Mutual Fund Style Drift Not Always A Bad Thing

Post on: 21 Июнь, 2015 No Comment

Style drift is a common issue for many mutual funds. It occurs when a fund’s current portfolio characteristics clash with its stated investment strategy. Drifting, by definition, is an inactive response to an external force. If you invest in a small-cap fund whose holdings grow up to become mid-cap companies, you’ve probably made a tidy profit and this drift doesn’t seem too bad. However, if a fund manager quickly invests in a stock outside the mutual fund’s scope to pad his or her quarterly stats, this type of style drift — although very rare — could be a big problem.

In this article we’ll explore why mutual fund style drift occurs and what the consequences are — both good and bad. We’ll then provide you with some solutions if you feel your mutual fund is beginning to wander. (To learn how style drift applies to portfolio management, see Focus Pocus May Not Lead To Magical Returns .)

Investment Strategies and Investment Objectives

Before delving into some of reasons for and consequences of mutual fund style drift, it will be helpful to explain some important mutual fund terminology. An investment objective is a performance goal consistent with other appropriate attributes such as risk tolerance, time horizon and income needs. Examples of investment objectives include capital appreciation. capital preservation and current income .

An investment strategy is the approach and style a fund employs in order to achieve its investment objectives. Examples of investment strategies include large-cap growth and small-cap value.

The terms investment objective and investment strategy are often used interchangeably. A mutual fund company normally makes the distinction between the two terms in a mutual fund prospectus. (To learn more about the prospectus, see Don’t Forget To Read The Prospectus! and Digging Deeper: The Mutual Fund Prospectus .)

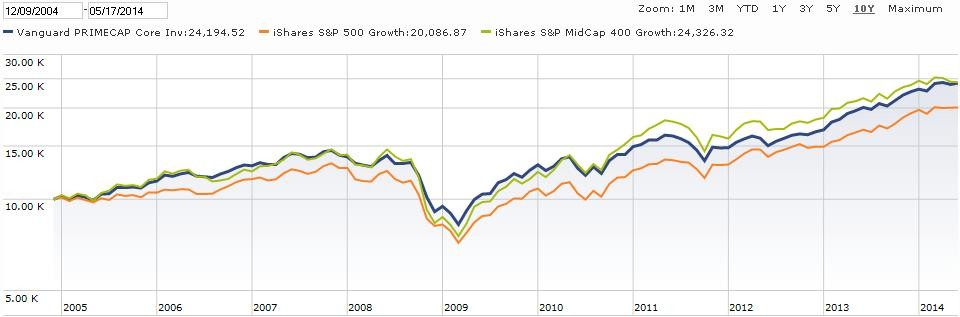

Mutual Fund Style Drift Across Market Capitalizations

Mutual fund style drift is most common in small-cap funds. especially when the small-cap market is rising and a fund’s companies are growing in market capitalization to the point where some holdings may no longer be small-cap. A portfolio manager has to make the decision whether to continue to hold a stock regardless of its size or sell it and look for a smaller company. Many portfolio managers prefer a buy-and-hold strategy and are more than willing to let their winners run if they still represent a good investment. (To learn about being a long-term investor, see Ten Tips For The Successful Long-Term Investor and What does buy and hold mean? )

Holding a few mid-sized companies, however, does not necessarily mean that a small-cap portfolio manager is engaging in style drift. The prospectus normally gives a fund substantial flexibility for implementing strategies and achieving objectives. Prospectus flexibility varies, but it is not uncommon for this document to allow a fund to invest only 65% of its assets in securities consistent with its investment strategy. It is also important to note that some prospectuses include an at the time of purchase clause to provide additional flexibility.

Style drift can also be an issue for mid-cap funds for the same reasons as outlined above.

Mutual Fund Style Drift Across Investment Styles

Mutual fund style drift is not as common across investment styles, such as a value fund switching over to growth fund. It is true that some portfolio managers chase the performance of hot areas of the market, but these managers are very often momentum or growth investors and thus would not be contradicting the fund’s stated style.

Value-oriented mutual fund managers tend to focus on stable sectors such as industrials and financial services and rarely emphasize growth-oriented sectors such as technology and healthcare unless prices for these companies have fallen substantially and represent value opportunities. Value managers are normally very disciplined and will not overpay for securities.

Similarly, growth managers are not likely to change their processes and start buying stock in undervalued companies unless they have strong growth potential. A growth manager does not normally buy stocks that are temporarily out of favor or those that have little or no current earnings.

Most portfolio managers are well trained in their respective styles and might not even feel comfortable buying stocks consistent with another strategy. In addition, both value and growth managers must adhere to the stated policies in a prospectus and in other marketing literature. Not abiding by the rules can have serious consequences for any portfolio manager.

The Impact of Style Drift

Style drift can be a problem for some investors, especially those that are very concerned about having specific fund investment-style percentages within certain asset classes. If your target fund diversification for small-cap funds is 10% and your small-cap fund grows into the mid-cap category, your fund diversification will fall well below 10%. Thus, if the small-cap market rallies, your portfolio could underperform due to the reduced level of small-cap exposure. (To learn more about asset allocation, see Five Things To Know About Asset Allocation and Achieving Optimal Asset Allocation .)

Similarly, if a mid-cap manager were to allow many of his or her holdings to become large-cap and the large-cap market encounters a bear market. your portfolio would suffer from the increased exposure to the large-cap market.

The Portfolio Manager’s Perspective

Portfolio managers are usually not overly concerned about style drift as it pertains to market capitalization (although senior management and marketing executives might be more concerned about this issue). Portfolio managers certainly do not want to violate a fund’s prospectus and will normally adjust a portfolio if necessary; however, a portfolio manager’s primary objective is to buy and hold the best investments for a mutual fund and to make his or her shareholders’ money. In the Forbes.com article The Style Mongers (June 2007), John Rogers Jr. a well-regarded CEO and chief investment officer at Ariel Capital Management, wrote, Style drift can occur naturally when a manager sees small- and mid-cap stocks outgrow their categories, just as children move up a size in clothes. What intelligent investor wants to stunt a portfolio’s growth just to fit it into a category?

What should investors do about style drift?

There is no definitive way to determine whether your mutual fund will experience style drift. However, you can get some insight into how a fund will address this issue by reviewing a fund’s stated investment strategies and historical turnover ratios. If your mutual funds are drifting from their stated investment strategies, you have a few options:

- Rebalance your portfolio to get back to your desired fund diversification by selling part of the fund and then using the money to buy a different fund to put your investment portfolio back into balance. (To learn more about this strategy, see Rebalance Your Portfolio To Stay On Track and Maintaining Your Mutual Fund Equilibrium .)

- If rebalancing doesn’t work for you, and it might not if your account is taxable, then you could simply do nothing about the drift and add new money to alter your fund diversification.

- As a last resort, you could sell the offending fund and look for another fund that is less likely to drift. Selling the drifting fund would be a very rational decision in an IRA account, but it could have significant tax implications for a taxable account.

Wrap Up