Options Expiratio Things to Know Before you Play the Game Options for Rookies

Post on: 21 Апрель, 2015 No Comment

Over at the Options Zone, this post (slightly edited) was published on April 14, 2010.

Options expiration.  When you sell options, its an anticipated event.  When you own options, its something to dread.

At least thats how most people view it.  Theres much more to an options expiration, and if you are a newcomer to the options world, there are things you must know and steps you should take to avoid unpleasant surprises.  However, if you enjoy nightmares, feel free to disregard this entire post.

Many investors come to the options world with little investing background.  they consider the options game to be simple:  You buy a mini-lottery ticket.  Then you win or you dont.  I have to admit thats pretty simple.  Its also a quick path to losing your entire investment account.

Its important to have a fundamental understanding of how options work before venturing onto the field of play.  But not everyone cares.  It you are someone who prefers to keep his/her money, and perhaps earn more, then those option basics are a must for you.

No one takes a car onto the highway the

very first time they get behind the wheel, but there is something about

options, and investing in general, that makes people believe its a

simple game.  They become eager to play despite lack of training.

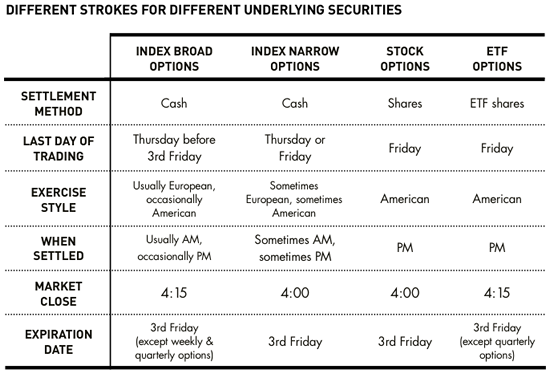

Todays post provides some pointers for handling an options expiration.  Options have a limited lifetime and the expiration date is always known when options are bought and sold.  For our purposes assume that options expire shortly after the close of trading on the 3rd Friday of every month. (Expiration is the following morning, but thats just a technicality as far as we are concerned)

***

Please dont get caught in any of these expiration traps.

1) Avoid a margin call

New traders, especially those with small accounts, like the idea of buying options.  The problem is that they often dont understand the rules of the game, and forget to sell those options prior to expiration. If a trader owns 5 Apr 40 calls, makes no effort to sell them, and decides to allow the options to expire worthless, thats fine.  No problem.  However, if the investor is not paying attention and the stock closes at $40.02 on expiration Friday, that trader is going to own 500 shares of stock.  The options are automatically exercised (unless you specifically tell your broker not to exercise) whenever the option is in the money by one penny or more, when the market closes on that Friday.

In my opinion, this automatic exercise rule is just another method that brokers use to trap their customers into paying unnecessary commissions and fees.

On Monday morning, along with those shares comes the margin call.  Those small account holders did not know they were going to be buying stock, dont have enough cash to pay for the stock even with 50% margin and are forced to sell the stock.  Rack up more costs for the investor and more profits for the broker.  Please dont forget to sell (at least enter an order to sell) any options you own.

2) Dont exercise

If you own any options, dont even consider

exercising.  You may not have the margin call problem described above, but did you buy options to make a profit if the stock moved higher?  Or did you buy call options so that you could own stock at a later date?  Unless you are adopting a stock and option strategy (such as writing covered calls), when you buy options, its generally most efficient to avoid stock ownership.  Heres why.

If you really want to own stock, when buying options you must plan in advance, or you will be throwing money into the trash.  For most individual investors at least inexperienced investors buying options is not the best way to attain ownership of the shares.

If the stock prices moves higher by enough to offset the premium you paid to own the option, you have a profit.  But, regardless of whether your investment has paid off, it seldom pays for anyone to buy options with the intention of owning shares at a later date.  Sure there are exceptions, but in general: Dont exercise options.  Sell those options when you no longer want to own them.

Example: Heres the fallacy.  The stock is 38, you buy 10 calls struck at 40, paying $0.50 apiece.  Sure enough you are right.  The stock rallies to 42 by the time expiration arrives.  You know a bargain when you see one, and exercise the calls, in effect paying $40.50 per share when the stock is worth $42.  This appears to be a good trade.  You earned $150 per option, or $1,500.

Before you congratulate yourself on making such a good trade, consider this: The truth is that you should have bought stock, paying $38.  If you are of the mindset that owning shares is what you want to do, then buying options is not for you.  And thats even more true when buying OTM options.

If you are an option trader, then trade options.  When expiration arrives (or sooner) sell those calls and take your profit (or loss).  Theres nothing to be gained by exercising call options to buy stock.  Why pay cash for an option, then hope the stock rises so that you can pay a higher price for stock?  Just buy stock now.  If you lack the cash, but will have it later, thats the single exception to this rule.

If this exception applies to you and you are investor, not a trader, then buying the Apr 40 calls is still the wrong approach.   Buy in the money calls perhaps the Apr 35s.  You might pay $3.60 for those calls.  If you do eventually take possession of the shares, the cost becomes $38.60 (the $35 strike price plus the $3.60 premium) and not $40.50.  Buying OTM options is not for the investor.