Offshore Tax Havens

Post on: 21 Июль, 2015 No Comment

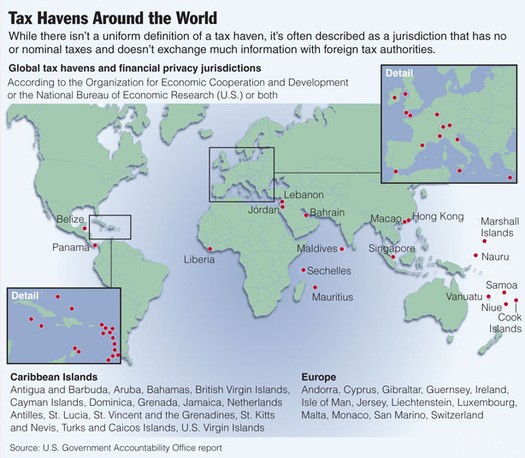

Examining offshore tax havens, their regulatory environments, and the investment, saving and banking opportunities available therein

Euro and Dollar Collapse! How Can You Escape The Fallout?

Contagion, panic, fear, the Euro’s future is uncertain and the US debt circus has driven another knife into the heart of the US Dollar.

Personally I really hope that never happens, some years ago I would have laughed at anyone who suggested the dollar was on the brink of collapse, plus I openly confess to being a fan of the Euro, it really did seem like a good idea at the time.

I was wrong, but what now?

Starting any article with a confession about how wrong my previous judgements were about the dollar and euro blows apart any pretence to market clairvoyance skills.

The fact is I don’t know if the euro and dollar are about to collapse, I really hope not, but there are some massive alarm bells ringing that tell me to at least take cover until the storms over.

I think the worst thing any investor can do is nothing, and just hope for the best when things start to smell bad.

How Your UK Passport Gets You a Legal Income Tax Free Lifestyle

Your passport is your ticket out of austerity UK and into a legal and legitimate income tax free lifestyle abroad

The trouble with income tax is that as a payer of it, you can’t stipulate where it’s spent. Most reasonable people are happy to pay some tax towards health and education – even towards defence and unemployment – i.e. towards all the things that keep UK cohesive and functioning.

However, now that most of your tax is going to pay off old debts. (not just UKs old debts, but also failed Euro state debt too), and for causes that you perhaps cant quite get your head around, like any old foreign war that the UK feels a strong urge to be involved in, are you wondering if your UK passport could enable you to live somewhere else and perhaps pay less income tax?

The really good news is that there are some countries that havent got themselves in quite so much of an economic mess as the UK, and some of them welcome Britons seeking an income tax free lifestyle! As we will also demonstrate, there are nations and havens around the world where there are tax caps, and where the likes of high net worth individuals and retirees are given the best deals on taxation.

How Tax Havens Help Expats Legitimately Retain Wealth

Tax havens are no longer generally considered to be illegal or immoral rogue offshore states. Rather they are more likely to be well-regulated and governed, wealthy nations where expats can potentially explore the options available to them for the better banking, saving and investment of their wealth – and where tax saving is often legitimately possible

Back in 2008 we were subjected to something of a smear in the Guardian Newspaper at the hands of journalist George Monbiot, (he’s the one who claims to be an ‘environmentalist’ yet he promotes the nuclear industry). He accused us of “help[ing] people to avoid their obligations to society.”

Clearly he didn’t spend much time on his research for the article, which was all about Britain’s tax havens allegedly fuelling crime and corruption. Had he spent just five minutes browsing Shelter Offshore he would have understood that we’re actually in the business of helping expats and would-be expats with everything from moving abroad to finding work overseas. We are not into the immoral promotion of illegal activities.

Tax havens become of interest to expats when they move abroad because they can potentially assist them in legitimately retaining more of their wealth, as we will detail in this article. But they are far from the terrible scourge on the world that divert funds away from developing countries, as Monbiot alleges. What’s more, while they [will probably always] exist, why should they not be made legal and legitimate use of by those who can benefit from them?

