Options Gamma by

Post on: 10 Апрель, 2015 No Comment

Options Gamma — Definition

Options Gamma is the rate of change of options delta with a small rise in the price of the underlying stock.

Options Gamma — Introduction

Just as options delta measures how much the value of an option changes with a change in the price of the underlying stock, Options Gamma describes how much the options delta changes as the price of the underlying stock changes. Of the 5 options greeks, Delta and Gamma are the only ones that are related to each other and that Options Gamma is the only options greek that describes the change of another greek. That makes understanding options delta and Options Gamma extremely important to all options trading beginners.

Why Is Options Gamma Important?

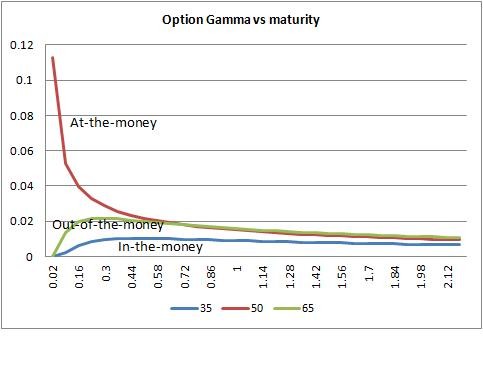

Options Gamma is important because it affects the single options greek that determines the value of stock options most and that is the options delta. There is no question that options delta changes as it starts off at 0.5 when it is At The Money and then gradually move towards 1 as the options go deeper In The Money or gradually towards 0 as the options go farther Out Of The Money. The real question is, by what magnitude would the options delta change? Options Gamma measures that magnitude as well as the direction of change.

So, why is understanding the magnitude and direction of the change of options delta represented by its Gamma important?

Understanding Options Gamma is important for both directional and hedging trades. In directional trades, one would want an overall position Gamma to lean towards the direction of interest so that options delta expands as the trade develops. In hedging trades, one would want as low an overall options gamma as possible so that the options trading position remains as neutral to changes in the underlying stock as possible. Such hedging method has come to be known as Gamma Neutral Hedging.

Of course, if you are only buying call options or put options for a single directional trade, Options Gamma really have little to do with you because you can be sure that you are already buying positive Options Gamma which will increase the delta of your options as the stock rises or falls accordingly. Positive Options Gamma ensures that the delta of your options increases as it goes more and more in the money, increasing your profitability.

As such, Options Gamma is important to understand for options traders starting complex options strategies for the first time and for options traders who manage many complex options positions within a single portfolio like Market Makers do.

Personal Options Trading Mentor