OFFBALANCESHEET FINANCING AND TRUSTS A COMPETITIVE ADVANTAGE

Post on: 16 Март, 2015 No Comment

A sale leaseback or lease leaseback can free up valuable capital that can earn a higher rate of return.

In today’s marketplace, corporations look to increase their efficiencies and competitiveness in any way possible. Different companies accomplish this task in various ways. Some companies focus on increasing their operating efficiencies in manufacturing, while others focus on trying to get the biggest bang for their marketing buck. Still others look to new technologies to give them a competitive advantage via Web=enabled strategies. In their quest for greater efficiencies, however, many companies have ignored what is fast becoming an important option—off-balance-sheet financing in the form of sale leaseback and lease leaseback transactions.

There may be a reason why some companies or others in particular industries have been slow to implement these potentially powerful strategies. Often, CEOs come from marketing or sales related positions, as these functions are credited with opening new markets and driving top-line sales. The old adage “Nothing happens until somebody sells something” is a potent reminder of this prevailing mindset. And perhaps there is justification for this bias. To push this point further, the business community feels that Finance is a support function. Without a strong-minded CFO, organizations will not explore or even discuss many financial solutions.

Unfortunately, this sales and marketing—or shall we say, non-financial—focus hides a very powerful strategy enabler off-balance-sheet financing, from senior management. Off-balance-sheet financing is a technique that allows a corporation to move the value of an asset off its balance sheet, thereby freeing up the capital previously locked-up in that asset. In highly competitive industries, this capital is better utilized in other areas where it can earn a higher rate of return.

Criticism of such techniques often comes from managers and owners. They focus on the necessity to own the assets outright since, historically, off-balance-sheet financing required that the assets be sold. Feeling the need to fully control their destinies, and thus fully own the asset, companies today are unwilling to sell off the assets to others, for fear that the decision may come back to haunt them in the near term. Management that is always fearful of being held captive by third parties in any manner simply will not put their operations at risk or be constrained by a potentially limited set of future options.

The good news is that there are techniques available that enable companies to enjoy the full benefits of ownership from a use-and-control standpoint, and at the same time benefit from freeing up otherwise locked-in capital. This is primarily achieved through the use of trusts and synthetic leases.

The bad news is that our primary concern must be the need to make sure that the mechanism employed is considered appropriate by both the accounting department and Canada Customs and Revenue Agency. Fortunately, we are able to accomplish this through a well-thought-out approach or technique that uses a trust vehicle as its core mechanism.

Let us start with this scenario. Imagine a manufacturing company that owns its $20-million facility. As mentioned above, it might believe that it is absolutely necessary to own it in order to maintain control. Under this scenario, the $20 million is locked up and sits on the company’s balance sheet under the line item “premises and buildings.” This $20 million is there to stay, save for the normal amortization expense and writedown of the asset. You can’t get at it unless you mortgage the facility, which would incur a financing fee and a lien against the property. Many business people would rather avoid this scenario, especially conservative, private-enterprise business people.

Instead, the company could sell the building to a third party that would feel more comfortable with a lesser return on capital. An example of a third party is a property-ownership company. The manufacturing company would at the same time sign a long-term lease with the new property owner to secure its operating position into the future. This is the traditional approach to sale leaseback transactions, and in the past it has created certain tax- and accounting-based situations that trust vehicles are uniquely designed to resolve.

A QUESTION OF TRUST

A sale leaseback transaction means an actual sale has taken place. One of the biggest problems is that it can generate immediate income taxes from capital gains and the recapture of depreciation. This is often a deterrent to structuring any transaction when attempting to achieve off-balance-sheet treatment, especially for companies trying to improve their gearing ratios. By using a trust mechanism, however, you can avoid immediate taxes because a sale is never consummated. Although there are many variations, the general structure of the transaction is shown in the figure below.

Under this structure, the trust is the borrower or debt issuer and Opco is the manufacturer that owns the facility. After borrowing the required funds from the lender, the trust makes a head-lease payment to Opco, representing the value of the asset. The trust will have the right to sublease the assets back to Opco under an operating lease or capital lease, as the case may be. The trust then receives periodic payments from Opco to sufficiently amortize the debt and repay the lenders, which otherwise represents a rental stream. For income tax purposes, Opco will likely be able to claim CCA on the leased assets since title has not passed to the trust. Opco will also be required to amortize the head-lease payment over the duration o the head lease as will the trust. Keep in mind that from a tax perspective, Opco never sold the asset.

