Options Basics Definition � Options Explained � optionMONSTER

Post on: 16 Март, 2015 No Comment

Summary

Options are used for speculation, income generation, or hedging a position.

Options buyers pay a premium for the right to, but not the obligation, to act.

Options sellers (writers) have an obligation (if assigned).

There are four basic positions: buying calls, buying puts, selling calls, selling puts.

Option premiums are made up of intrinsic value and time value.

Time value is largely a function of implied volatility.

Trading stocks is reasonably easy, at least in theory. If you think a stock is going up, buy it. If you think it is going down, sell it; or sell it short if you are a real risk-taker. If you think a stock is going nowhere, sell it or avoid it in the first place. The stock price is what it is and that is what you pay. Things are not so simple with options trading. Many factors influence the value of an option contract. It is for largely that reason that most retail options traders underestimate the challenge of making money with options.

Would you like to.

- Increase your leverage without paying margin rates?

- Profit from dropping prices — with limited risk?

- Generate more income in your account?

- Get paid to enter long stock positions?

- Insure your positions or even your whole portfolio?

Options are exceptionally versatile. You can do all of the above with the use of options.

What is an Option?

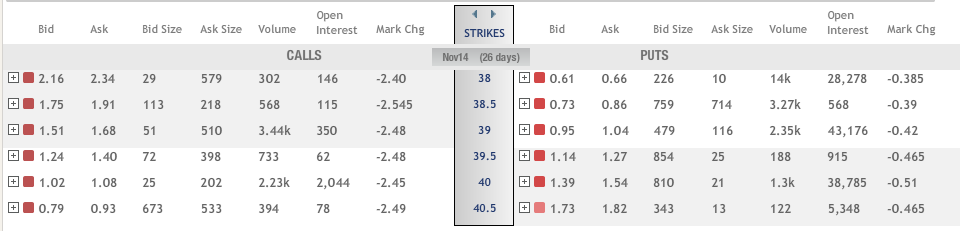

An option is a standardized contract providing for the right — but not the obligation — to buy or sell an underlying financial instrument. In our context, this underlying is a stock or exchange traded fund (ETF). The contract controls 100 shares, and is good until a defined expiration date. The price at which shares can be bought or sold also is defined by the contract, and is known as the strike price.

There are two types of options: calls and puts. You can buy or sell either type. If you buy an option you are the holder of the contract and considered to be long, while if you sell an option you are the writer of the contract and considered to be short.

The buyer of a call has the right to buy the underlying security (e.g. 100 shares of Google) at the strike price on or before the expiration date. The seller of a call has the obligation to sell the shares, if asked.

The buyer of a put has the right to sell the underlying security (e.g. 100 shares of Google) at the strike price on or before the expiration date. The seller of a put has the obligation to buy the shares, if asked.