MutualFund Investors Benefit by Paying Advisers Fees Rather Than Commissions

Post on: 5 Апрель, 2015 No Comment

The Journal Report

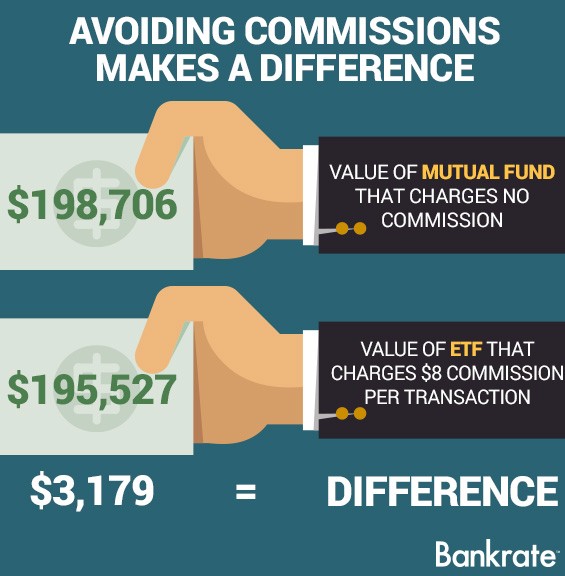

Over the past 15 or 20 years, advisers have started charging annual fees—frequently around 1% to 2% of assets—rather than taking commissions on individual transactions. The motive was simple: Securities firms realized they could bring in a steady stream of income while avoiding regulatory concerns about running up commissions in investors’ accounts. And some advisers have been leaving brokerages to join the ranks of independent fee-only financial advisers.

These fee arrangements aren’t necessarily cheaper for investors, but there are other important benefits:

• Fewer conflicts of interest for the advisers, who used to have significant financial incentives to push one fund over another or to recommend a change in an investor’s portfolio.

• More transparency about adviser fees and fund expenses. In the past, adviser compensation was typically built into mutual-fund shares—with those charges subtracted either at the time of purchase, year after year or upon a sale.

• A wider variety of funds for an adviser to work with. Fund companies used to offer either commissioned, or load, funds for securities-firm clients or no load funds for do-it-yourself investors, but usually not both. So, investors usually ended up working with one type of company and holding one type of fund. Now, fee-paid advisers and their clients are using, side by side, traditional no-load funds and load funds on which the commissions are waived.

For instance, M. Griffith Investment Services Inc. a small brokerage and advisory firm in New Hartford, N.Y. is steering its clients to funds from longtime direct sellers such as Vanguard Group and T. Rowe Price Group along with funds from traditional load sellers such as the American Funds family.

Using those Vanguard and T. Rowe funds kind of felt like I was going to bed with the enemy at first, says President David Griffith. But after a transition to mostly fee business that began 12 or so years ago, he says, we don’t care if a fund is from the traditional direct-sold or adviser-sold side of the business. They were like two armed camps…and that has gone away.

In 2008, 17% of financial advisers were fee-only, and an additional 48% were fee based advisers who got at least half of their revenue from fees, according to Cerulli Associates, a research and consulting firm in Boston. That combined 65% was up from 46% five years earlier.

But the shift toward fees hasn’t been consistent year in and year out. Last year, the combined percentage of fee-only and fee-based advisers contracted to 54%—in large part as the bear market ate into investors’ account balances and therefore the dollars that advisers were collecting in fees based on assets.

Last year also saw some renewed activity in commissioned mutual-fund sales, according to Cerulli and consulting firm Strategic Insight in New York.

In particular, some big brokerages booked significant commissioned sales of short-term-bond funds, including sales to investors who were temporarily shifting dollars out of money-market funds yielding almost nothing, says Dennis Bowden, a research analyst at Strategic Insight.

To a certain extent, the commission-based avenue opened up another way for advisers to make a little money to recoup some of the huge losses they had had in their revenue, Mr. Bowden says. But he adds that he isn’t suggesting the transactions were inappropriate for the investors.

Here’s an investor’s guide to the mechanics and potential benefits of fee-based fund sales:

As securities firms have shifted from commissions to fees, they’ve offered two broad types of fee-based, or wrap, accounts. In one variety, the client retains control of investment decisions. In the other, discretionary, accounts, clients hand over their money for the financial adviser to invest.

ENLARGE

Christophe Vorlet

In both cases, the idea is that you are getting continuing attention in return for your steady fees. The accounts are typically backed by a research department, which draws up asset-allocation models and identifies funds that are appropriate for different types of investors. Securities firms argue that big-picture guidance from an adviser—as opposed to the transaction-by-transaction advice that comes in commission-based arrangements—can be valuable.

Both discretionary and nondiscretionary accounts are growing in popularity, according to Cerulli.

For instance, in 2008 Edward Jones launched a fee-based program with both discretionary and nondiscretionary options. In 2009, 40% of the St. Louis firm’s mutual-fund sales were done through the program, says partner William Broderick, who is responsible for the firm’s advisory business.

Investors in Edward Jones’s discretionary program—by far the more popular choice of the firm’s advisory clients—have access to 24 research models that are geared toward different portfolio objectives, risk tolerances, tax sensitivities and other factors. For both discretionary and nondiscretionary accounts, clients generally pay an annual fee of 1.35% or less of assets to be in the program, which includes quarterly statements and automatic rebalancing.

