OffBalanceSheet Entities An Introduction

Post on: 24 Июнь, 2015 No Comment

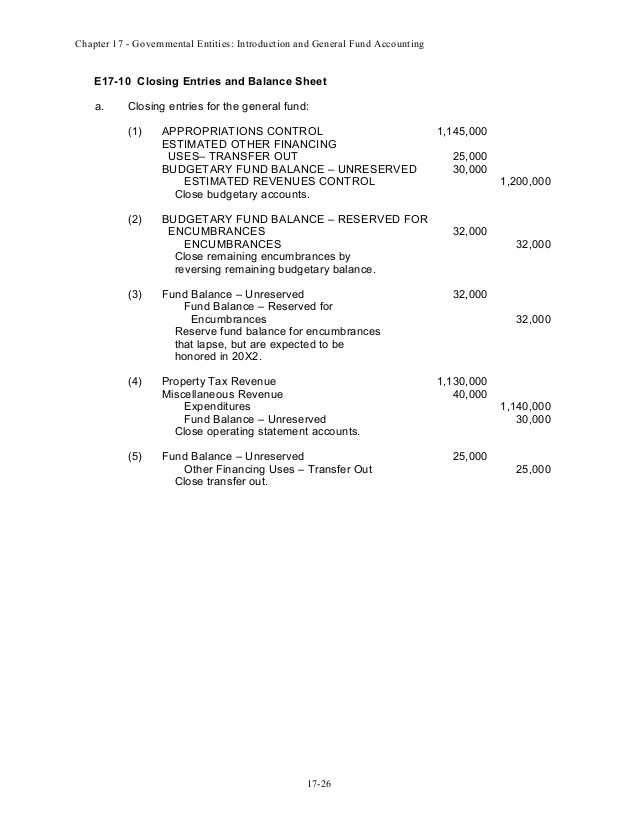

Off-balance-sheet entitles are complex transactions where theory and reality collide. To understand how off-balance-sheet entities work, it is useful to have an understanding of corporate balance sheets. A balance sheet. also known as a statement of financial position, reveals a company’s assets. liabilities and owners’ equity (net worth). (For a more detailed overview of balance sheets, see Reading The Balance Sheet and Breaking Down The Balance Sheet .)

Investors use balance sheets to evaluate a company’s financial health. In theory, the balance sheet provides an honest look at a firm’s assets and liabilities, enabling investors to make a determination regarding the firm’s health and compare the results against the firm’s competitors. Because assets are better than liabilities, firms want to have more assets and fewer liabilities on their balance sheets.

A History of Fraud

The Enron scandal was one of the first developments to bring the use of off-balance-sheet entities to the public’s attention. In Enron’s case, the company would build an asset such as a power plant and immediately claim the projected profit on its books even though it hadn’t made one dime from it. If the revenue from the power plant was less than the projected amount, instead of taking the loss, the company would then transfer these assets to an off-the-books corporation, where the loss would go unreported. (For more insight into this scandal, read Enron’s Collapse: The Fall Of A Wall Street Darling .)

Basically the entire banking industry has participated in the same practice, often through the use of credit default swaps (CDS). The practice was so common that just 10 years after JPMorgan’s 1997 introduction of the CDS, it grew to an estimated $45 trillion business, according to the International Swaps and Derivatives Association. That’s more than twice the size of the U.S. stock market, and only the beginning as the CDS market would later be reported in excess of $60 trillion. (Credit Default Swaps: An Introduction . provides a closer look at these products.)

The use of leverage further complicates the subject of off-balance-sheet entities. Consider a bank that has $1,000 to invest. This amount could be invested in 10 shares of a stock that sells for $100 per share. Or the bank could invest the $1,000 in five options contracts that would give it control over 500 shares instead of just 10. This practice would work out quite favorably if the stock price rises, and quite disastrously if the price falls.

Now, apply this situation to banks during the credit crisis and their use of CDS instruments, keeping in mind that some firms had leverage ratios of 30 to one. When their bets went bad, American taxpayers had to step in to bail the firms out in order to keep them from failing. The financial gurus who orchestrated the failures kept their profits and left the taxpayers holding the bill.

The Future of Off-Balance-Sheet Entities

Efforts to change accounting rules and pass legislation to limit the use of off-balance-sheet entities do nothing to change the fact that companies still want to have more assets and fewer liabilities on their balance sheets. With this in mind, they continue to find ways around the rules. Legislation may reduce the number of entities that don’t appear on balance sheets but loopholes will continue to remain firmly in place. (To learn more, see What Caused The Credit Crisis .)