No Load Mutual Funds Load Fund Investments

Post on: 20 Август, 2015 No Comment

In simple terms, a load is a commission (sales charge) collected by a broker or advisor for selling you a mutual fund. Put another way, any mutual fund sold with a load results in your advisor collecting money simply for having sold the fund to you. Loads don’t help the fund manager make better buy, sell and hold decisions, and they don’t help you.

The alternative is buying a no-load mutual fund.

Many funds are sold without the incentive for brokers; others are sold on a load-waived basis when purchased through certain brokers or advisors.

You may think that owning a fund available only by paying a load automatically increases the chances it will perform better than any similar fund without a load, but thats not necessarily true.

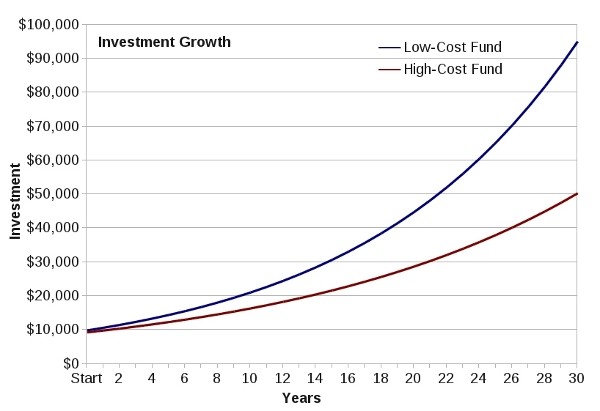

In fact, its common that load funds do not consistently outperform no-load funds. Actually, load funds reduce the value of your investment by the amount of the load. For example, if you spend $10,000 to buy shares of a fund with a five percent load, the broker would pocket a $500 commission and youd have just $9,500 in your account. Because of sales loads, a load fund must outperform its no-load peers by more than the load to be a better investment for you. And no one can realistically project such outperformance on a regular basis.

Load funds come in all shapes and sizes. When youre searching for funds, many are commonly listed as A or B shares.

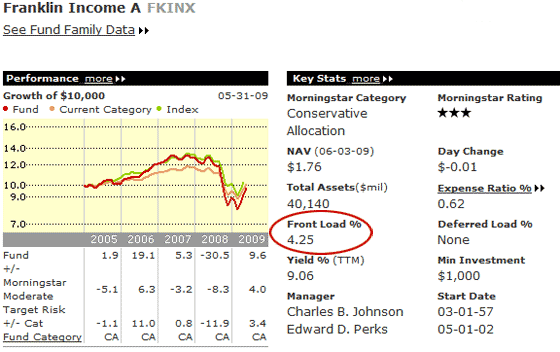

A shares have a front-end load; that means the advisor gets paid up front for selling shares. Front-end loads typically range between 3 and 8 percent. B shares have a back-end load (or CDSLs, short for contingent deferred sales load). If you buy B shares and subsequently sell them within 5 to 7 years, you have to pay a penalty of anywhere from 5 to 7 percent. Additionally, fund companies pay brokers an upfront commission when selling B shares, but that extra expense is recouped in the form of higher annual operating expenses for B shares.

In addition, many load funds charge annual marketing fees, also known as 12b-1 fees. They’re used for promotional costs. These costs vary from 0.25 to 0.75 percent of a fund’s net asset value. Some no-load funds also charge 12b-1 fees, but no-load funds that do not charge 12b-1 fees are known as 100 percent no-load or true no-load.

You may sometimes feel trapped by having paid a load for your funds.

If youve invested in a load fund and decide you want to sell, you have a couple of options. You can switch to another fund outside of the first fund family, and potentially pay another front-end load, or perhaps move to another fund in the same family. However, staying in the same fund family may limit your choices and opportunity to find a better investment.