Offshore Asset Protection

Post on: 28 Июнь, 2015 No Comment

I know that the term Offshore Asset Protection may sound daunting.

When do you need a plain old offshore bank account, and when do you need what we call offshore asset protection?

What is the difference?

Most importantly: How can you make your assets and savings untouchable?

These questions and more will be answered in this free report.

You might already have thought of opening an offshore bank account. That is a great first step that opens up a range of currency and investment options that you would not previously have had access to.

However, there’s more to it than that.

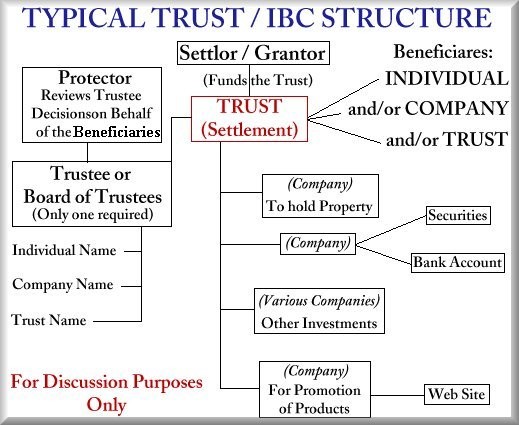

Most people setting up offshore bank accounts these days will do so not as individuals, but in the name of an entity such as a company, trust or LLC. This affords, at relatively low cost, a far greater degree of privacy and wealth protection than you could normally achieve in your home country, while ensuring full compliance with your local laws – if it’s done properly.

This report looks at what we mean by asset protection, why it is important, and how it is really quite straightforward for you to gain the upper hand against plaintiffs — even governments — by choosing in advance a legal forum that is more favorably inclined to protect your private property rights.

Later on in this report we will zero in on Nevis, a small Caribbean island which is one of the best jurisdictions for those seeking secure asset protection today.

First of all though, let’s look at asset protection in more general terms…

GOVERNMENT AND THE JUIDICIAL SYSTEM OUT OF CONTROL

To have a full understanding of how you can use the law to protect your assets, and why you should, please indulge me for a moment as we look at some legal basics.

Constitutionally, in western democracies, there are three branches of government:

The Legislative Branch makes the laws. It is here in parliament, or the Senate and House of Representatives in the US for example, where elected lawmakers vote on the laws that form the basis of the system.

The Administrative Branch are the unelected bureaucrats. Their job is to administer and enforce the system that is laid down by the Legislative Branch. They are not supposed to think for themselves. To give a recent example, the same bureaucrats who were originally charged with enforcing the British national ID card system are now, following a change of political masters, charged with dismantling the same system they set up.

The Judicial Branch are the lawyers who get involved where disputes arise about laws made by the Legislative branch. Their job is to interpret the sometimes complicated and ambiguous laws.

All three of these branches are supposed to act separately and independently from each other. They have clearly defined roles within the system. In theory, and if we look back in recent history to when life was generally simpler, this system is pretty good.

The problem is that in practice, the system is simply no longer working in the way it was designed. That’s a nice way of saying ‘it’s broken.’

First, our elected representatives rarely even bother to read the laws they are voting on. Even if they did, they likely wouldn’t understand them… because the laws presented and proposed to them by the administrative branch are deliberately designed to be confusing. Important provisions slip through unseen, which is just what the bureaucrats want!

A good example was the recent HIRE Act in the USA: ostensibly an act to stimulate employment, it also brought in by the back door the most sweeping extra-territorial legislation yet interfering with the financial affairs of foreign banks and Americans doing business overseas.

The bureaucrats usually show little inclination to think for themselves, but they tend to take on the role of interpreting the law in a way that was never intended. Modern laws developed by the bureaucrats but rubber-stamped by legislators often encourage this, specifically covering only broad outlines whilst leaving interpretation and implementation to Whitehall or Washington, through bureaucratic diktats such as Statutory Instruments or decrees.

The judiciary, meanwhile, has to a large extent been politicized and lost any common sense. In the USA, and other highly litigious countries like the UK, Canada and Australia, we see contingent-fee lawyers who act as predators.

Judges and juries play along, in the role of Robin Hoods, apparently determined to redistribute wealth. Did you know that in the USA you are more likely to be sued than you are to have a hospital stay?

LITIGIOUS PLAINTIFFS AND RECKLESS GOVERNMENTS

The main flaw of the modern judicial system is that it makes it too easy for plaintiffs to sue you. Plaintiffs and their lawyers can and will sue you for just about anything they can dream up, because the plaintiffs don’t need to pay their lawyers in advance.

These contingent-fee lawyers will work for a (high) percentage of whatever they can squeeze out of you. Any lawyer can easily cast you as the villain. You are the greedy rich at the expense of working stiffs — and the judges and juries are out to redistribute your wealth to the plaintiffs, who have most likely never done an honest day’s work in their lives!

