Natural Gas Bucking the Seasonal Trend

Post on: 16 Март, 2015 No Comment

Natural gas is, perhaps, one of the most cyclical commodities in the space, as its demand and usage is heavily tied to seasonality. As a result, its price cycles for the past few decades have been somewhat predictable, even though it can be quite volatile day-to-day. Both of those factors combine to make it one of the most popular commodities traded on the market. 2013, however, looks like it may be moving away from its normal trend [for more natural gas news and analysis subscribe to our free newsletter ].

Natural Gas Falling Out of Line

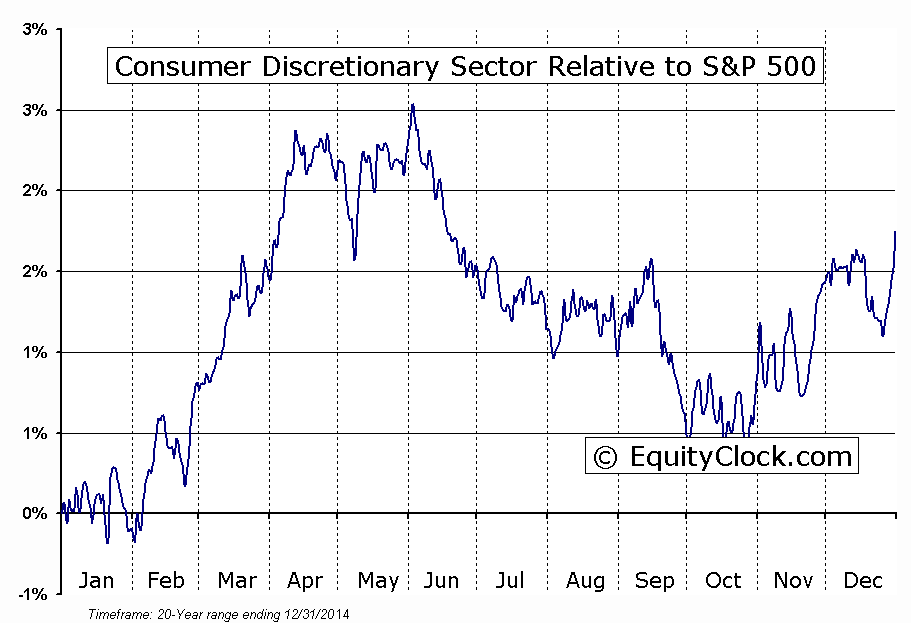

For the last two decades, the trend for natural gas has brought a hefty increase just as summer draws to a close. Notably, September is used to seeing marked gains. From there the commodity has typically hit a plateau or a slight pullback, only to surge higher during the October/November period. This year, however, natural gas has yet to fall into that trend. Since the beginning of September, the commodity is actually down more than 5%.

The drop comes as a big hit to traders, as many had been shoring up big bets prior to the usual seasonal jump. Instead, the United States Natural Gas Fund (UNG ) has seen outflows of $21 million since the beginning of the month, compared with the inflows of over $120 million from June to August. The diversion from its typical trend comes from a culmination of factors, with the potential to set up NG for a strong winter period [see also 25 Ways To Invest In Natural Gas ].

Weathering the Weather

NG is dominated by weather patterns, as its demand and consumption is heavily tied to heating and cooling devices in homes across the country. After a relatively mild summer, temperatures across the country are hovering in a not-so-sweet spot where homes do not have much use for cooling or heating devices, driving down demand and driving stockpiles higher. The most recent EIA Natural Gas Storage report indicated a rise of 87 bcf from the week prior.

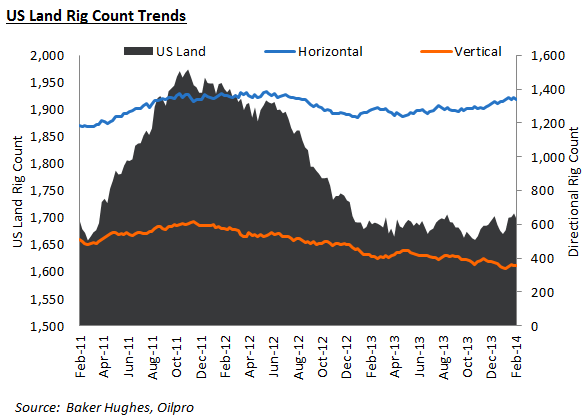

Another factor playing against NG has been a relatively mild hurricane season. Hurricanes that often blow through the Gulf and key producing regions of the country have been known to knock out production and send prices on a temporary tear. 2013s hurricane season has been one of the mildest in recent memory, and while that certainly is welcomed news for citizens of those regions, it has had a slight impact on NG prices [see also Investing In The U.S.’s Surging Natural Gas Production ].

Despite prices sitting at lows for the time being, the commodity could be gearing up for a strong winter run. Should this winter be a cold or even average one, NG will have more room to rise given its current suppression. While the weather is impossible to predict with absolute certainty, it will be important for traders to keep an eye on forecasts and average temperatures across the country, as they could present a great buying (or selling) opportunity for this fossil fuel.

Don’t forget to subscribe to our free daily commodity investing newsletter and follow us on Twitter @CommodityHQ .

Disclosure: No positions at time of writing.

Commodity HQ is not an investment advisor, and any content published by Commodity HQ does not constitute individual investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities or investment assets. Read the full disclaimer here .