Mutual Fund fundamentals What is expense ratio Economic Times

Post on: 16 Март, 2015 No Comment

While choosing a mutual fund, you should judge it on various parameters, such as its past performance with respect to its benchmark and category average, its asset allocation pattern and the fund manager’s history. Another common criterion that can help you select a suitable fund is its expense ratio.

What is expense ratio?

The expense ratio measures the per unit cost of managing a fund. It is calculated by dividing the fund’s total expenses by its assets under management. Asset management companies (AMCs) employ highly qualified professionals to track developments in equity, debt and money markets and then transact accordingly in the asset markets to attain the objectives that are stated in the fund’s offer documents. For such specialised services, the AMC pays a management fee to the professionals.

There are operating expenses too, such as the fee for transfer and registrar agents. They are responsible for issuing and redeeming units of the mutual fund and providing other related services, such as preparation of transfer documents and updating investor records. Other than these charges, a fee is also paid to the custodian, who buys and sells securities in large volumes. Moreover, there are legal expenses, audit fees, as well as marketing and distribution expenses.

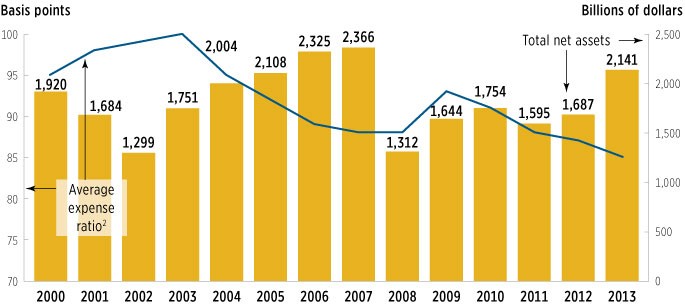

A mutual fund recovers such costs through its unit holders on a daily basis. The daily net asset values (NAVs) of a fund scheme are reported after deducting such expenses, though the expense ratio is disclosed only once every six months. The market regulator, Sebi, has set a ceiling for the expense ratio. For an equity mutual fund, it cannot be more than 2.5% of its average weekly net assets. For debt funds, the ceiling is 2.25%, while for index funds and fund of funds (FoFs), the expense ratios are capped at 1.5% and 0.75%, respectively.

Impact of expense ratio

If you invest Rs 1 lakh in a mutual fund at a NAV of Rs 10 and the expense ratio is 2%, after one year, there is a gain of 12% on the NAV. So, the value of Rs 1 lakh has gone up to Rs 1.12 lakh.

However, after a deduction of 2% charge, the amount is reduced to Rs 1.09 lakh, which translates into a loss of Rs 2,240. Though it does not seem a big reduction, it could impair the value of investments over the long term.

The impact of expense ratio is greater in case of debt funds, which earn 8-9% on an average. For an investor of an equity fund, paying 2% from an average return of 15-20% may not pinch, but it will hurt to pay 2% in case of an 8-9% average return for debt funds.

Consider the above table, where the value of Rs 1 lakh is growing at 12% a year. In 15 years, the fund with a 2.5% expense ratio has reduced the value of investments to 20%, compared with a fund that has a 1% expense ratio. If you compare this with an imaginary fund that has no expense ratio, the fund with a 2.5% recurring expense ratio will see an erosion in value of the investment to 32%. This clearly indicates that a high expense ratio can eat into your returns, so you must take into account this factor while investing in a mutual fund.