NJBEST New Jersey s 529 College Savings Plan

Post on: 14 Сентябрь, 2015 No Comment

About NJBEST

Tools and Calculators

Application Forms

About Us

*Offered and administered by the New Jersey Higher Education Student Assistance Authority (HESAA); managed and distributed by Franklin/Templeton Distributors, Inc. an affiliate of Franklin Resources, Inc. which operates as Franklin Templeton Investments. No federal or state guarantee. Principal value may be lost, and investing in the plan does not guarantee admission to college or sufficient funds for college. Please refer to the Investor Handbook for more complete information.

The New Jersey Better Educational Savings Trust Program (NJBEST) is a higher education savings and investment program of the State of New Jersey designed to satisfy the requirements of Section 529 of the Internal Revenue Code. NJBEST is a service mark of the State of New Jersey. The State of New Jersey Higher Education Student Assistance Authority (HESAA) selects investment managers for NJBEST, adopts regulations and carries out other functions necessary for its operation.

HESAA has selected Franklin Templeton Distributors, Inc. (FTDI) to provide, directly or through subcontractors, certain distribution, investment management and administrative services relating to NJBEST. FTDI has retained Franklin Mutual Advisers, LLC. a registered investment advisor, to serve as the initial investment manager for the Franklin Templeton investment options. Both FTDI and Franklin Mutual Advisers, LLC. are affiliates of Franklin Resources, Inc. which is a global investment organization operating as Franklin Templeton Investments. Through various Franklin Templeton entities, Franklin Templeton Investments provides global and U.S. investment, shareholder and distribution services to the Franklin, Templeton and Franklin Mutual Series funds and institutional accounts, as well as separate account management services.

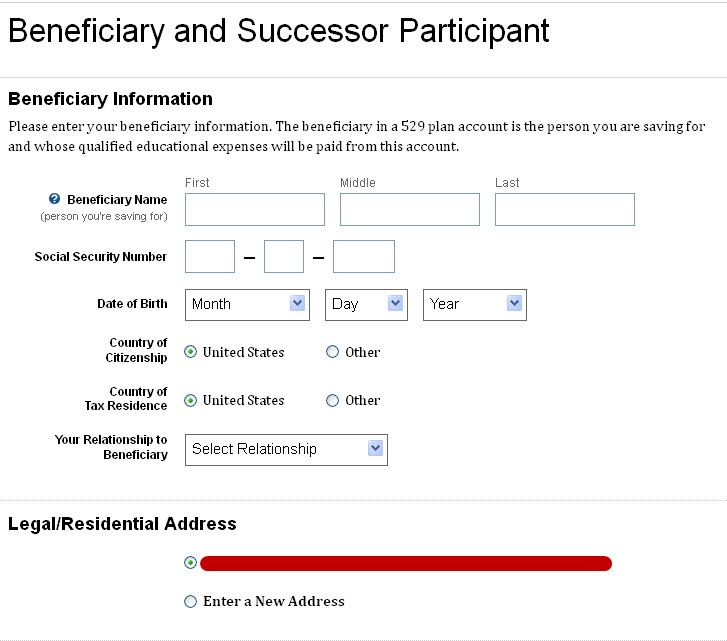

Investors should carefully consider plan investment goals, risks, charges and expenses before investing. To obtain the Investor Handbook, which contains this and other information, call Franklin Templeton Distributors, Inc. the manager and underwriter for the plan, at (877) 4NJ-BEST. You should read the Investor Handbook carefully before investing and consider whether your or the account beneficiary’s home state offers any state tax or other benefits that are only available for investments in its qualified tuition program.

This material is not a recommendation of any particular security, is not based on any particular financial situation or need, and is not intended to replace the advice of a qualified attorney, tax advisor, investment professional or insurance agent. Before making any financial commitment regarding a Section 529 college savings plan, consult with the appropriate financial advisor.

2015 Franklin Templeton Investments. All rights reserved.

You are about to leave the Franklin Templeton Investments Website

Clicking OK below will take you to an independent site, not affiliated with Franklin Templeton Investments. Information and services provided on this independent site are not prepared by, guaranteed by, or endorsed by Franklin Templeton or its affiliates. Please keep in mind that this independent site’s terms of use, privacy and security policies, or other legal information may be different from those of Franklin Templeton’s site. Franklin Templeton is not liable for any direct or indirect technical or system issues, consequences, or damages arising from your use of this independent website.

For your convenience, the independent site will be displayed in a new browser window, and our site will not automatically close, but will remain visible and accessible through its current browser window. Although multiple windows permit you to easily move back and forth between the two sites, Franklin Templeton is not responsible for the independent site.