NRE Fixed Deposit Should you invest in it

Post on: 13 Июль, 2015 No Comment

Number of View: 405733

Multiple banks in India have started to offer interest on NRE fixed deposits as high as 9.6% p.a. In order to appreciate this deal better, you first need to understand who can take advantage of this deal and what does NRE stands for. Basically for Non Resident Indians (NRI) there are three types of bank accounts which can be opened in India NRE, NRO & FCNR. You can read in detail on these three accounts on our website https://banyanfa.com/banyanfa/nri/bank_account.html .

Income Tax Act in India allows all interest from NRE bank account as TAX FREE. Contrary to this, interest from NRO account attracts flat tax deduction at the rate of approx 30%. So now you can appreciate that Tax Free interest for NRIs would be an attractive deal. To make it more attractive, let me give a brief history around NRE fixed deposit interest rates.

I believe NRE fixed deposit were one of the lowest interest paid deposits within India for a simple reason the interest on such deposits was tax free. Banks hence never thought about increasing the interest rates beyond 3-4% p.a. So if you had booked a FD for Rs. 10 lacs, you would have not got more than Rs. 40,000 per year. Possibly, the banks were always aware that even if the NRIs went for NRO fixed deposit which offered much higher rates of interest, the after tax yields would be a bit higher than NRE interest rates. Further the added benefit of free repatriation of NRE deposit and its associated interest income further added to the banks incentive to keep NRE interest rates down to less than 4%.

Why are NRE Interest Rates at 9% plus now?

I must call it that if the banks could prevent, they would have definitely kept the interest on NRE fixed deposits where they always used to be. However, a combination of multiple factors forced the banks to increase the NRE interest rates to 9%. These factors are:

1. The primary reason is Life time high Foreign Exchange rate (USD / INR at 53.5 Rs.). It prompted Reserve Bank of India attract NRI remittances to tame the rising rupee. Increasing NRE deposit interest rates to over 9% would attract a lot of foreign currency into India which would in turn increase the supply of foreign currency in India and hence reduce the exchange rates.

2. High Inflation and interest rate scenario prevailing the economy influenced the high NRE deposit rates.

Is it Really good opportunity to invest in NRE FDs ?

In our opinion, this is an excellent opportunity to give a good run to your money. Money creates money. Investing your funds into NRE fixed deposits would provide you an opportunity to gain a good return in the current volatile economic situation. Even resident Indians dont have this opportunity. For resident indians, any interest income on fixed deposits over Rs. 5,000 from a bank is liable to an upfront 10% tax deduction (TDS) and is residual is also subject to tax. NRE fixed deposits would not be subject to TDS and entire FD interest would be released to NRIs as tax free income in India.

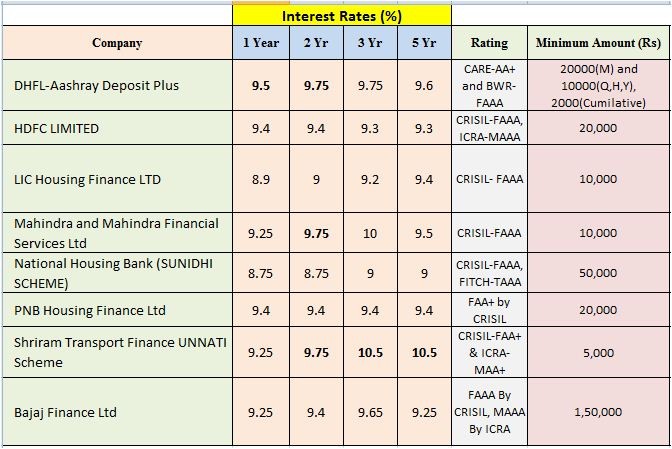

Interest Offered by Different Banks

Different banks are offering variable interest rates. As an illustration, we have noted a few options available from the leading banks in India (at January 2012):