Option Value

Post on: 16 Март, 2015 No Comment

The price of an options can be broken down into two parts: extrinsic value and intrinsic value.

Intrinsic Value

Intrinsic value is the portion of the option that can be realised if the option is exercised. Therefore, only in-the-money options have intrinsic value.

Consider the following example:

Underlying: Microsoft

Underlying Price: MSFT $30

Type: Call Option (American)

Strike Price: $25

Expiry Date: 30th September

Now, imagine that this particular call option is currently trading at $7. How can we better understand this price?

Well, the first part we can look at is it’s Intrinsic Value: the value of the option that, if exercised, would result in a profit. We know that the call option’s strike price is $25 and with Microsoft trading at $30 it is already worth at least $5.

This is what’s known as Intrinsic value — the value that can be made by exercising the option.

Extrinsic Value

When an option is trading at more than the intrinsic value, the difference is known as Extrinsic Value, or more commonly known as Time Value.

Looking at the previous example, we have already determined that the option is worth at least $5 — its Intrinsic Value. However, it is actually trading at $7.

The remaining $2 is called Extrinsic Value and represents the markets view of how far the underlying could trade as high as by the time the contract expires.

Sometimes an option can have 0 Intrinsic Value but can still be worth something in the market. Why?

This is because traders believe that there is still some chance that the underlying could trade in a favorable direction, which would make the option profitable.

An option that has 0 Intrinsic Value is said to be out-of-the-money, i.e. if your were long (you bought) this call option and you exercised it, you would lose money by being assigned Microsoft shares at the exercise price $37, which are actually worth only $36 on the open market, leaving you with a loss of $1.

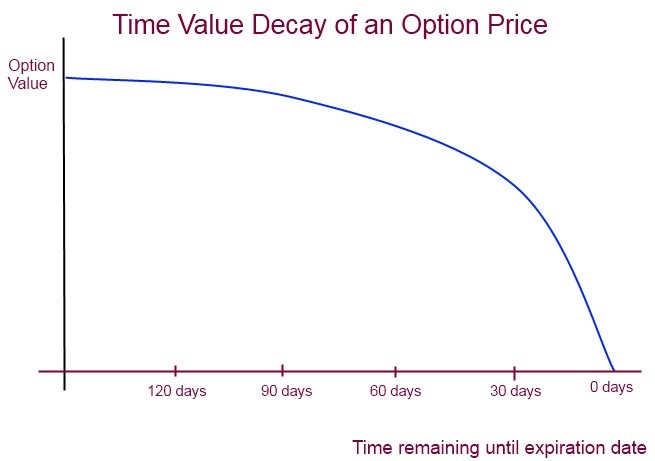

So, the call option has zero Intrinsic Value. Yet it’s price in the market is $1.75. Does this mean that the option is over valued? Not really. It simply means that because the option still has 6 months until expiry, there is still plenty of time for the option to exceed the exercise hurdle of $37.

If the option expired tomorrow, it would have almost zero Extrinsic Value and zero Intrinsic Value — therefore being considered worthless. This is because the call option only has one day left for it to trade higher than $37 to give the trader a chance at making money from it.

However, because the option doesn’t expire for another 6 months, there are approximately 120 days (or 120 chances) that Microsoft has to trade another dollar higher and therefore turn this option into an in-the-money option.

Peter

December 16th, 2014 at 4:23am

Hi Mike,

Exercising an option means you will need the required capital to take delivery of the stock (if exercising a call, for example). A holder of a long option my simply choose to exit the trade by selling back the option to avoid having to buy the stock and having the trade continue.

Yes, it is just like selling a stock, which means there needs to be a buyer ready to sell to.

Mike

December 13th, 2014 at 12:35pm

New to options. My question is why would anyone want to sell an option versus exercising it? I know there is time value + intrinsic value, and you miss out on the time value by exercising it, but I would be afraid that someone would exercise it if I sold it.

Also, if one decides to sell an option can he/she just sell it like selling a stock or does there have to be a buyer who want to buy it?

Peter

November 23rd, 2014 at 6:34pm

Hi Souvik,

Mmm, I've not heard of time negatively effecting a put option's value when volatility is high; I always thought time increased the value of both calls and puts.

If time to expiration is more, why would call option only increase in value whereas put options may increase or decrease in value, when volatility is also high?

Manojg

December 28th, 2013 at 9:48am

If there is not arbitrage in the market (because supply and demand eliminates if there is any arbitrage), then how can a arbitaguers make profit?

Take a read through the page on Put Call Parity — I think this will help with your question.