For collateral, the lender will usually receive a leasehold mortgage/lien and a guarantee of specific performance under the lease by Opco. Opco cannot guarantee the debt directly and achieve off-balance-sheet treatment.

Thus, we see that the major advantages of using a trust in an off-balance-sheet transaction are:

- A trust that is part of a synthetic lease can be used to facilitate a sale leaseback effect without incurring immediate taxes.

- Certain structures involving a trust can achieve off-balance-sheet treatment for accounting purposes.

- The use of a trust will allow a company to retain significant control over a key manufacturing facility.

- A trust can help insulate a lender from potential environmental or related problems associated with a sale leaseback transaction.

- Using a trust to complete a synthetic lease eliminates the residual risk for the lender.

OPERATING OR CAPITAL LEASE

The major issue in off-balance-sheet financing—which is transparent to the lender, but can have significant accounting implications—is whether the lease will be considered a capital lease or an operating lease. Accountants will treat the two differently. Operating leases are not capitalized on the balance sheet, which is what we are trying to accomplish. In contrast, capital leases are treated as debt obligations and the present value of the obligation is recorded on the balance sheet, essentially as debt. Thus, we must make sure that the lease under the sale leaseback transaction is considered an operating lease. We ensure this by meeting the following four criteria for Canadian GAAP rules on what defines an operating lease:

- The present value of the lease payments cannot be greater than 90 percent of the estimated fair-market value of the asset.

- There is no bargain purchase option available to the lessee.

- The term of the lease does not exceed 75 percent of the economic life of the asset.

- The lease does not transfer ownership to the lessee before the lease expires.

The above clearly indicates that you can never finance 100 percent of the fair market value of the asset under an off-balance-sheet structure. This is typically not an issue. It also indicates that a bargain option cannot be structured or the operating lease exceed 75 percent of the life of the asset. In reality, these issues are quite easy to deal with.

The most difficult issue is the potential tax implication in the trust if the head lease and operating lease are not coterminous. However, this issue can be overcome if the terms of the head lease and operating lease are relatively close together, since any tax losses can be carried over to other years.

There are other advantages, particularly for foreign subsidiaries, where there are no withholding taxes for payments to a non-resident. In this case it is possible to locate the trust in a jurisdiction with low or no income taxes and if the problem of taxable income due to the different terms for the head and operating leases is overcome. When structured correctly, the lease to the trust can be treated as an operating lease for accounting purposes.

RETAINING CONTROL

As we originally stated, control of the asset is often the overriding issue with management. Under a synthetic lease structure, as described above, the assets ultimately revert back to the lessee at the end of the lease term, since title to the assets is still held by Opco. There is therefore no need to structure complicated buy-back provisions, as in the case of off-balance-sheet financing without the use of a trust.

Nevertheless, companies may wish for even greater control. They can obtain this greater control through the use of a ground lease. In our example, Opco structured a sale leaseback with the trust to unlock the $20 million of capital within the asset. For that it received a long-term lease enabling it to continue to use the premises and otherwise control the facility. However, in order to solidify its control over the asset further, Opco could also grant the trust a ground lease that could have an equal term as the operating lease. Now, Opco has significant control over the asset under the lease since it has control over the ground lease. In many situations, as in our manufacturing financing, this could be a significant safeguard.

Some clarification is required. While the ground lease is a safety feature of sorts, it will almost always be assigned to the lender of the trust as collateral. However, the ground lease still contains two principle benefits:

- It ensures that when the debt of the trust is repaid and the lender no longer has a claim on the collateral, Opco will have effective control over the assets regardless of the term of the leases

- The ground lease can assist with off-balance-sheet financing, since the operating lease and the head lease—with respect to the assets—may be for different terms in an off-balance-sheet structure.

