Open Interest (Stock market) Definition Online Encyclopedia

Post on: 3 Июнь, 2015 No Comment

The number of open trades in a particular market. An open interest is not the same thing as volume of options and future trades.

FREE to Subscribe.

OPEN INTEREST

Overview.

Definition

Open interest (futures )

Open interest is the number of open contract s of derivatives like futures and options that have a time limit after which they expire. Open interest in a derivative is the sum of all contract s that have not expired, been exercise d or physically delivered.

Open Interest (OI) is the number of contract s outstanding in the market place. Open Interest only applies to futures and option contract s. Changes in open interest either confirms price action or acts as a warning of a potentially weakening trend.

What is the definition of Open Interest ?

Das Bцrsen- und Finanzlexikon: Open Interest

Anzahl der nach einer Bцrsensitzung nicht glattgestellten Kontrakte.

Verwandte Eintrдge.

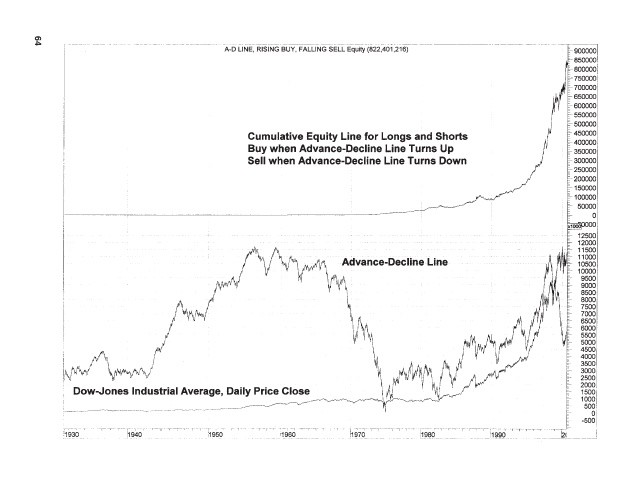

Open Interest RISING — Indicates that the present trend (up, down, flat ) will continue

Open Interest FALLING- Indicates that the prest trend (up, down, flat ) is likely to change or is coming to and end

What Is Open Interest ?

Open Interest is the total number of outstanding contract s that are held by market participants at the end of each day. Where volume measures the pressure or intensity behind a price trend. open interest measures the flow of money into the futures market.

Open interest indicates the trend in the F&O market and measures the flow of money into the futures market. The open interest position represents the increase or decrease in the number of contract s for a day, and it is shown as a positive or negative number.

Open Interest is the number of outstanding contract s of a security by the end of the day.

Next Term:

SPY October Put Open Interest Table

So on our assumption that the floor traders have sold all of these October Puts, they are synthetically long 35 million SPY shares. So the hedge for this is that they are short 35 million SPY underlying stock.

Open Interest. The number of options or futures contract s that are still unliquidated at the end of a trading day. A rise or fall in open interest shows that money is flowing into or out of a futures contract or option. respectively.

OPEN INTEREST .

Open interest is one of the most confused terms in derivatives. In simple terms, open interest is the number of unsettled contract s. This term should not be confused with ‘volume ‘.