Do Offshore Tax Amnesties Work

We look at whether there are viable alternatives to aggressive tax amnesties which don’t always net HMRC as much in evaded offshore taxes as they would have hoped, and we discuss tax competitiveness and legitimate expats’ offshore tax options.

With the news that the latest offshore tax amnesty introduced by HM Revenue and Customs to persuade tax evaders to bring their wealth back under the taxman’s watchful gaze has only netted £140m of an expected £3bn, it’s time to ask whether offshore tax amnesties work, and whether there isn’t perhaps a better way to keep tax revenues in the UK.

The tax amnesty we’re referring to is the Liechtenstein Disclosure Facility which was introduced in 2009 and which David Hartnett, the UK’s permanent secretary for tax said could net the British taxman up to £3bn by the disclosure’s cut of date in 2015.

However, as the Telegraph reports today, the facility has so far only generated about £140m in tax revenues for the British government. So why are the figures so low, are tax amnesties effective, who evades tax anyway, and isn’t there a better way of ensuring that everyone pays their dues? We investigate…

Is the Isle of Man a Good Jurisdiction for QROPS?

As expats seek to make the most of their offshore status through the correct investment of their pensions, according to their own individual position, the Isle of Man is seeking to attract a greater market share of QROPS business through important tax changes and greater investor protection.

We recently reported on Guernsey’s’ move to establish a QROPS Code of Practice to remove consumer confusion from this area of financial services provision on the island. Guernsey has raced ahead of its competitors as a leading destination for QROPS (qualifying recognised overseas pension schemes), but because this is such an as-yet under-explored area of international pension business, other offshore centres are keen to compete on a level playing field with Guernsey.

In our earlier report we commented that the Isle of Man as a QROPS jurisdiction had recently raised a few eyebrows: certain providers’ interpretations of HMRC qualifying recognised overseas pension schemes rules had seemingly stretched the limits of the taxman’s guidelines. However, because QROPS business is so critical to the Isle of Man’s ongoing development as a leading offshore centre, we can now report that new tax rules and seemingly strong policyholder protection regulation may mean that the Isle of Man is the new jurisdiction to explore for expats seeking to offshore their pension.

So is the Isle of Man a good jurisdiction for QROPS? Clearly only a personal examination of scheme offerings from locally based providers will determine whether it’s the right offshore financial centre for you to choose, but as you will see in our report, the Isle of Man has certainly gone all out to dominate this market and to push Guernsey into second place.

British Offshore Tax Haven Update

The Isle of Man and Gibraltar are working to lose their tax haven status and instead become respected financial centres in Europe – we chart their recent legislative and regulation changes for affected and interested investors.

The UK has a number of tax havens associated with it – from Jersey and Guernsey in the Channel Islands to the Isle of Man and even Gibraltar. All are jurisdictions closely associated with mainland Britain, but which have a certain autonomous status allowing them to make their own rules when it comes to the likes of taxation for example.

In the past these particular British offshore tax havens have been among the most well respected in the world within the financial services industry because of the degree of regulation in place protecting investors’ assets etc. However, the collapse of Kaupthing Singer and Friedlander in the Isle of Man really undermined British tax havens in general, and called into question the scope of investor protection schemes and the degree of regulation in place too.

As a result of this fact, combined with elements such as the EU Savings Tax Directive and the global crackdown on tax evasion, all tax havens around the world have been forced to reassess their position and how they handle the management and protection of invested assets on their shores. Most recently this has led to significant changes in the Isle of Man and Gibraltar. Here we present a British offshore tax haven update so you can determine where your money will be best invested and protected.

Why is Switzerland Cleaning Up its Tax Haven Status?

Switzerland is a famous offshore tax haven, renowned for its banking secrecy – but its status has been eroded and now it is having to transform itself to protect its economy

Ever since the American tax authorities began a concerted crackdown on US citizens’ banking activities abroad in an effort to bring all wealth back onshore, heavy emphasis has been placed on Switzerland sorting itself out as a tax haven! Traditionally the one place in the world where everyone knows that banking secrecy is assured, Switzerland has inadvertently developed itself a negative reputation for facilitating tax avoidance.