Manoj

August 27th, 2013 at 1:06am

Can anybody explain me why arbitrage will happen in case the options price is exactly equal to intrinsic value? Please help me as i m lot of confusion with this question.

Peter

September 18th, 2012 at 5:39pm

Hi Avijit, yes, that's exactly what extrinsic value is — time value.

Avijit Mete

September 18th, 2012 at 5:05am

Thank you very much for the example,however,can we call extrinsic value as a time value of an Option?

Thanks a lot.

Mike

May 14th, 2012 at 1:01pm

Trying to understand options and their pricing. Is it correct to say that the option price depends on the probabtility that the option expires ITM? Does the delta (as an absolute number) of an option give the probability that the option will be ITM?

Looking at this big number of different options. how do we value them? with the BS-formula, binomial tree, Monte-Carlo-Simulation. Is there a correct pricing value or are all methods estimations based on their assumptions? F.e. how would you value a barrier option?

Are there some rules of thumb of options values? I am thinking of the value of an American option is always higher than Bermudan than European. I think this order should be correct until expiry and on expiration date the value is the same, namely the intrinsic value, am I right? Do you have an overview which u could upload as it would be interesting to see the different values of exotic options as well.

Thanks in advance!!

Peter

April 22nd, 2012 at 7:45pm

Hi Vinny,

Correct — once you have sold back (or sold to close) the option you no longer have a position in the call option and hence no obligation to deliver anything.

It's only if you have a short position (sell to open) in a call option that you have the obligation to deliver.

Vinny

April 22nd, 2012 at 2:46pm

Hey Peter,

Great Site! I know you have gotten many similar questions to this, but I just have to ask to be completely sure.

I buy a call and I see the value of the call went up in price then I can sell it back on the market for a quick profit. however, I am still not responsible for providing the stock if the option is exercised, correct? The original writer of the call is still on the hook.

Peter

April 15th, 2012 at 10:20pm

Hi DH,

For a long call option the P&L is the max(stock — strike, 0) — premium paid. Let's assume the price of the 2.50 strike option is 0.10 — so you paid $10 for the option.

If the stock is at 2.70 by the expiration date then the profit to you is $10 (2.70 — 2.50 — 0.10) * 100.

April 13th, 2012 at 2:05pm

I have a July call option opened on a stock with a strike price of $2.50. The underlying stock is currently trading at $1.70'ish. I am trying to learn how to calculate potential profit with options once the pps exceeds the strike price. If by July the stock moves above $2.50, say $2.51 or $2.60 even, how much will the option be worth if I sell it? And is that multiplied by 100 (per contract)? Thx.

where can one get info. about above terms.

December 24th, 2011 at 11:54am

Hi Al,

If there is a dividend payment due then it is possible that you may have your option exercised.

Holding a call option alone doesn't carry any rights to dividend payments so a holder of a call option may exercise the option in order to have the shares delivered to ensure that they collect the dividend payment.

Al Moura

December 10th, 2011 at 2:10pm

I sold a 12 call while the underlying was trading at $18.77.Is there the possiblity of that call holder to exercise it? I believe that if the call holder exercise it he will receive only $12 for a stock trading at $18.00. Correct? So there is no chance to be exercised under those conditions.

October 3rd, 2011 at 11:03pm

Delta is only relevant for the extrinsic part of the option value. Options that are comprised of only intrinsic value will show deltas of +1 for calls and -1 for puts.

September 30th, 2011 at 10:33am

Hi Peter

Very helpful explanation. Could you please explain where delta fits into all this?

Many thanks

Peter

July 31st, 2011 at 7:02pm

Correct — so for a put option, say $25 put option is trading at 0.50. Then intrinsic value = 0 and extrinsic value = 0.50. MSFT will need to trade at or below $24.50 for you to be profitable.

jeff r

July 30th, 2011 at 3:13pm

I'm new and need to understand. msft $25 sept 30 call @ 7 trading at $30 presently. My intrinsic value = 5 and extrinsic value = 2. I would be profitable if msft would trade > 32 right? and if you could use an example of a put option using simple example. thx. jeff

Peter

July 24th, 2011 at 5:29pm

For call options intrinsic value is zero when the strike price is above the underlying price and for put options intrinsic value is zero when the strike price is below the strike price.

nagesh HOTKAR

July 24th, 2011 at 4:03pm

hi,

In my book, it said the value of option must be equal at least intrinsic value. I don’t really get that. I thought value of option = time value + intrinsic value = option premium. If the value of option (option premium) need to be equal at least intrinsic value then how could option's buyer make profit?