INSULATION FOR THE LENDER

In certain situations, it may not be desirable for a lender undertaking a sale leaseback to actually have title to the asset, even though the lender wants control. A trust is very useful in this situation and can be used to finance a smaller portion of a large manufacturing facility. For instance, in the mining industry, it is possible to finance various portions of a refinery or other key facilities. The figure above illustrates that title to the asset never passes, although it is subject to a head lease. It is an important feature of a synthetic lease in that it provides an ability to finance a key component of the asset without losing total control.

Or, consider a situation in which a manufacturing facility in a remote location has an adjacent power generating facility. This facility delivers an obvious strategic benefit in that it indirectly controls the rest of the manufacturing plant. Without a dedicated source of energy, it cannot operate. It may be an ideal asset to finance with a sale lease-back, but the lenders may be concerned with PCB levels. Opco may also be concerned that if they enter into a sale leaseback, it will strain the relationship with the existing lenders since control would rest solely with a third-party lender/investor in a sale leaseback. Again, the trust is the buffer that helps maintain some neutrality and also insulates the lender from having to take title to the asset.

RESIDUAL VALUE CONSIDERATIONS AND PRICING

One of the single most advantageous results from the use of a trust and a synthetic lease is the elimination of residual-value risk. The often-cited problem with manufacturing facilities that contain specialized leasehold improvements and a sale leaseback structure is pricing. In virtually every transaction, an outright purchase is completed at a yield that is higher than direct financing. One reason is that for specialized facilities, the residual risk necessitates a higher rate of return. In many cases, lenders don’t really want to take the residual risk on the specialized asset. Of course, lending is often completed at something less than the fair market value of the assets. This provides a greater margin for security and reduces the risk to the lender; hence a reduced rate of return.

However, with a strong corporate covenant, it is possible to structure the synthetic lease with a high inherent loan-to-value ratio and still eliminate the residual-risk premium. The reason is that the asset resorts back to the lessee at the end of the lease term and title never passes to the lender.

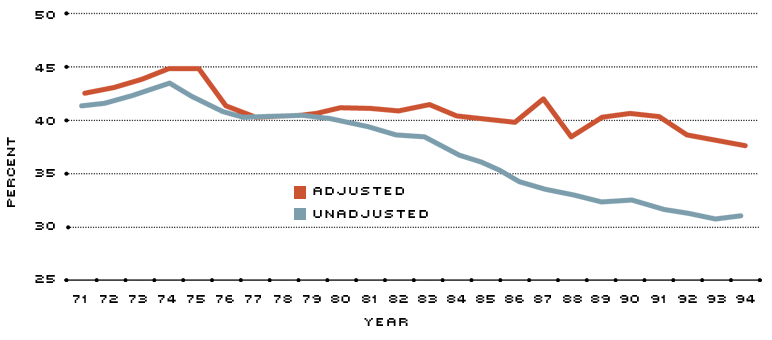

To ensure the lender is confident that the lease will be honoured, Opco or its parent can structure a guarantee of specific performance under the lease and still achieve off-balance-sheet financing, if so desired. The table below illustrates what might be expected on a comparative basis when financing a specialized manufacturing facility. It is assumed that the appropriate spread over the GOC rate is reflected as 8.5 percent for the asset in question, assuming project borrowings are arranged on a full-recourse basis.

Another interesting application of the trust can occur in many government or Crown agency financings, where the particular entity is precluded from borrowing. There are many examples of this in the marketplace, including the CBC Broadcast Centre in Toronto. In these cases, there is not a significant spread over the appropriate government-borrowing rate, depending on the regulations and structure surrounding the lease and how the particular agency obtains its operating funds.

The sale leaseback transaction utilizing the trust mechanism can achieve the control needed by manufacturers and enable the company to free up capital locked in to its hard-asset base. This capital can be better used in other areas of the company, where it may generate a higher return and thereby improve the overall competitive positioning. The shift in efficiency from a capital employment perspective will give the company an ultimately stronger financial base and stronger footing to take on competitive pressures and challenges. Gearing ratios will necessarily improve. However, the real benefit will be the increase in capital available for use, along with safeguarding ultimate control of the operations. At the same time, additional capital through the mortgage process will not be required, nor will debt levels be increased. A better understanding of the mechanism behind off-balance-sheet financing and the use of trusts will enable more and more businesses to adopt the strategy while they fight to remain as competitive as possible.