Myrtle Beach Mortgages Rates

Post on: 28 Май, 2015 No Comment

Apply Online

Myrtle Beach real estate shoppers looking for a mortgage and great mortgage rates? From purchase loans to equity and refinance loans, the right options are waiting for you here.

Ask an Expert

Have a Myrtle Beach mortgage question? Need some expert advice? Let us know your needs and concerns and our experts will help you decide the best options before you make mortgage mistakes.

Loan Status

Mortgage Lending | Mortgage Rates

Myrtle Beach Mortgage Place is your source for lending in Myrtle Beach SC. Looking for the lowest possible interest rate on your next mortgage or refinance? Use our QUICK CONTACT to get someone working on a no-obligation, lowest rate comparison quote today.

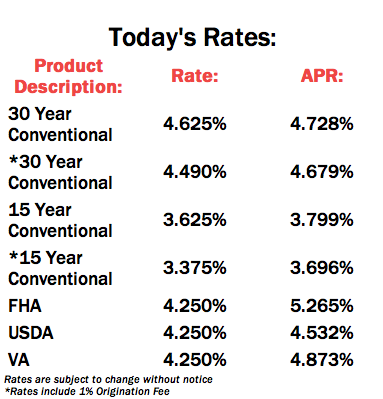

Mortgage Rates

The above estimates are an average of availability and do not reflect an exact interest rate you may be offered. Your actual interest rate may vary up or down based on many factors such as: the type of mortgage you qualify for, the type of property, credit score, amount financed and loan to value among other factors.

What Key Factors Affect Your Mortgage Rate

A real estate purchase, mortgage loan, refinancing and second mortgage are all huge financial commitments and finding the best mortgage rate and terms can be a confusing and sometimes overwhelming process. First time home buyer can especially find the task very intimidating. Your Myrtle Beach Mortgage Place independent broker can help you all along the way but here are a few of the Key things to start considering:

What Type of Mortgage and terms might be best for you?

Mortgages come in two categories mainly:

Fixed Rate Mortgage – The fixed rate mortgage means exactly that: the interest rate is fixed for the full length of the loan term. Other factors such as insurance and taxes may fluctuate but your interest rate will remain the same. Most of the time a fixed rate mortgage will be at a slightly higher interest rate, but gives you the borrower the security of fixed principle and interest payments.

Adjustable Rate Mortgage – as you might guess the payments and interest on an adjustable rate mortgage (ARM) can and does fluctuate over the life of the loan. Most of these loans begin with a fixed period at the beginning of one to ten years that your mortgage interest rate is fixed. Then, the rate is subject to change based on a number of standardized indices such as the prime lending rate. Many buyers take advantage of the lower introductory rates that can help them budget for a larger home. Your lending professional can help you determine which might be best for your situation.

How much Should You put down (Down Payment) on your new property?

Down payments or equity in your Real Estate is a big determining factor in the cost of your new loan. More equity; that is the amount you will owe verses the value of the home can help you get a better interest rate. Down payments of 20% typically put you in the best bargaining position but some lenders offer loans, that you might qualify for, with down payments as low as 0 to 5%. Equity positions (the value of the property less your down payment ) of less than 20% will usually require that you pay mortgage insurance and the will add to the overall cost of your mortgage payback. Paying as much down as you can but leaving enough savings for emergency situations, will usually afford you the best interest rate and loan terms.

Buying down the interest rate or paying points up front:

In mortgage terms, points are upfront fees paid to lower the ongoing interest rate by a fixed amount usually in increments of 1% (1 point) equal to a reduction in the interest rate of 0.125%. Points can make sense if you plan to own your home for a long period of time. But, currently the national average of 7 years will not make paying up-front points a good decision for most real estate buyers.

Other hidden factors to look out for:

We have lenders that vary in their requirements from borrowers and your Myrtle Beach Mortgage Place lending professional is experienced in sourcing the correct lender for your unique situation. But keep in mind that special conditions may exist that can affect the overall monthly costs of you home. The bank need to protect is investment in your property so they will look at factors such as: flood zone and the type of property: single-family homes, condominiums, Multifamily homes and manufactured homes. Loans are available for many different property types, but typically interest rate are lower for single family homes verses that for multifamily and other types. Higher risk properties will have a higher interest rate.

Occupancy of the home can also affect the risk assessment of the lender. If your loan is for the home you live in full-time, part-time or rent to others will and does affects the interest rate offered. The best rates generally are given to owner-occupants who live in their homes full-time, vacation homes and investment properties can expect slightly higher interest rate offerings.

Mortgage Lenders Guide to Myrtle Beach Flood Zones

Individuals looking for a home mortgage in Myrtle Beach, SC and across the low country need to be aware of the impact that Flood Zones have on obtaining financing. Below is a guide prepared to explain the different zones and what they mean. .