Shen

May 5th, 2011 at 11:35am

Thanks pete, it's really helpful. I finally understood what my lecturer had been talking.

Peter

March 30th, 2011 at 6:59am

There isn't any relationship between intrinsic value and volatility — volatility is only relevant when it comes to extrinsic value.

geeke

March 30th, 2011 at 6:32am

what is the relation between intrinsic value and volatility

November 14th, 2010 at 3:59pm

Absolutely not! I wrote the content myself from what I have learned and experienced being in the options industry. Would you mind please providing a page or two from Investopedia as examples of your claim?

arjun

November 14th, 2010 at 5:14am

its look like that content is copied from investopedia

Peter

May 17th, 2010 at 9:45pm

Yes.

vinay

May 17th, 2010 at 6:39am

can u tell that it that the option value (intinsic + time value ) is actually the premium that the buyer would pay.

Peter

February 15th, 2010 at 3:43am

Almost. If you have bought a call option and choose to exercise it, then yes, you now buy the stock at the strike price of the option — not the premium. The premium is the price you pay for the contract when you enter the position. and this premium is received by the seller of the option.

So, let's say you buy a $25 (strike price) call option. The stock trades to $27. At this point you decide to exercise the option. What happens is that you are assigned stock in your account at a purchase price of $25 (thanks to the option seller) while the stock is currently trading at $27.

mark

February 14th, 2010 at 8:23am

So, when I exercise an option that is in the money. above it's strike price. I actually purchase the underlying stock shares at my original options premuim purchase price? When options are exercised. they actually are converted to stock shares at the current stock value?

Peter

February 14th, 2010 at 5:57am

Hi Mark, for a call option at expiration, the stock has to be above the strike the option to be profitable. However, options are tradable like many other assets on the market. that is, you can buy a call option for 20 cents while the stock is below the strike and then sell it the next day for 25 cents (if the market has move in your favor).

Mark

February 9th, 2010 at 6:35pm

New to options! Does an option have to be above its strike price in order to make a profit? Also, if you sell an option before expiration, but below the strike price do you lose your total investment or just part of it as long as the price of the stock is above where you bought it. I am not sure how you make your money in options?

Peter

September 12th, 2009 at 7:30am

Correct. the price shown in the market is 2 but the premium you pay is $200.

newbie

September 11th, 2009 at 11:37am

srry m new 2. if i buy an option for say 2.00, if it's for 100 shares the value is 200.00. Then premium price is also 200$ right?

Peter

August 17th, 2009 at 6:51am

Hi Adnan,

1) For a call option the intrinsic value is underlying price — strike price. In your example, the instrinsic value is $8 ($33 — $25).

2) Time Value depends on the volatility. See my spreadsheet under the Pricing link above for an idea how option pricing works.

3) Option value = intrinsic value + time value. If you buy an option you pay the value (i.e. premium) to the option seller.

adnan jahangir

August 14th, 2009 at 1:50am

Me want to know the exact basics. my example is

If i bought option of 20$ with strike price of 25$ for 3 months at the date of expiry underlying asset is having price of 33$ what are

1) intrinsic value and to whom it will go to holder of option or writer.

2) what is time value to whom it will go holder or writer

3) what is the option value and to whom it belong writer or holder.

please explain those in call option .hopping that my question is complete .

Peter

July 10th, 2009 at 7:34am

Hi Thomnel,

You would pay $200 for the option and your maximum loss would therefore be $200.

thomnel53

July 5th, 2009 at 3:43pm

o.k. so if you buy an option for say 2.00, if it's for 100 shares the value is 200.00 right. Do you pay 2.00 or 200.00 for it, and if it tanks do you only lose the 2.00 or what? sorry i'm new.

Peter

May 11th, 2009 at 6:28pm

Hi Joe, yes, $37 in the above represents the exercise price. I used $30 and $36 to represent two examples of MSFT share prices.

Joe

May 11th, 2009 at 1:28pm

Hi, I dont understand with the example given in the intrinsic value, it is said that if your were long (bought) this call option and you exercised it, you would lose money by being assigned Microsoft shares at the exercise price $37, which are actually worth only $36 on the open market.

My question is whether the exercise price of $37 is from the Microsoft share which is $30 and $7 from trading value. if yes, how about $36? where the sum ($36) comes from? thanks. I hope you understand what i am trying to ask ![]()

lincoln

March 22nd, 2009 at 11:36am

Excellent. using simple examples to explain difficult market situation,its is very helpful. thanks

David

March 17th, 2009 at 12:52pm