Nonprofit Investing Mission Responsible

Post on: 8 Июнь, 2015 No Comment

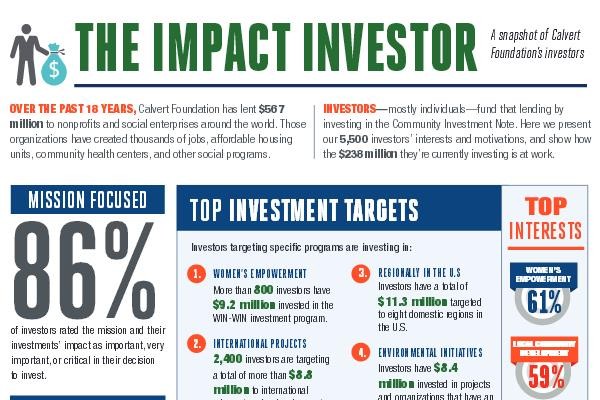

Sustainable and responsible investing, or as it is often called, socially responsible investing (SRI), has grown as more investors desire to have their investment dollars channeled towards investments that reflect their own personal or organizational values. In the case of nonprofit organizations, mission-related investments have become increasingly important in the last 10 years.

SRI is generally accomplished by investing in a company or municipality that is in line with an investors own morals or by avoiding investments in companies that violate an investors specific beliefs. In the case of nonprofits, investments would be made or avoided according to its mission, which should be reflected in its investment policy statement. Therefore, its key for responsible investing that nonprofit boards view investments through a mission-critical lens.

Having an Impact

As of 2012. there were $3.74 trillion of responsible investments in United States─an amount equal to the 2011 GDP of Canada and Brazil combined and an increase of more than 42% since 2003. Further, of the total U.S. assets under management that are tracked by Thompson Reuters Nelson, 11.3% are engaged in sustainable and responsible investing practice. 1 That means about $1 out of every $9 under management can be classified as a sustainable and responsible investment.

20Investments.jpg /%

Typical motives for using a socially responsible approach in investing range from concerns over the environment, corporate governance or social well-being. SRI then can be broken down into three main areas─environmental or societal/corporate governance concerns (ESG), shareholder advocacy and community investing.

Basing investments on ESG concerns is what will usually come to mind when one thinks about SRI. This typically employs a screening strategy in which potential investments are screened for acceptability against a specific set of criteria where agreeable business activities are deemed suitable for investment and offensive activities are shunned. Common positive screens include a desire for businesses that enact environmentally friendly policies, practice sustainability or are highly regarded for their treatment of employees. The negative screens would disqualify firms for investment based on those criteria. For example, an investor might not invest in companies that are not sensitive to the environment. There also are other negative screens that seek to deny investment dollars to firms that derive revenue from the manufacture or sale of disagreeable products or services. Examples of this type of negative screen might be avoiding investing in companies that manufacture chemical weapons or companies that sell tobacco products.

ESG investing is a distinct and subjective methodology of screening potential investments. It is a strategy that is defined only by the constraints assigned by an investors unique value system. While this leads to numerous investment opportunities being labeled as SRI, many of those same investments wouldnt be an acceptable SRI investment to all investors.

Shareholder activism is another area of SRI, but is focused on acquiring shares in a company that might not otherwise meet the screening criteria so that the investor can influence corporate actions though shareholder activities. This method allows an investor to benefit from stock price appreciation and any dividends that a company offers while working to change the companys policies. In individually held investments, the investor would file shareholder resolutions and actively lobby for desired changes to business practices. In the case of SRI funds, however, the fund manager would file resolutions on behalf of all of the fund shareholders pursuant with the stated goal of the fund. The resolutions will typically focus on transparency in political activities, human rights and sustainability reporting. They also can focus on the composition of the board of directors and executive pay.

Another segment of SRI is community investing. which is a small, but growing portion of SRI investments. This strategy generally involves investors deploying capital to explicit geographic regions, both domestic and foreign, where access to low cost capital for the purpose of community service investment is not readily available. Some examples of the type of activities supported are food and clean water access, education, health care, infrastructure development, affordable housing, access to jobs and environmentally focused initiatives.

Putting Mission-Related Investing in Action

Nonprofit investors can focus on one particular SRI strategy or many in combination in order to accomplish their overall goal of providing incentives for certain behaviors and disincentives for other behaviors. Overall, most investors tend to fall into either the ESG or the activist shareholder category. However, when the two coincide about 88% of the total could be considered to be ESG investing and 41% could be considered shareholder activism. When adjusted for the overlap, the ratios look more like 68% and 31%, respectively.

20Split.jpg /%

The channels through which investors choose to direct their investment capital also vary depending on investor preference and/or makeup. Historically, the majority of assets involved in SRI have been managed using a separately managed account (SMA). Using a SMA allows the investor to customize their SRI requirements to reflect their specific values. If a SMA is not a viable option, there are a variety of mutual funds and exchange-traded funds (ETFs) available to fit a variety of values and beliefs. However, mutual funds and ETFs do not offer the same level of customization available in SMAs.

The additional layer of SRI oversight is not without cost. The average expense ratio for SRI funds can vary versus their counterparts. According to Morningstar, SRI funds in its database have a 1.18% average expense ratio compared to an average 1.26% for funds that are not classified as SRI. It is important to note, however, that the difference in expenses may stem from the fact that SRI funds are usually underrepresented in some of the most costly categories. Mostly, SRI funds will have higher expenses than their counterparts due to the higher internal costs of maintaining a screened fund; however, there are funds in the SRI universe that do have relatively low expense ratios, some of which can go well below 1%. Finding the right fund that meets an investors SRI directive while contributing to the balanced performance of a portfolio can be achieved with a bit of diligence, information gathering and a clear purpose for the investment.

There are abundant options in the marketplace for nonprofit investors that would like to incorporate some type of SRI into their portfolio. Its important to keep in mind that not all options will fit into the criteria of all investors. Completing adequate diligence before deciding when, how and into what to invest is critical to achieving the investment goals. A broad and ongoing discussion amongst SRI investors will lead to a better understanding of the benefits of sustainable and responsible investing. A good place to start is a qualified investment consultant with experience in that very unique field. Further information on SRI can be found at:

1 2012 Report on Sustainable and Responsible Investing Trends in the United States. US-SIF Foundation. www USSIF.org .

This article has been prepared by Lancaster Pollard Investment Advisory Group. It is for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or instrument or to participate in any particular investment strategy. The information provided is not intended to be a complete analysis of every material fact respecting any strategy and has been presented for educational purposes only. Please contact your investment consultant to discuss your organizations situation. The information herein has been obtained from sources believed to be accurate and reliable; however, we do not guarantee the accuracy, adequacy or completeness of any information and are not responsible for any errors or omissions or for the results obtained from the use of such information. Opinions and data provided in this article are subject to change without notice. Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or prediction that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses. There are risks involved with investing, including possible loss of principal.

Jason E. Terry, a 2013 summer associate with Lancaster Pollard, is a recent MBA graduate from the University of Chicagos Booth School of Business. He may be reached at Jason.Terry@chicagobooth.edu .