UBS was the first bank to be accused of assisting clients to avoid tax – by the Americans. And since then, other institutions have been investigated, targeted and accused of enabling the non-tax compliant activity of clients. Employees of Swiss banks have allegedly sold off secrets about account holders, and now the German and French authorities are sifting through the records they’ve acquired looking for proof that some of their citizens have been using Swiss banks to evade and avoid tax.

However, significant change is now afoot in Switzerland, with one commentator stating: We are in the midst of a transformational period both culturally and operationally. Tax-compliant wealth management will become the product in Switzerland, not bank secrecy and a tax haven. So why is Switzerland cleaning up its tax haven status? Because it has to or because it can see the benefits of doing so?

Offshore Tax Dodgers to Face Even Bigger Fines in 2011

The UK tax amnesty has been extended, but miss it and you face even higher fines of up to 200% for the deliberate avoidance of your British tax obligations through the use of offshore solutions

HMRC recently extended the tax amnesty deadline to the 4th of January – which is a good thing because shortly after doing so it was announced that there will be a massive increase in the potential fines faced by those who deliberately evade tax by squirreling their money away offshore.

Offshore tax dodgers are to face even bigger fines from 2011 it has been announced – therefore if you have undeclared assets offshore, perhaps you should be speaking to an accountant about declaring your ‘crime’ to the Treasury quickly before January the 4th 2010.

The new fines will be up to a ceiling of 200% of the unpaid tax amount – and the legislation behind the move will come into being next year following the Budget, and be brought into effect by 2011. As we always repeat, ignorance is no excuse when it comes to taxation – you have to be aware of your own liabilities and responsibilities and fulfil your obligations. But if you’re a British tax payer and you’ve avoided taxes…now is a good time to get your affairs in order.

British Offshore Financial Centres Report

Britain’s offshore financial centres are well run, provide essential capital inflows to the UK and are in a strong financial position apparently, so why does no one want to know!

Isn’t it interesting how, in the build up to the publication of Michael Foot’s independent review of British offshore financial centres, the media were right on the story telling us how it would reveal that centres like Jersey and Guernsey not only drain the UK tax coffers of billions, but that they are now in crisis and that the British taxpayer will have to bail them out.

Then, when the report is published and it actually reveals that British offshore financial centres are responsible for propping up the British economy, are very well run in many cases and that they have a vital role in supporting the ongoing health of Britain’s banks and overall economy, no one wants to publish such interesting yet seemingly ‘boring’ news!

In this article we’re going to explain why nothing’s been published about the British Offshore Financial Centres Report because the facts and findings contained therein are not the stuff of scurrilous headlines that will sell papers on the back of fear. Rather, the findings are fascinating and prove to anyone who has an interest in all things offshore that offshore jurisdictions are critically important — not only to international business, but to the British government as well!

Offshore Tax Havens and British Higher Rate Tax Payers

Taking a look at whether the British government’s assault on higher earners is pushing more people and more wealth offshore from the UK

In their April 2009 Budget the British government not only made it very clear that they want to tax higher earners far more, but that they want to put a cap on any tax relief that such individuals currently enjoy on any of their savings and investments too.

This shocked many as a lot of the proposals represented a u-turn in policy and really made it very clear that the UK government is wholly unsupportive of those who work exceptionally hard and earn more as a result. Needless to say, those who will be affected by the far reaching and damaging changes from as early as April 2010 have been looking into ways to get around the tax increases.

So, the question on many people’s lips is – ‘are offshore tax havens benefitting from British higher rate tax payers’ wealth’ – and the answer is a resounding and almost universal yes! In this report we’ll examine how the British government is pushing some of its most important citizens – in terms of their influence on British business and the British economy — away from the UK.