No 401(k) Available at Wor To Do 401k Solo 401k

Post on: 16 Март, 2015 No Comment

I received an interesting question the other day about a topic I hadnt given much thought to before. A reader e-mailed me asking what they should do if their work didnt offer a 401(k) plan. I talk a lot about asset allocation, investing strategies and making contributions to your retirement accounts but its a lot harder to implement these strategies without a 401(k), so whats one to do?

Although most companies do offer a 401(k), not all plans are the same. In some cases, your plan might have such outrageous fees that it will only make sense to contribute up to the company match(if there even is one) and then start exploring alternatives like IRAs and fter-tax accounts. Its gotten easier and easier for small businesses to set up 401(k)s for their employees but there are still some out there that dont. I think our 401(k) system needs a lot of work but not offering one isnt the solution.

Get Everyone on the Same Page

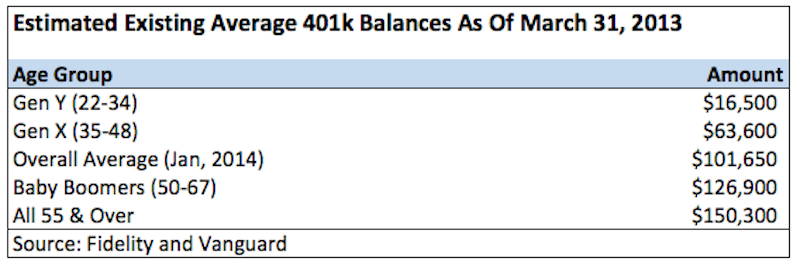

If youre a W2 employer for a company that doesnt offer a 401(k) youre at a huge disadvantage. You are effectively losing $17,500(2013 contribution limit) worth of tax advantaged space. I would try to get all of the employees on the same page and show them how much of a disadvantage it is not having a 401(k). That way, you can all calmly and reasonably approach the boss and carefully lay out the reasons why you want a 401(k). Dont go in and make demands, instead be reasonable yet firm that you all deserve a 401(k).

Open a Traditional IRA

The best thing about a traditional IRA is that you can open it with almost any broker and invest in anything you want, from Lending Club to CMC Markets. IRAs are very flexible and you should choose a broker that offers low cost funds in order to maximize your earning potential. The only problem with IRAs is that you will be limited to $5,500 a year(2013 contribution limit) so its not a great substitute for a 401(k).

I would probably stay away from a Roth IRA since the contributions wouldnt be tax deductible like with a traditional IRA. And since you only get to pick one(traditional or Roth), Id go with the deductible one since you dont get a 401(k) contribution deduction.

1099 Income Means You Can Open a Solo 401(k)

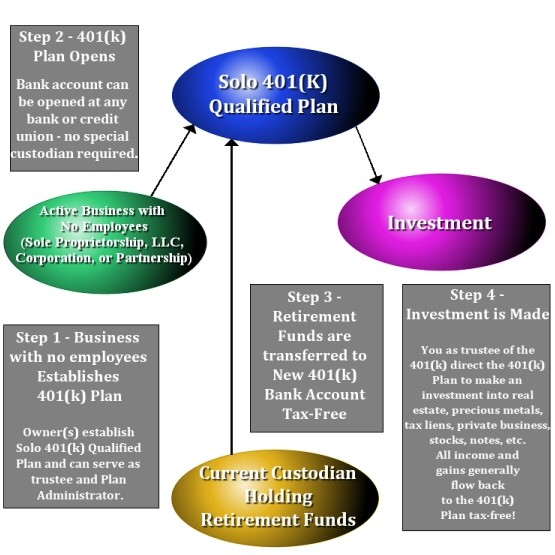

If you get paid in 1099 income or you own your own business, then you have the option of opening a solo 401(k). Usually when an employer pays you with a 1099, it means that you are a contract type or temporary employee. You wont get any benefits like medical and 401(k) but getting paid with a 1099 means you are self employed, and technically you now own a business. That business is you.

A solo 401(k) does exactly what it sounds like and allows you to open a 401(k) for yourself in order to deduct your business income. This is a great option for those with 1099 income since you can open a solo 401(k) pretty easily with whichever broker you choose. Things can get a little bit more complicated though around tax time, so I would probably consult with a tax specialist here.

If you have W2 and 1099 income, you can still open a solo 401(k) but the $17,500 contribution limit applies across all your 401(k) accounts. So you wont be able to ever contribute more than $17,500 across all your 401(k) accounts. But this could come in handy if you have W2 and 1099 income and your W2 employer doesnt offer a 401(k) or if you leave your W2 job halfway through the year and your new employer wont allow you to make 401(k) contributions for 6 months.

Having no 401(k) shouldnt be an excuse for not being able to save. Instead, it just means that youre going to have to work a little bit harder. Having 1099 income makes things way easier but if you dont, dont give up. Losing out on $17,500 of tax advantaged space is a big deal so maybe its time you start looking for other opportunities in the area, or at least ask for a raise!

Readers, have you ever worked for a company that didnt offer a 401(k)? If so, how many employees were there? I would really have to love the company to work for one with no 401(k) but I love saving!