New Market Neutral Fund Employs Global Long

Post on: 19 Июль, 2015 No Comment

By DailyAlts Staff

The Stone Toro Market Neutral Fund debuted earlier this month on February 6. Managed by Jeffrey Russo, a founding partner and Chief Strategist of Stone Toro, the fund pursues long-term capital appreciation with lower-than-average volatility by employing a global long/short equity approach.

The bulk of the Stone Toro Market Neutral Fund’s long and short positions are selected from stocks that comprise the MSCI All Country World Index (ACWI). The MSCI ACWI consists of 23 developed market indexes and 23 emerging market indexes, for 46 in all. At least 60% of the Stone Toro Market Neutral Fund’s investments are typically in U.S. companies, and no more than 20% are in the shares of countries from emerging markets.

A couple key points from the prospectus, regarding the fund’s long and short exposure, is as follows:

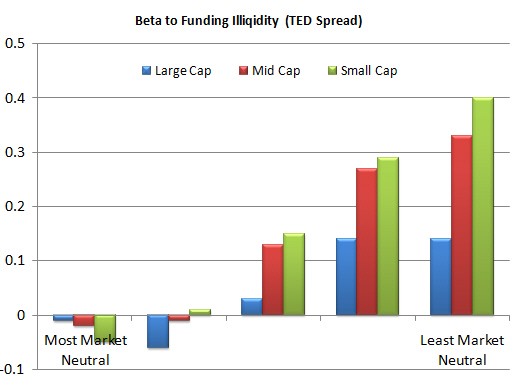

- The Fund’s advisor expects the Fund’s net exposure (long exposure minus short exposure) to average between -10% and 60% of the Fund’s net assets.

- The Advisor expects the Fund’s short exposure (through short positions and related derivatives) and long exposure (through long positions and related derivatives) to each average between 100% and 150% of the Fund’s net assets.

Portfolio manager Jeffrey Russo attempts to generate market-neutral returns by identifying arbitrage opportunities in the market caused by structural imperfections related to corporate events. Mr. Russo may also use derivatives, such as call options and put options, in pursuit of the fund’s investment objective. Prior to founding Stone Toro, Mr. Russo was a Director and portfolio manager at BlackRock (NYSE:BLK ) and one of its predecessor organizations, Merrill Lynch Investment Managers.

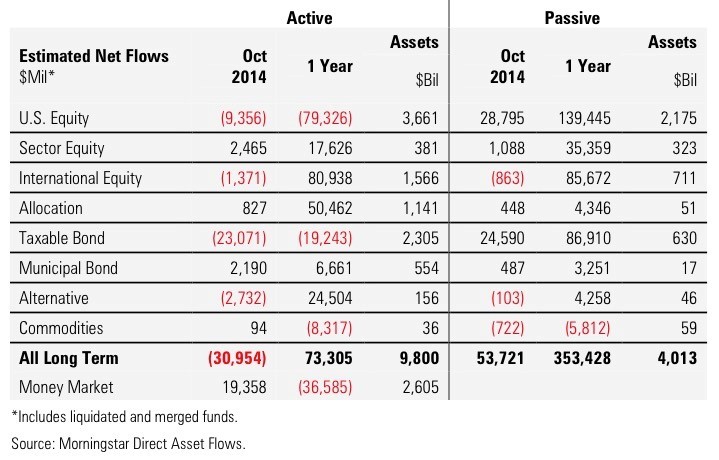

Funds in Morningstar’s Market Neutral category returned an average of 0.76% in 2014, while the number of funds in the category grew. But several market neutral funds have gotten off to a great start thus far in 2015, with the top funds generating year-to-date returns as high as 13% through February 22.

According to its prospectus, shares of the Stone Toro Market Neutral Fund will be available in three share classes: A (MUTF:STMKX ), C (MUTF:STMTX ), and I (MUTF:STMNX ); with respective net-expense ratios of 3.93%, 4.68%, and 3.68%. The fund’s investment management fee is 1.65%, and the minimum initial investment for A- and C-class shares will be $1,000; while the minimum for I-class shares is $25,000. As of this writing, only the I-class shares had launched.