Option Trading Strategies

Post on: 8 Апрель, 2015 No Comment

In this section, I will cover some of my favorite option trading strategies. I primarily use what are referred to as advanced options strategies. That means usually a combination of options that will form a spread. I do this for two key reasons.

- Limited risk, which Ill talk about more in a minute.

- Better odds of success. By that I mean that in many cases, I may be a little wrong in my assessment and still make money. In fact, I’ve had a few trades where I’ve been quite wrong and still broken even or made a little.

Most of the option trading strategies I use are also income generating strategies, which to me means that they take advantage of the erosion of the time value of the option. That means the stock could go nowhere and I still make my money. If you are unfamiliar with option greeks. have a look before going on. These components pay a big factor in how and why I select the strategies I’m going to discuss.

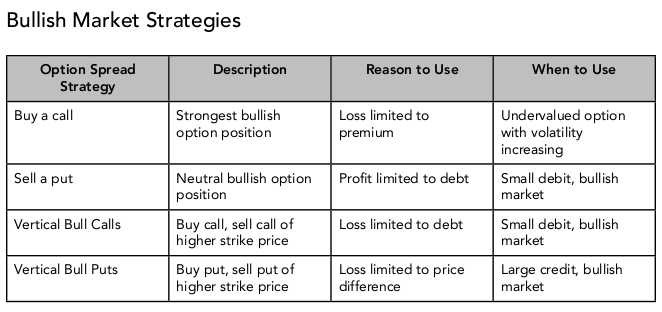

These strategies include short vertical spreads (credit spreads), calendar spreads, diagonal spreads and iron condor spreads. Once I’ve covered some basic concepts, Ill go into more detail on each of these strategies.

What is a Spread?

Spreads are constructed by buying one option and selling a different option on the same underlying.

A short vertical spread or credit spread is created by selling an option at one strike, usually in the current option month and buying an option at a further out-of-the-money (OTM) strike in the same month. In the following example, I am bearish on JP Morgan(JPM) so I might sell a $27.50 call and at the same time buy a $30 call in the same month. This chart illustrates that concept.

A calendar spread is created by buying an option at a specific strike in a farther out month and then selling the same strike option on the same stock in a closer month. This is sometimes referred to as a time spread or horizontal spread. This makes sense if you look at an options chain and notice the prices and strikes organized vertically.

In this trade, the most I can lose is the initial debit, thereby allowing me to size my position accordingly.

With these two basic spreads as building blocks, many other spreads can be created.

A long vertical spread is the opposite of a short vertical spread meaning that you would buy an option in-the-money (ITM) or even at-the- money (ATM) and sell an option out-of the-money (OTM).

A diagonal spread can be thought of as a combination of a calendar spread and a vertical spread.

An iron condor is a combination of a short put vertical spread and a short call vertical spread.

If this seems overwhelming, hang on because I will be going into much more detail on each of the strategies. I just wanted to lay some groundwork before moving on. If any of the basic options concepts are unfamiliar to you, make sure you visit the options basics section to learn more.

My Favorite Option Trading Strategies

OK. I’m finally ready to talk about my favorite option trading strategies. These are my four basic strategies that I use. You’ll see a brief description of each one here with more detail provided by the links.