OptioNewton Neutral Strategies

Post on: 18 Июль, 2015 No Comment

Strategies

Neutral & Protective Strategies

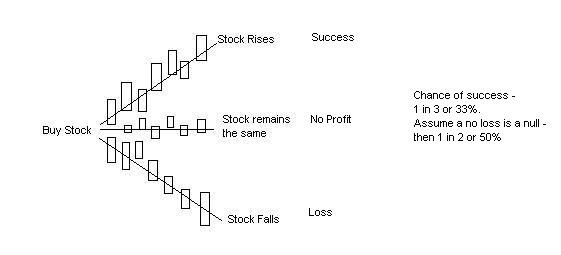

More strategies are listed in the neutral section than in the bullish or the bearish section. A few reasons for this; as mentioned before, the direction of the market or stock priceВ often moves very closely to a fair coin toss. Neutral strategies protect against unanticipated moves in the direction opposite the chosen sentiment. Although neutral strategies limit the profit potential somewhat (the first rule of investing is preservation of capital), they can increase the probability of success. And as weve already seen, even small monthly gains can turn into large annual returns. Neutral strategies generally involve buying oneВ or more options while simultaneously selling one or more options. Since when an option is sold its a credit toВ the account and when one is bought its a debit to the account, the net premium of the trade will be less than buying an option alone. This reduces the cost of the trade. Finally, bullish and bearish strategies are relatively simple. They may not be as successful as often, but with simplicity comes fewer choices.В В

Neutral Strategies

When it comes to neutral strategies, there is an additionalВ choice to be made in the strategy selection process and that isВ the anticpation of High Volatility or Low Volatility in the stock price movement. High Volatility is the anticipation thatВ the stock price will make a large move in either direction by opex. Low VolatilityВ is the anticipation that the stock price will remain in a relatively narrow range up to opex. High volatiltiy neutral strategies are generally debitВ to net debit transactions. Low volatility neutral strategies are generally net creditВ to all credit trades. Some examples are listed below.

High Volatility NeutralВ

Expect a large move in either direction in theВ underlying stock price by opex.

Straddle -В is a neutral combination that expects a large move in one direction or the other.В An ATMВ call and an ATMВ put of the same strike and expiration month are bought. The strike can be below or above the current stock price, but usually near the current stock price. The premium is a debit.

Strangle -В is a neutralВ combination that expects a large move in one direction or another.В An OTMВ call and an OTMВ put,В both with the same expiration month, are bought. The premium is a debit, but less than for a straddle.

Most other neutral combination strategies are derivatives of the straddleВ or the strangle.

Combinations

Reverse Iron Butterfly -

Reverse Iron Condor -

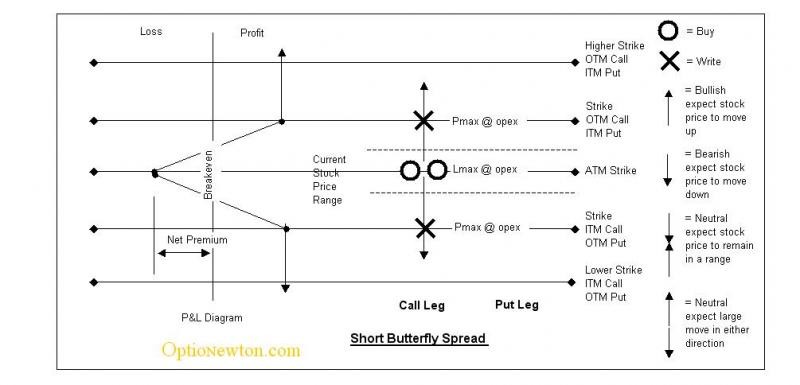

Short Butterfly SpreadВ

Short Condor Spread

Low Volatility Neutral

Expect the underlying stock price to remain within a certain range up to opex day.

Combinations

Iron Butterfly (combination) — a combinationВ similar toВ a short straddle, but with protective OTM calls & puts..

Iron Condor — a combinationВ similar to a shortВ strangle, but includes selling upper strike calls and lower strike puts to lower the cost of the premium. It has 4 legs and involves buying an OTM call, selling a higher stirke call, buying an OTM put and selling a lower strike put. The premium is a net debit.

Butterfly SpreadВ -В

Condor SpreadВ -