple condor, the trader bought the January 2011 350 and 375 calls for the ask prices of $5.44 and $0.58, respectively, and sold the January 2011 355 and 370 calls for the bid prices of $3.57 and $0.90, respectively.

Note: All prices are at the time of publication. Be sure to check for updated pricing before considering a trade such as this.

Click to Enlarge

Overall, the trade breaks down like this: The trader paid $258,400 for 475 January 350 calls, and shelled out $27,550 for 475 January 375 calls. Meanwhile, the trader received a credit of $169,575 by selling 475 January 355 calls, and pocketed another $42,750 by selling 475 January 370 calls.

So, we have a bearish call spread between the January 370 and 375 strikes, and a bullish call spread between the January 350 and 355 strikes. At this point, the position has cost the trader a total of $1.55, or $155 per set of contracts. The breakdown for this iron condor is listed below:

Click to Enlarge

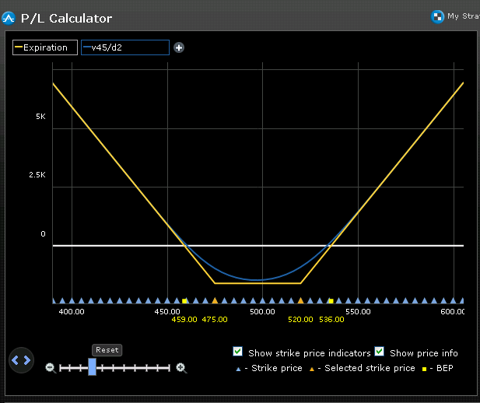

There are several potential outcomes for this condor position. Under the best-case scenario, AAPL closes between $355 and $370 when January options expire. Assuming that the stock closes at $360, the sold January 370 call and the purchased January 375 call expire worthless, while the sold January 355 call finishes five points in the money, and the January 350 call closes ten points in the money. To exit the trade, all you will need to do is sell (to close) the January 350 call for $10 and buy back the January 355 call for $5. Subtracting the net debit of $1.55 paid at initiation, your profit comes in at $3.45, or $345 per contract, which represents the maximum gain on this call condor.

However, what happens if AAPL takes a turn for the worse and closes below $350 at expiration? In this case, all four of your options will expire worthless, leaving you with a loss of $1.55, or $155 per contract. This loss, which represents the net debit paid to enter the trade, is the maximum risk on a downside move by the underlying security.

On the other hand, if AAPL were to rally to $380 by January expiration, all four of your options will expire in the money. The purchased January 375 call will be worth $5, the sold January 370 call will be worth $10, the sold January 355 call will be worth $25, and the purchased January 350 call will be worth $30. To exit this trade, you would sell (to close) the January 350 and 375 calls for a total of $35, and buy (to close) the both the January 355 and 370 calls for a total of $35. Once again, your total loss is limited to $1.55, or the net debit paid upon initiating the long call condor.

Below is a chart for a visual representation:

Click to Enlarge

Implied Volatility

After the condor has been established, increasing implied volatility becomes a considerable liability. Still, the main concerns in this position are the sold January 355 and 370 calls. An increase in implied volatility for these options will increase their prices, making it much more expensive to exit the position should the trader need to buy these options back.

Tickers Mentioned: Tickers: AAPL