What can we conclude from all this? Basically, as I said, that the system is broken. You can no longer rely on the government or the legal system to protect constitutional rights like property rights or personal financial freedom.

Very often, it will be the very same government that is violating those rights!

Meanwhile, governments are running out of money.

They are tightening the screws. Britain’s Emergency Budget recently showed how bad things have already become – Capital Gains Tax was raised by ten points literally overnight! In the past, there has generally been some time to prepare and adapt for such tax increases.

Not any more it seems.

While European governments have traditionally run their pension plans as ponzi schemes, Americans saving for their retirements have been more fortunate, having had the opportunity to invest in retirement accounts that still have some value.

However, the Obama administration, more desperate than ever for funding, is now eyeing those retirement accounts very closely and very jealously. I don’t think they would go so far as to confiscate them, but they don’t need to. there are plenty of ways they can obtain more control over those funds.

They will obtain this control, ironically and sarcastically, in the name of ‘investor protection’ – for example, by insisting that pension funds invest in supposedly triple-A rated US government debt.

It is for these reasons that any person of even moderate wealth needs to take asset protection into their own hands.

It is a fallacy that asset protection is only for the extremely rich or for those in high risk professions like doctors and chiropractors.

Conclusion. Having an asset protection strategy is a necessity today for anyone who has a pension plan, anyone who owns a business, and anyone who has a bank or brokerage account with some funds in it.

IS ASSET PROTECTION COMPLICATED?

Asset protection might sound complicated.

Sometimes it is. It doesn’t have to be. Ironically, those lawyers who have caused the malfunctioning of the judicial system will quite happily switch sides to protect the exploited rich against the filthy poor. They still, however, see the wealthy as ‘deep pockets’ to be exploited.

I have seen all manner of highly complex and legally questionable asset protection schemes dreamed up by lawyers. in the US in particular.

Over the years I have read several ‘how to’ manuals running to thousands of pages that are sold to hopeful law firms looking to enter the business for upwards of $10,000 per copy, all explaining asset protection in detail.

I have even seen lawyers suing other lawyers about the contents of these how-to manuals!

In reality, the whole idea stinks. It seems designed more than anything else to extract fees and line the lawyers’ pockets. If, or should I say when, these asset protection plans are tested in court, the legal fees to defend them are astronomical.

At that stage it really doesn’t matter any more – even if you win, you lose.

Fortunately, there is a better way…

THE BEST AND SIMPLEST WAY TO PROTECT YOUR ASSETS

My advice: forget about domestic asset protection. Your money is safest outside your home country, and therefore beyond the reach of the legal system where you are most likely to be attacked.

The best and simplest asset protection move you can ever make is to bring a new jurisdiction or two into the equation.

The mere fact that assets are located offshore will be enough to stop most lawsuits in their tracks — just like that!

It’s logical when you think about it.

Who would bother to sue a deadbeat with no money? Certainly not a contingent fee lawyer, because he knows that even if he wins a judgement, he won’t be able to collect. So he will move on to an easier target.

Because offshore assets are outside the jurisdiction where the lawyer is licensed to practice, and because court orders are only valid within domestic boundaries, he knows that he will have to apply for enforcement in the jurisdiction where the assets are.

Even assuming he knows where the assets are in the first place (no easy task in itself) this process will typically involve a whole new procedure in the foreign court.

For example Nevis, one of the best Asset Protection countries, requires the posting of a $50,000 bond in a Nevis court before an action can be filed. It’s also necessary to hire local lawyers who will demand a substantial payment up front, win or lose.

For all but the very largest cases, it would never be worthwhile even trying.

Sure, you might hear once every few years of a major lawsuit where offshore assets are targeted. But you will never hear about hundreds of thousands of cases that are thought of but never even filed because a good international asset protection structure is already in place.

The general public has been programmed by the mainstream media to believe that offshore finance is only for the crooks, money launderers, and the super-rich. This is typically reinforced by wellmeaning onshore lawyers and accountants at home, who – to be fair – may have little idea about international asset protection.

They might tell you it is too risky, too expensive, too bothersome or downright illegal.

But that is simply not true.

Owning a foreign corporation or LLC, for example, is certainly not illegal. It’s business as usual.

Can asset protection structures be used for money laundering? Sure – but so can most things. Most of the world’s money laundering is done in the United States and Europe. Because that’s where drug money is made, that’s where it has to be washed.

And expensive? You can easily set up a watertight offshore asset protection structure, without leaving home, for under $5000 using a reputable and licensed provider.

Compare that to what one of those high-flying asset protection lawyers at home will charge you!

OFFSHORE ASSET PROTECTION JURISDICTIONS

As I said, the mere fact of being in another country gives you a great deal of protection. In legal parlance, this is called jurisdictional immunity.

But while you are at it, you might as well set up in a country that makes asset protection its business – what we will call, for purposes of this article, and Asset Protection Jurisdiction or APJ. There are a few of them around the world. places like Panama, Nevis and the Cook Islands.

