Mutual Funds Enjoy A Very Favorable Impression 3 Funds To Buy Now

Post on: 21 Июнь, 2015 No Comment

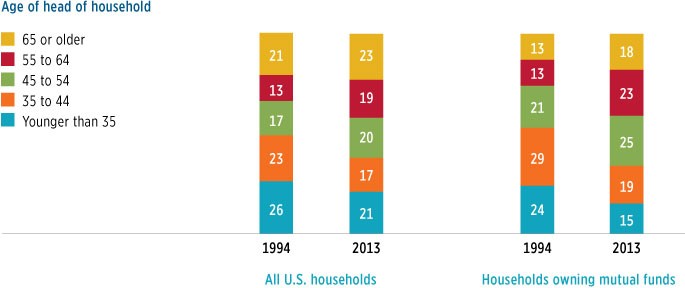

According to the recently published annual survey by the Investment Company Institute, mutual funds dominate a significant portion of investment choices by US households. About 53.2 million U.S. households and 90.4 million individual investors were the owners of mutual funds in mid-2014. The 44.3% of U.S. households owning shares of mutual funds and U.S. registered investment companies include closed-end funds and exchange-traded funds among others.

What is more promising for mutual funds is that its popularity has remained on the higher side. The popularity of mutual funds is reemphasized by the fact that favorability rating among shareholders for mutual fund companies has remained at 68% in mid-2014.

Mutual funds are definitely a preferred alternative investment option for more than one reason. Before looking into 3 top fund picks currently, lets look into the details of the popularity of mutual funds .

Mutual Funds as Alternative Investment

Mutual funds are great options for investors looking for a relatively less risky way to earn at least more than what fixed income instruments offer. Money from individuals and even organizations are invested in stocks, bonds, or other assets covering diverse industries globally.

One of the benefits of mutual funds is that it allows a small investor to invest in a basket of securities at once. Investors need not worry about investing a large chunk in securities separately. Moreover, these are less risky than any individual asset class as underperformance of a security that is mitigated by outperformance of others in the portfolio. In addition to the asset diversification, mutual funds also provide liquidity, economies of scale and are professionally managed.

Favorable Impression for Mutual Funds

While the percentage of households having very or somewhat favorable impressions of fund companies continued to be the same as in May 2013 at 68%, fund investors having very favorable impression surged from 13% in May 2013 to 17% in May 2014. Meanwhile, 87% of shareholders with opinion on fund companies and familiar with mutual fund companies had very or somewhat favorable impressions.

The somewhat favorable impression percentage has been stable over the years, while the very favorable impression keeps changing. The following chart shows the percentage changes since 1997.