New Competitor On The Horizon For Real Estate ETFs

Post on: 27 Сентябрь, 2015 No Comment

by Eric Dutram on September 28, 2010 | ETFs Mentioned: RWR SCHH

As the fourth quarter nears, the ETF industry remains in flux. A number of newcomers are preparing to to jump into the ETF waters while others, such as Geary and Old Mutual, are pulling the plug on ETF dreams. And competition among some of the industrys bigger players is heating up, as recent product development initiatives have focused more on duplication than innovation. Charles Schwab appears to be in the early stages of its ETF build-out; the firms first waves of products have met a warm reception, and the company has said it plans to continue filling in holes in its ETF coverage map.

While Schwabs initial foray into the ETF market was built around funds targeting the broad U.S. and international equity markets, it has begun to branch out in recent months to other corners of the investable universe. The company recently debuted an international small cap fund as well as a variety of Treasury bond ETFs targeting various parts of the yield curve. Now Schwab is laying the groundwork to expand further; earlier this week the company made a filing with the SEC detailing plans for a real estate ETF.

The ETF, which will trade under the symbol SCHH, would seek to replicate the Dow Jones U.S. Select REIT Index. a float-adjusted market capitalization weighted benchmark comprised of real estate investment trusts (“REITs”). That index excludes mortgage REITs, net-lease REITs, real estate finance companies, mortgage brokers and bankers, commercial and residential real estate brokers and estate agents, home builders, large landowners and subdividers of unimproved land, hybrid REITs, timber REITs, and companies that have more than 25% of their assets in direct mortgage investments [also read Believe It Or Not U.S. Real Estate ETFs Crushing International Counterparts ].

Competition

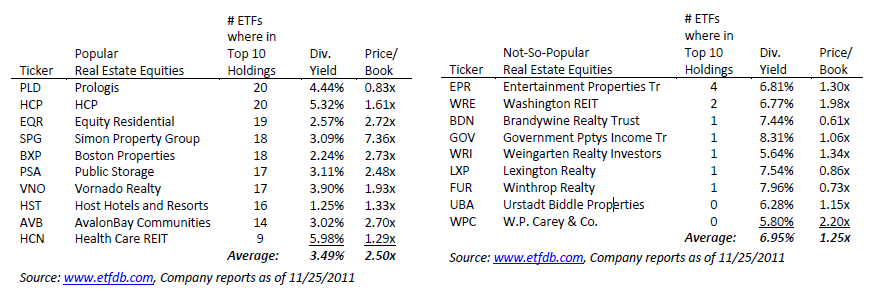

This proposed ETF would mark the 12th fund for Charles Schwab and would be the 14th ETF in the Real Estate ETFdb Category. Currently, the real estate ETF market has an extreme divide between the most popular funds and smaller options in terms of assets under management; four founds have more than $1.2 billion in assets under management, while the other nine in the category combine to take just $280 million. Its worth noting that Schwabs proposed real estate ETF would track the same exact index as the already popular and established Dow Jones REIT SPDR (RWR ), which has amassed $1.2 billion in assets and has daily volume approaching 380,000 shares [see all the Charles Schwab ETFs here ].

[For news on all new and proposed ETFs, sign up for our free ETF newsletter .]

Disclosure: No positions at time of writing.