Oil Prices Have You Confused Here s a Peek Behind The Crazy Oil Market

Post on: 8 Май, 2015 No Comment

Image owned by The Motley Fool.

The oil market is a crazy place that over the years has made and lost fortunes, been accused of manipulation by speculators, and yet continues to hold an oversized weight over our financial lives, no matter where we sit. If oil prices go down most consumers are happy because they save money at the pump, but investors can lose big as prices drop. When prices rise the opposite is true and often consumers are looking for someone to blame.

In some ways, that’s a natural reaction to a market that’s not well understood by most Americans. The trading of oil is a far off concept that’s controlled by a small group of speculators who push prices higher or lower depending on their whims that day. And in some ways that’s true.

But the oil market is also unlike any other market we’re familiar with in the U.S. It has elements of stocks, bonds, options, and commodities like corn, but it’s a strange beast because of the structure of the market and oil itself. Oil doesn’t expire like agricultural commodities; it’s consumable unlike a financial security like a stock or bond, yet there are costs associated with holding it for too long. These factors drive some of the price movements of oil, so let’s dive into how these factors affect the strange world of oil trading.

With oil below $50 per barrel oil drilling is starting to slow. Image source: LINN Energy.

What makes oil trading different from everything else

When you hear headlines about oil prices hitting new lows, what are they really saying? Market reporters are quoting what’s called the spot price of oil, but it’s not really a spot price at all. In fact, it’s a futures price over a month into the future. Look at Bloomberg’s energy quotes and they’re actually contracts for March 2015 delivery. Why so far in the future?

The price of oil is actually quoted based on the most liquid near-term futures contract. In the February contract liquidity, or trading of the contract, dries up because most traders don’t want to actually take delivery of oil. An oil futures contract is unlike a stock, which you could buy and hold forever; with oil there’s a date in the future where your contract turns into actual oil — a lot of oil.

The standard crude oil futures contract traded on the CME Global market comes with the following delivery terms (condensed from the full list of specifications you can read here and here ):

- Delivery type: Physical

- Delivery quantity: 1,000 barrels

- Delivery location: Delivery shall be made free-on-board (F.O.B.) at any pipeline or storage facility in Cushing, Oklahoma with pipeline access to Enterprise, Cushing storage or Enbridge, Cushing storage.

You can see why a hedge fund or ETF may not want to actually own the futures contract after a certain point. I don’t know where I would put 1,000 barrels of oil in the Cushing, Oklahoma area if I got stuck with a contract.

Oil prices and oil volatility

This structure also shows why oil prices can be incredibly volatile. If there’s suddenly an oversupply of oil traders that own oil futures, betting the price will rise, they may rush to sell their contracts to get out of that position, sending prices plummeting. This is exactly what happened over the past six months.

Image source: LINN Energy.

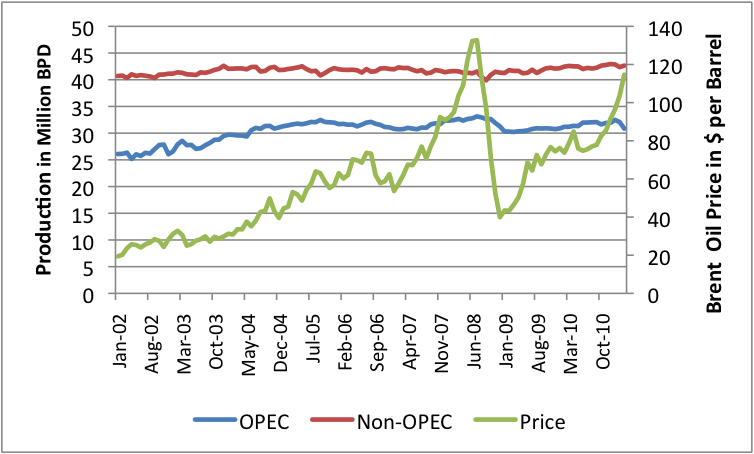

According to the U.S. Commodity Futures Trading Commission, hedge funds were long 413 million barrels of oil — about 22 days worth of U.S. consumption — in June and when the market began to turn no one wanted to buy those contracts. Since none of these funds wanted to take physical delivery of oil they had to dump contracts and prices plunged.

It’s simple supply and demand, but in the oil market it’s the supply and demand of a contract to take delivery in the future, not the actual supply and demand from producers and consumers, that can drive prices. Oil markets are crazy and this is a big reason why.

Eventually supply and demand wins

At the end of the day, oil traders get a lot of flack for their roll in oil markets, but they do serve a useful purpose. They’re taking on the risk of future price movements so oil producing companies can guarantee a price at a certain time in the future. This allows businesses to plan expenditures according to what price they can get for oil instead of just selling into a true spot market.

And eventually oil prices are going to follow the laws of supply and demand between producers and consumers. There’s just this complex and sometimes illogical futures market in between those market forces skewing prices one way or another short-term.

Knowing just a little about how the mechanisms of the oil market works can make you a more informed investor. And when looking at energy stocks today, the oil market is worth understanding and hopefully this has given you a small peek behind the curtain.

How to invest in the technology fueling the U.S. energy boom

As the price of oil plummets, savvy investors are looking for a way to invest in this new energy dynamic. And there’s one high-caliber company in the oil-services sector using advanced technology to profit from the U.S. oil boom. Given the country’s ongoing quest to extract more and more oil, I strongly urge you to claim your copy of our brand-new investigative report on this company helping fuel its boom. Simply click here for access .