Option Pricing Stock Price Probability Calculators

Post on: 4 Май, 2015 No Comment

On-Line Options Pricing & Probability Calculators

Employee stock option (ESO) valuation: Standard Black-Scholes and lattice pricing models cannot be used to value ESOs due to vesting requirements, the impact of staff turnover rates, and other ESO-specific factors which are not a part of standard option pricing. For tools which specifically handle IFRS 2 and FASB 123R-compliant ESO valuation see ESO valuation .

On-line option pricing

Black-Scholes pricing analysis — Ignoring dividends: Lets you examine graphically how changes in stock price, volatility, time to expiration and interest rate affect the option price, time value, the derived Greeks (delta, gamma, theta, vega, rho), elasticity, and the probability of the option closing in the money. For simplicity, dividends are ignored so you just specify the time to expiration in days rather than entering specific dates. See section below for more information. or Use it now.

Black-Scholes pricing analysis — Including dividends: Black Scholes pricing and analysis of Greeks where a dividend is paid during the life of the option. One dividend (an amount and an ex-dividend date) can be specified. (The Excel add-in available from this site will handle an unlimited number of dividends.) Use it now.

Binomial tree graphical option calculator: Lets you calculate option prices and view the binomial tree structure used in the calculation. Either the original Cox, Ross & Rubinstein binomial tree can be selected, or the equal probabilities tree. Both types of trees normally produce very similar results. However the equal probabilities tree has the advantage over the C-R-R model of working correctly when the volatility is very low and the interest rate very high. Both European and American Exercise can be specified; dividends can be discrete or a continuous yield. For American options the nodes in the tree at which early exercise is assumed are highlighted. Use the Cox, Ross & Rubinstein or Equal Probabilities calculator now.

Trinomial tree graphical option calculator: Calculates option prices using a trinomial tree and displays the tree used in the calculation. Like the binomial model European and American Exercise can be specified; dividends can be discrete or a continuous yield and early exercise points are highlighted. When a small number of tree steps is used the trinomial model tends to give more accurate results than the binomial model. As the number of steps increases the results from the binomial and trinomial models (for vanilla options) rapidly converge. The trinomial model (or adaptations of the trinomial model) is sometimes more stable and accurate than the binomial model for exotic options (eg barrier options). Use it now.

Barrier option calculator using trinomial lattice: Calculates barrier option prices, and hedge parameters, using a trinomial lattice, and displays the tree structure used in the calculation. Key features include American & European option pricing, dividends as continuous yield or discrete payment, continuous or discrete monitoring of barrier, and two methods of computation enhancement. Analytic prices, where analytic formulas exist, are displayed for comparison.

Black-Scholes/Binomial convergence analysis: Display graphically the way in which options priced under the binomial model converge with options priced under Black-Scholes model as the number of binomial steps increases. Whether the option is out of the money, at the money, or in the money at the time of pricing also has a significant impact on the way the two pricing models converge and the calculator lets you examine how the strike price/spot price relationship, as well as volatility, time to expiration and interest rate affect the rate and ‘shape’ of convergence. Use it now.

Dividend impact analysis & American & European option pricing comparison: Shows graphically how dividends paid during the life of an option impact the price, and in particular the sensitivity of the option price to different ex-dividend dates. It also lets you compare American and European pricing on the one graph for different option durations and ex-dividend dates. See section below for more information. or Use it now.

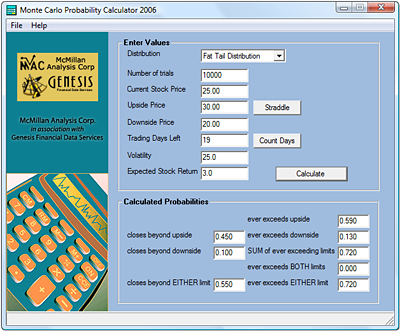

Stock Price Distribution & Probability Calculators