Oil profit taking may become buying opportunities

Post on: 16 Март, 2015 No Comment

Quote of the Day .

Make use of time, let not advantage slip.

William Shakespeare

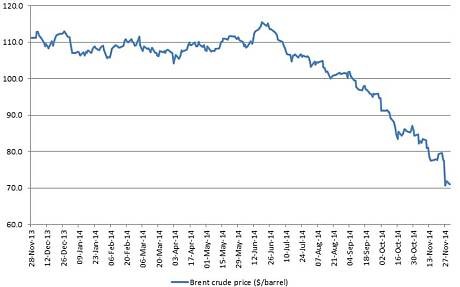

The correction in the oil complex continued for another session with the spot Nymex WTI contract now down around $5/bbl since peaking a tad over $100/bbl on Friday. As I have been suggesting the market was toppy and susceptible to a downside correction. which is what has been underway for the last two trading sessions. The current round of profit taking selling has resulted from a combination of a buy the rumor sell the news on the QE3 front coupled with the fact that in spite of all of the geopolitical risk that exists there is still a very ample supply of oil in the world. The Saudi’s are producing more than 10 million barrels per day of oil while demand is lackluster at best as even the main oil demand growth engine of the world. China is also slowing.

QE3 in the US, QE in the UK, the ECB bond buying program and investments in China are all forms of stimulus programs that at some point in time will result in pushing inflation higher, the US dollar lower and thus higher oil and commodity prices. What is going on in the market at the moment (in my opinion) is a consolidation phase as the weak longs head to sidelines while the medium-term investor/ traders wait for a buying window. which I do not think will be too long in the making. I do not expect the current downside move to be more than a correction and definitely not the beginning of a bear market trend. There are too many headwinds at the moment that are supportive of oil prices going forward.

On the other hand I do not expect oil prices to soar to new year-to-date highs anytime soon. barring an oil supply disruption in the middle east. Once the correction is over I would then expect the oil complex to enter into a slowly evolving uptrend that is likely to last as long as the geopolitical risk from Iran and elsewhere in the Middle East exists and the central bank printing presses continue to roll out money. Limiting the upside moves in oil will ultimately come down to what all of the stimulus programs do to the global economy. if anything. Unless the accommodative monetary policies in both the developed and developing world countries results in an economic growth spurt global oil demand is not going to grow at a faster rate than it has over the last year or so and as such supply should outstrip demand in the medium term.

Global equity markets fared better than oil today falling only about 0.2% over the last 24 hours as shown in the EMI Global equity Index table below. The Index is down by 0.5% so far this week narrowing the year to date gain to 9.3%. The global equity markets are still holding onto the majority of the gains since the announcement of the ECB bond buying program as well as QE3. Much like the oil complex the global equity markets are also in the midst of a round of profit taking selling that I also expect to be short lived and shallow. This week global equities are a neutral to slightly bearish price driver for oil and the broader commodity complex.