Option ARMs for Dummies Why Mortgages Rates will do Absolutely Nothing for these Toxic

Post on: 5 Июнь, 2015 No Comment

Option ARMs for Dummies: Why 4.5 Percent Mortgages Rates will do Absolutely Nothing for these Toxic Assets.

Ive been sorting through numerous e-mails especially after the 60 Minute show looking at Option ARM mortgages . If anything, I think the show has caused more confusion and I have even seen some articles posted online that are incredibly off base on this one subject area. Some now think that the 4.5% mortgage rate is somehow going to save those in Option ARMs. It is not that simple. In addition, there is a difference between a re-cast (as in, re-calculating your loan) and a loan adjustment on more bread and butter adjustable rate mortgages. The thing about option ARMs is they fly under the umbrella of adjustable rate mortgages yet are insanely toxic. There are many implications that are being missed and I feel it warrants and article to clear up at least the most elementary components of the loan.

What is an Option ARM mortgages?

The option ARM is a loan that is an adjustable rate mortgage with the added flexibility of a variety of payment options on your monthly mortgage. The gist of these mortgages was to increase the flexibility of your monthly payment. These loans have a low introductory rate that allows you to make very low initial payments and the low qualifying rate also allowed many people to buy more home than they could otherwise afford with more conventional mortgages. When I show you a real case example of an Option ARM, you will completely understand why these mortgages had no place in the marketplace.

The option ARM has four major type payment options:

(a) Minimum payment the initial minimum payment is set for the first 12 months usually with the initial interest rate. After that the payment changes on an annual basis with payment caps that limit increases or decrease each year. Keep in mind the minimum payment was selected by many borrowers during the initial months and many times did not even cover the full interest of the principal balance which was deferred and any unpaid interest was tacked on to the initial principal balance. In other words, your mortgage can actually grow.

(b) Interest-Only Payment with this payment option the borrower avoids any deferred interest yet this option was not available on all loans if the interest only payment was less than the minimum payment option. This payment option does not result in any principal reduction. The payment is based on the ARM index used to determine the fully indexed rate (FIR) for the mortgage. Ill get into how these rates are calculated since I think this is where people are simply missing the boat with the 4.5% mortgage argument.

(c) Fully Amortizing 30-year fixed payment In this case, you are paying both the principal and interest and keep your loan on schedule.

(d) Fully Amortizing 15-year fixed payment We should call this option the why do we even have this on the menu option. Here, you are actually accelerating and paying off your mortgage on a 15 year accelerated time frame.

The number of people selecting option c and d is practically non-existent in option ARMs. In fact, from surveys I have seen anywhere from 70 to 80 percent of option ARM borrowers elected to go with the minimum only payment option.

Fully Indexed Rate

I think this is where people get confused. You need to remember that many of the option ARMs are based on a blended rate system. That is, you have a variable index like the LIBOR or MTA and a margin rate. For example, let us use the MTA (12-month Treasury Average) for November 2008 which came in at 2.053%. A typical margin rate is 2.75%. So the fully-indexed rate is 4.803%. Normally the FIR is rounded to the nearest 0.125% so the rate in this case would be 4.75%.

Why is this important? Because Ive been noticing some article with a weird fixation to the LIBOR index alone:

Okay, without a doubt the LIBOR has fallen drastically over the past year. This is excellent news for those in more conventional adjustable rate mortgages. In the case of options ARMs, first, not all are indexed to the LIBOR but more importantly the margin rate is fixed. So assuming the 2.75% margin rate and the .47 1-month LIBOR the new blended rate is 3.22%. A good deal for readjustments but not for re-casts. And for the purposes of option ARMs, this does very little because keep in mind most people are making the minimum payment only and even if rates went down to zero (which they may) it doesnt remove the margin or the fact that the monthly payment will be going up no matter what. Why? Because they are on a negative amortization schedule and even with a zero percent rate, the principal and interest will amortize causing the payment to go up.

And speaking of index options, not everything is tied to the LIBOR (London Interbank Offered Rate). Im not sure what is going on with this obsession with this rate and option ARMs recently. It is merely one of the many index options. Most commonly used are:

MTA: Monthly Treasury Average

COSI: Cost of Savings Index

LIBOR: London InterBank Offered Rate

COFI: 11 th District Cost of Funds Index

And these rates vary anywhere from 1 to 2 percent which is a world of difference when you are talking about $500,000 mortgages. A big reason people have jumped into the market as well is the first time home buyer tax credit. It is important to get these details correct because we have a tsunami of $500 billion in option ARM mortgages that will flood the markets in the upcoming years . It helps to get the terminology right so we can better understand how these mortgages will hit the market.

