Open your eyes to closedend funds_1

Post on: 24 Июнь, 2015 No Comment

Dear Mr. Berko: Mom and I have $17,000 from the sale of a few worthless acres out here, and wed like to earn at least 9.5 percent. We are told there are stocks called closed funds which pay that kind of money. We know its a gamble to earn 9.5 percent, but we want to take a chance and see what it brings. So, could you give us the name of one of these closed funds so we can buy it?

J.G. San Antonio

Dear J.G. I need to tell you and other readers that closed-end funds are identical to the big open-end funds like American Funds, Putnam Funds or Franklin Templeton Funds.

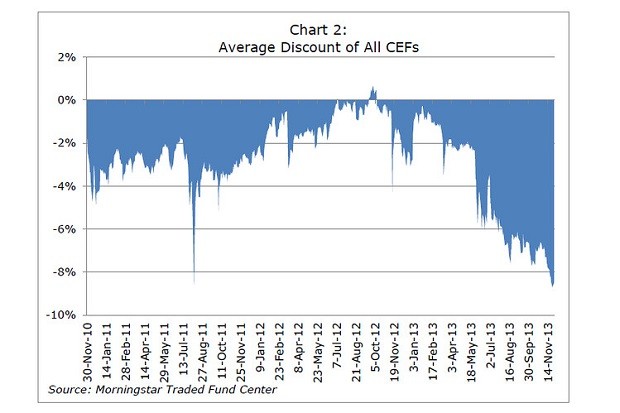

But unlike open-end funds, closed-end funds: (1) trade like common stocks on the Big Board, (2) have a fixed number of shares outstanding, (3) can trade at a premium to net asset value or at a discount to its net asset value and (4) cannot accept new portfolio money.

Because closed-end funds trade on the New York Stock Exchange, you dont have to pay a gut-wrenching 5 percent commission to own them.

I will recommend five closed-end funds. Each pays between 9.5 percent and 11.5 percent, but I cant give you assurance that these nose-bleeding yields are without risk or will remain constant. Each of these closed-end funds trades at a discount to its net asset value, which means that you are buying shares for less than their immediate liquidation value. And thats a good thing because this discount gives the shares a layer of protection in a down market.

I suggest that you invest about $3,400 in each of the five funds rather than dumping all your money in one fund. Investing in five funds spreads your risks, and this diversification will give you better protection than would investing in a single closed-end fund.

• So lets begin with ING Global Equity Dividend and Premium Opportunity Fund (IGD), which pays a dividend of $1.872 and sports a 9.93 percent yield. IGD was a 96 million-share initial public offering, raising $1.6 billion, coming public at $20 a share in March 2005.

IGDs first objective is high income. It earns this by investing in a montage of global stocks that have a long history of high-dividend yields, and the managers increase the yield using an option-writing strategy.

IGD is not leveraged, has an expense ratio of 1.03 percent and has a portfolio turnover exceeding 200 percent.

• Liberty All-Star Equity Fund (USA) came public in 1986 at $10 and raised $1.55 billion. The 88-cent dividend yields a scary 12 percent, and USA trades at an 11 percent discount to its $8.29 net asset value. USA has five fund managers and allocates 20 percent of its portfolio to each manager, each of whom has a different investment style.

USAs objective seeks total investment return via long-term capital growth and current income. The expense ratio is 0.99 percent and the portfolio is not leveraged.

• First Trust/Fiduciary Asset Management Covered Call Fund (FFA) came public at $20 in August 2004, raising $380 million. Its $1.60 dividend yields a comfy 9.3 percent and trades at 6 percent discount to its $18.36 net asset value.

Its objective is to earn a high level of income and gains and, to a lesser extent, capital appreciation. FFA attempts to achieve this goal by investing in equity securities and then selling options on at least 80 percent of its portfolio. The portfolio turnover exceeds 250 percent, its expense ratio is 1.23 percent, and FFA is not leveraged.

• Small Cap Premium & Dividend Income Fund (RCC) has a $1.67 dividend yielding a nice 9.83 percent and came public a year ago at $20.

The first objective of its $330 million portfolio is a high level of current income with a secondary goal of capital appreciation. RCC invests at least 80 percent of its portfolio in small-cap stocks, most of which I know nothing about. RCC is not leveraged, trades at a 7 percent discount to its $18.79 net asset value and has a 1.07 percent expense ratio and very low portfolio turnover. This is an aggressive closed-end fund.

• Enhanced Equity Yield & Premium Fund (ECV) pays a $2.05 dividend with an 11.81 percent current yield. ECV came public a year ago at $20 and trades at a 3.33 percent discount to its $18.33 net asset value.

ECVs first objective is current income, then capital gains. ECV will repurchase 5 percent to 25 percent of its outstanding shares each year. ECV hopes to achieve its goals via a portfolio of dividend-paying stocks and by selling equity index options to generate gains. The fund is not leveraged and has an expense ratio of 1.07 percent, and 34 percent of its $320 million portfolio turns over annually.

Good luck to you.

Malcolm Berko personally responds to each letter he receives. You may send your questions to Malcolm Berko c/o The Daily Journal of Commerce, P.O. Box 1416, Boca Raton, FL 33429.

� Copley News Service