First, APJs won’t recognize or enforce foreign civil judgements or administrative orders (such as those from tax authorities). Although of course criminal matters like fraud will be duly investigated in any respectable jurisdiction, civil and tax matters are quite a different issue altogether!

Since APJs won’t enforce a judgement from any court outside their country, the plaintiff is forced to re-litigate their case within that foreign jurisdiction. This is typically impractical, if not impossible.

For example, the statute of limitations is typically much shorter in APJs, normally around two years. Or the APJ may not recognize the plaintiff’s underlying liability claim. When it comes to enforcing claims, these countries are debtor oriented.

They try to protect their clients’ wealth because wealth protection is their business.

These asset protection jurisdictions have deliberately passed special laws — usually drawn up by top flight British or American lawyers who are experts in the field — that allow you to form specially protective asset protection structures and entities.

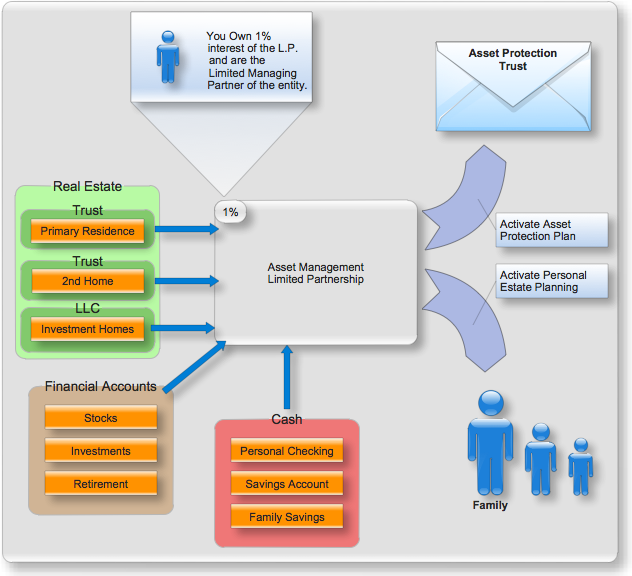

Offshore asset protection trusts, limited liability companies, limited partnerships, foundations, captive insurance companies, international business companies, and multiform foundations are examples.

Each entity, in its own way, gives you far more protection than you could obtain through a comparable onshore entity.

Asset protection jurisdictions are also great privacy havens. It is not possible to look up details of owners or directors of the offshore entities, so it is almost impossible to prove that the entity is linked to you.

For anyone sick of the insipid invasions of privacy that have become commonplace in most major countries, doing your banking through a structure like this can offer a breath of fresh air – huge advantages at low cost.

OFFSHORE PROTECTION AGAINST FRAUDULENT TRANSFER CLAIMS

You probably won’t be notified in advance when someone decides to sue you.

Often, a creditor will try to argue that there was a fraudulent conveyance – that is, that you transferred assets to the new structure specifically to avoid their claim, because you knew a lawsuit was pending. If the plaintiff can convince a court of this, they can usually get the transfer set aside, and you lose the benefits of the asset protection vehicle you have set up.

It’s therefore particularly important that your asset protection strategy must withstand a potential fraudulent transfer claim. This is where laws in APJs come in handy. In an APJ, your creditor must prove beyond a reasonable doubt that your transfer offshore was fraudulent — an extremely difficult standard to prove.

Another formidable obstacle is that a creditor with a judgement must nevertheless re-litigate their case in the courts of the offshore jurisdiction − and win a judgement from those courts − before the creditor can even attempt to claim a fraudulent conveyance.

In order to re-litigate, the case must follows rules of liability recognized by that jurisdiction. For example, your creditor probably could not file for discrimination or anti-trust.

Still other requirements effectively filter most prospective claims against a defendant’s offshore assets. While no worthwhile asset protection country would completely disregard fraudulent transfer claims, these APJs can and do deliberately make it exceptionally difficult to pursue such claims.

Finally, I haven’t even touched on the fact that the assets most likely won’t be in the jurisdiction where you are being sued anyway!

When advising clients on offshore structures, I always suggest that the banking, brokerage accounts and other assets be located in a completely different jurisdiction from the place of incorporation. Your Nevis LLC, for example, might hold a bank account in Panama or Switzerland and a brokerage account in Singapore.

These barriers to recovery explain why, according to US research, fewer than 3 out of 100 judgement creditors even attempt to recover offshore assets.

And these few cases are usually settled for pennies on- the-pound.

Without offshore protection, these creditors would undoubtedly have recovered considerably more!

About $10 trillion is now safeguarded in offshore asset protection jurisdictions. These countries feature the best and most attractive privacy, private banking and wealth management services, as well as — most importantly — the best and most powerful asset protection statutes.

SELECTING AN ASSET PROTECTION JURISDICTION

Many offshore jurisdictions can offer you excellent asset protection. So how do you choose.