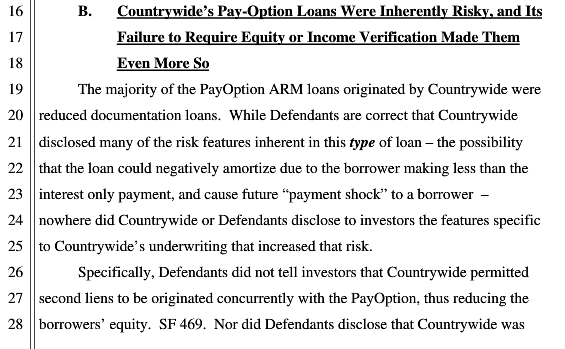

It usually helps to look at a real world example. In a lawsuit filed by the State of California against Countrywide, examples of some real world option ARM mortgages show us how absurd these loan products really are. Let us look at the details first:

I know at a quick glance, you are probably shaking your head at the absurdity of the terms above. We are looking at an option ARM with a 1% teaser rate offered by Countrywide. The margin on this mortgage is 2.9%. That is why you saw people spending like A-list celebrities because with the initial one year payment of $1,479 a month, they had money to spend even though the mortgage itself was negatively amortizing. Little by little the payment went up until it hit the 5 th year and explodes to $3,747.83. How can that happen? Well the note negatively amortized such that the balance of the loan increased to approximately $523,792.33 . That is right the note grew. Many of these notes had 110% or 115% re-cast ceilings but when youre dealing with a $460,000 mortgage 10% or 15% is enough rope to do yourself in.

And just for giggles, let us see what happens if a borrower actually made the interest only payment for 5 years and then refinanced into a 30-year fixed rate of 4.5%:

Big difference from the teaser $1,479 monthly payment. Lower rates are a drop in the bucket for option ARMs.

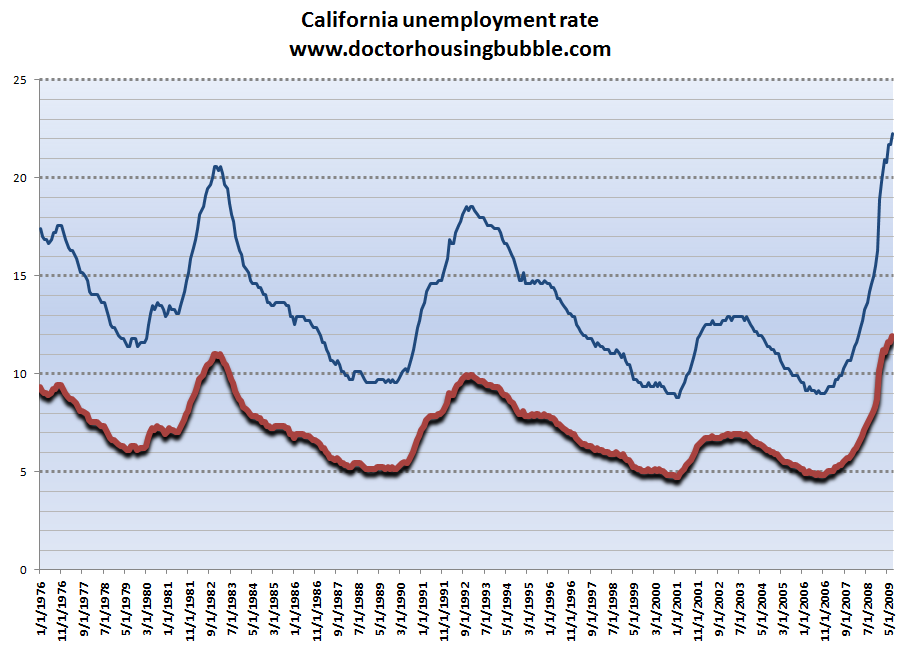

It also doesnt help that California and areas like Southern California are now quickly approaching a 50% reduction in home prices from the peak levels reached in 2007 . So assuming the current rate declines, let us assume the person went zero down and the home was worth $460,000 when it was bought and now it is selling for $250,000. You can take a wild guess what little use the 4.5% rate is going to do.

And not all lenders created the same option ARMs:

This is my point that not all option ARMs are created equal. Countrywide used a variety of index options and IndyMac went with the MTA. These mortgages are simply laughable. I want to make one point very clear:

The most important thing about buying a home is the price.

Repeat this to yourself ten times because Im seeing people fixate on these index changes which mean nothing in relation to the option ARM disaster. It seems those that write the articles may not have any firsthand experience with these notes or investing in real estate. Any successful real estate investor understands that price is the most important thing in buying a home. Why? First, a good price gives you wiggle room even if you have a high interest rate. With a high interest rate, you always have the option of going lower through other financing. If you are at 3% or lower there isnt much a drop to 1 or 2 percent is going to do. Let us look at a quick example to highlight this. And Ill exaggerate simply to drive the point home:

Here we have the lower rate argument taken to the extreme. Youll notice the monthly payments are practically the same yet one mortgage is $200,000 and the other is $105,000. As an investor, the rate is negotiable. You want a lower price because it gives you more flexibility:

(a) A lower price means you can sell the place much easier

(b) You can always refinance a very high rate

(c) You have the option of paying the note down faster. Any extra payment will take care of more principal on a lower mortgage

I think these misconceptions and the focus on the monthly payment or lower rates is one of the primary reasons so many people are losing their homes. Those dealing the loans didnt understand that having a rock bottom rate leaves no wiggle room and borrowers are paying with losing their homes. If your rate is 1 percent for example, you have nowhere to go but up. Any future buyer is constrained to the same mortgage environment. But say you buy a home at a rock bottom price with a high interest mortgage, say rates drop then your home is more lucrative because when you are selling, all you care about as the seller is the final amount paid. As a seller do you really care if a borrower buys a home with a 4.5% new FHA loan? Of course not.

I hope this helps to clear up some of the confusion surrounding option ARMs. I felt it was necessary to clear up some of the details of these mortgages to put an end to any notion that lower rates are somehow going to buffer $500 billion in option ARM recasts over the next few years . It wont. It is all about the price.