We look at every single account every week to make sure the asset allocation is still in line with their investment objective, Mr. Broderick says. If their account is out of balance for two weeks in a row, we’ll tweak their portfolio, he says.

Many managed-account programs have inherent in them an ongoing relationship with the client, says Ian MacEachern, the managing director of the advisory-products group at Wells Fargo Advisors, a unit of Wells Fargo & Co. As clients and financial advisers take a longer view…these types of programs make more sense.

Meanwhile, independent fee-only advisers have long had a business model that separates the provision of advice from product sales. Clients’ investments are typically held in discount-brokerage accounts at firms such as Charles Schwab Corp. and Fidelity Investments.

The shift from fund commissions to fees is a good thing for investors because it much more closely aligns the client’s interest and the broker’s, says Mercer Bullard, an associate professor of law at the University of Mississippi and founder of investor-advocacy group Fund Democracy. Both will benefit over time if the portfolio performs well, and the broker generally has no incentive to recommend one fund or type of fund over another or to churn the account with excessive trading.

In contrast, with commissioned fund sales, stock funds typically pay more than bond funds, and commission levels can vary from fund company to fund company. In years past, if advisers mostly sold funds with upfront sales loads, they always needed to be looking for the next transaction to keep the income flowing.

In fee programs, there can be more flexibility to change asset allocation or replace a lagging performer because making the change doesn’t saddle the investor with a new commission on the funds being purchased. As an adviser working in a fee-based program, you have the ability to sell and buy without negatively affecting the client, says Andrew Gotfried, director of mutual-fund research at Raymond James & Associates Inc.

What’s more, financial advisers in fee-based advisory relationships have a fiduciary obligation—meaning they have to put clients’ interests above their own. When it comes to commission-based brokerage accounts, financial advisers have an obligation to recommend suitable investments, which some investor advocates have argued is a lesser standard.

There’s one final wrinkle to consider: Some independent advisers argue that advisers at brokerage firms may still have an incentive to push certain products. Jason Thomas, chief investment officer for Aspiriant in Los Angeles, says that brokerages often receive payments from the fund-management companies for inclusion in their platform of recommended products. Independent fee-only advisers, Mr. Thomas argues, don’t take off their fiduciary hats to sometimes sell products for commissions—and they are paid only by the clients. We are on the client’s side and we don’t get paid by anybody else, he says.Morgan Stanley Smith Barney, a joint venture between Morgan Stanley and Citigroup Inc. is a securities firm that offers both fee-based advisory and commission-based brokerage accounts, with some financial advisers providing both. Spokesman James Wiggins says financial advisers are expected to act in a client’s best interests regardless of how they are paid.

ENLARGE

Christophe Vorlet

In fee-based and fee-only arrangements, the payment for advice is largely divorced from the mutual funds an investor owns. The adviser’s fee can typically be subtracted from the investor’s brokerage account periodically or paid directly by the investor.

Each mutual fund still has operating expenses, of course, including fees to pay the portfolio-management company. But with all or almost all compensation for advisers stripped out, the charges at the fund level can be both lower and easier to understand.

Most funds offer multiple classes of shares with different expense structures. Many fee-only advisers and some fee-based advisers use institutional shares that have the lowest recurring expenses.

Morgan Stanley Smith Barney is moving in this direction: Starting in April, the firm will shift to institutional shares in most (though not all) of its fee-based mutual-fund platforms, according to Mr. Wiggins. The move will coincide with a simplified fee structure for fee-based accounts.

The fund expense ratio is typically a little higher if, instead of institutional shares, the adviser uses no-load shares designed for individual investors or traditional front-end-load Class A shares on which the loads are waived. In 2008, 60% of A-share sales occurred without commissions, according to a Strategic Insight survey.

Consider the $5.4 billion Aim Charter fund. Class I shares designed for institutions such as foundations and endowments have expenses of 0.78% a year, according to the fund prospectus. Class Y shares designed for fee-based advisory accounts have expenses of 0.96%, while Class A shares—also available to fee-based programs, with their usual loads waived—have a 1.21% expense ratio.

The annual charges are a much higher 1.96% of assets on Class B and Class C shares, two share classes that have substantial continuing expenses built in to compensate financial advisers who work on commission.

As advisers have moved to focus more on investors’ overall portfolios and less on making the next transaction, the communications between fund companies and advisers have also changed.

We used to approach advisers with recommendations to use a certain fund or group of funds as individual investment opportunities for their clients, says Peter Cieszko, president of Fidelity Investments Institutional Services, a unit that works with advisers who sell Fidelity funds.

Today, he says, Fidelity makes recommendations to advisers on managing their practices or building client portfolios, and we include our funds as one part of a much broader conversation.

Fund companies have also been busy working to build relationships with potential distribution channels that weren’t open to them years ago, with traditional direct sellers reaching out to securities firms and traditional load-fund companies building bridges to the expanding universe of independent fee-only advisers.

For fund companies that traditionally sold through brokers, those fee-only advisers were the fastest-growing sales channel in 2008, with a 21% growth in business, according to Strategic Insight.

Last fall, Putnam Investments named one of its distribution executives to a new role overseeing a team focused on independent fee-only advisers, in what the company said is an effort to serve this important segment with an expanded set of dedicated resources.

Ms. Damato is a news editor for The Wall Street Journal, based in South Brunswick, N.J. Email her at karen.damato@wsj.com. Ms. Pessin is a writer in New York. She can be reached at reports@wsj.com .