Option Spread FREE Option Income Trading Videos WATCH THESE

Post on: 7 Апрель, 2015 No Comment

Option Spread Popular Trading Strategy

Posted on October 27, 2010, 3:30 pm, by. under Option Spread.

The option spread is one of the more popular strategies among option traders. Along with being one of the easier option trading strategies to understand, another reason newer option traders in particular gravitate to this strategy is that it can require very little time to manage it while it is on. Another way to put it, is that credit spread sellers dont need to be glued to their computer screens all day watching every tick of the market in order to generate consistent income with this trade.

There are a number of different option spread techniques that traders can utilize. The credit spread debit spread or vertical spread is a fundamental element to numerous other option spread strategies including the iron condor, the butterfly spread, the double diagonal and others. It if fairly common for beginning option traders to gravitate to this strategy soon after discovering options and once they have gotten their feet wet with the purchase of straight calls and puts, then covered calls, and debit spreads.

Option traders love to trade this strategy because the way these trades are constructed can allow the trader to be wrong and still make money. If the trader creates a particular credit spread position, he or she can win if the stock or index being traded winds up doing three out of four possible scenarios. If the stock goes down, the trader makes money. If the stock goes nowhere the trader makes money. If the stock goes up a little, the trader makes money. The only way the trader can lose money if the stock goes up far enough to threaten the vertical spread that has been sold. And even then, there are management and adjustment techniques that can be utilized to hedge against losses.

Lets create an imaginary trading scenario to illustrate. Imagine that a trader believes that a particular stock will be heading down in the short term. Because he is bearish on this stock, he sells a bearish credit spread called a bear call spread which benefits from bearish move.

If the stock does move down as our trader anticipates, this spread trade wins. If the stock does absolutely nothing and just remains trading at its current level, this trade wins. Even if the stock moves up against our traders outlook, this trade can win just as long as it doesnt move up too much. The only way this option spread position will lose money is if the stock moves too high too fast in which case the trade could still be profitable just as long as our trader knows how to properly manage and adjust the position.

Comments Off

Option Spread Adjustments

Posted on May 15, 2010, 6:42 am, by. under Option Spread.

When a trader has on an option spread be it a credit spread, a vertical spread, iron condor, calendar spread or whatever eventually the market will move against that position and the trader will either have to close it for a loss or adjust the position.

One way to adjust an option spread that is in trouble is to simple place on another option spread either at the position where the market or underlying has moved to or a bit in front.

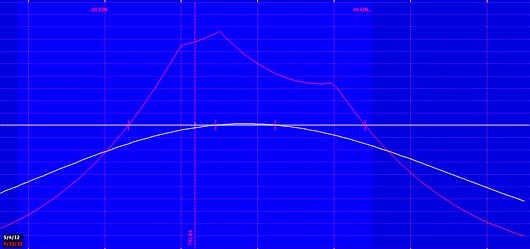

When this is done correctly it can really open up the profit tent of the position from where the original spread was initially placed and emcompassing through to the out edges of the newer option spread placed on as an adjustment.

Keep in mind however that this technique is also adding capital to the position and potentially increasing the risk on the trade. Some traders will take this potential adjustment method into account when they first initate the trade though and will not put all of their funds into the position up front because they plan on potentially adding to their position in this way later on through the duration of the option strategy trade.

Comments Off

Option Spread

Posted on May 10, 2010, 1:07 am, by. under Option Spread.

An option spread that is popular among both retail option traders and professional traders is the credit spread.

There are various option spreads available to traders, including the iron condor, the condor, the butterfly spread, the calendar spread, and more. Each of these strategies are made up of combinations of purchasing and selling different options at different strike prices and months and the purpose is to financially benefit from the variances in the spreads.