Mutual Fund

Post on: 20 Май, 2015 No Comment

Investment institution. Commissions. Types

London Guildhall University

Business Joint Project

Friday, 12 th May 2000

AN ANALYSIS OF THE SPANISH

MUTUAL FUND INDUSTRY:

GROWTH, INNOVATIONS

AND ITS FUTURE

TABLE OF CONTENTS

1. INTRODUCTION

1. INTRODUCTION

It seems clear that the mutual fund industry is showing to be in the middle of a golden age all over the world. And the Spanish case is not an exception at all. As usual, mutual funds arrived to Spain much later than they did in more developed countries like Japan, the United Kingdom and, of course, the United States, but when they arrived at the beginning of the 1990s, success was instantaneous. It was mainly due to the lack of depth the Spanish financial system suffered from by that time. There were not many investment alternatives to that of the Madrid stock exchange, and mutual funds were very much welcomed by investors.

Even though that happened just a decade ago, now it seems that centuries passed. So many events that modified the financial landscape have taken place that now the situation is totally different. Inverco (association of all Spanish mutual and pension fund companies) provided me with specific information about the size, nature and growth of this market. In just ten years, the mutual fund sector in Spain grew 2852%, from 6.9 billion managed in 1990 to 206 billion in 1999.

This report examines the evolution of the mutual fund industry in Spain throughout a whole decade and its present situation, discussing the probable future of the sector, which will depend very much on the investors’ decision-making and the variety of products offered by financial institutions. In order to produce this project, it has been necessary to do a great deal of research using various sources: newspaper and magazine archives, textbooks, Inverco annual reports, several internet websites, a couple of interviews with sector insiders and, of course, lots of perseverance.

2. WHAT IS A MUTUAL FUND?

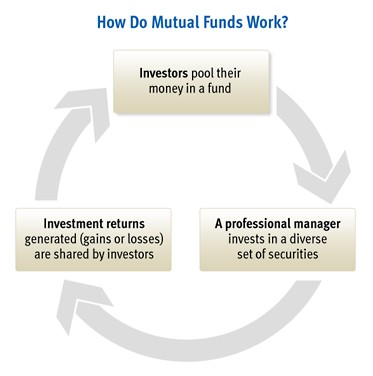

A mutual fund is a collective investment institution constituted by the contributions made by different investors and administered by a management company which is responsible for the administration of the fund. There also exists a custodian bank which guards the securities, controls and guarantees the investment for the investors. Both the management company and custodian bank’s conduct are regulated by the CNMV -Comisión Nacional del Mercado de Valores, Spain’s securities and exchanges regulatory body-.

Just in case it is still not clear enough, these are the characteristics of the different agents that take part:

Investor: Individual person or company who buys a stake and, therefore, makes a contribution to the fund’s total assets. His/her right of property is represented by a share certificate. Investors usually delegate their investment decisions on a group of experts: the management company.

Management company: It administers and manages the fund’s total assets, but is no the owner of those. The management company is responsible for the good or bad performance of the fund for its investors.

Custodian bank: This is generally a bank or savings bank. It keeps and takes care of the fund’s assets, securities and deposits, and is some sort of supervisor of the operations done by the management company.

Given that mutual funds are not companies themselves, they do not issue stocks, but share units instead. These share units represent the right over a certain percentage of the fund’s total assets. The price or value of each share unit is sometimes also called liquidating value, which is calculated daily as the result of dividing the fund’s total assets by the total number of share units. The initial number of share units is determined when the fund is constituted. This number, though, will not be fixed, and will be modified when more contributions or refunds are made.

Thus, a mutual fund is an open-end investment company whose capitalisation is formed by multiple investors’ savings, thus allowing the benefits of the economies of scale in portfolio management. Given these economies of scale, fund management companies always aim to be as large as possible in terms of its assets. The explanation for this is simple. It seems clear that expenses would certainly rise as assets under management increase, but not at the same rate. So, because investment managers can oversee various amounts of money with few additional costs, management companies seek to increase the size of the fund or funds being managed.

There are currently more than 120 fund managers in Spain, and 99% of the total number of funds are cumulative funds, that is, no dividends are provided at the end of the year to their investors, as profits are reinvested in order to create value for the investor. Any profit or loss an investor makes is given by the difference between the price the investor paid at the beginning minus and the actual listed price of the fund’s share unit.

3. ADVANTAGES OF INVESTING IN MUTUAL FUNDS

Liquidity: mutual funds are completely liquid. An investor can sell his/her stake at any time, and has a guaranteed money-back period which is less than one day for the FIMs and less than three days for the FIAMMs. Because of this, mutual funds are legally obliged to keep 3% of their total assets invested in liquid securities, always ready for those who want to sell their part.

Flexibility in the contributions: stakes can be acquired at any time and in any quantity.

Diversification: each stake from a fund acquired means investing in a proportional part of all the securities and assets that the fund invests in, so individual investors are capable of getting a bigger diversification and, thus, manage the risk they want to assume better.

Economies of scale: as mentioned before, the union of a large number of small total assets in a centralised management allows investors to get strong savings in commissions and access markets that otherwise would be very difficult to invest as a separate individual.

Transparency: the price of the mutual funds are published daily, and fund management companies are compelled to send periodically a detailed report of its management to all of its investors.

Taxation: important tax advantages exist for mutual fund investors in Spain.

4. MAJOR TYPES OF MUTUAL FUNDS

There is a wide variety of mutual funds, capable of satisfying the requisites of all different investor profiles, basically regarding risk and lifetime of the investment. Here can be found each type of mutual fund explained, considering that they all have different requisites required by the CNMV. There are two major types of mutual funds: financial and non-financial. Among financial mutual funds we can find:

Money market mutual funds (FIAMMs)

Securities investment mutual funds (FIMs)

In the case of FIAMMs, these are open-end investment companies whose portfolios consist of money market securities. Their assets are invested mainly in short-term fixed income instruments listed in any OECD Stock Exchange market, but also in other financial securities with high liquidity that the CNMV authorizes, with the only legal prohibition that certain securities such as stocks and convertible bonds. Money market mutual funds hold assets such as Treasury Bills, repos, negotiable Certificates of Deposit, and commercial paper. Money market mutual funds are also legally obliged to invest at least 90% of their total assets in highly liquid securities, listed, of course, in a Stock Exchange. They also need to have a lifetime of less than 18 months.

FIAMMs are mutual funds with a very low risk and volatility, but returns are low as well and depend very much on the market’s interest rate evolution. This kind of mutual funds are appropriate for risk-averse investors or those who want to profit from short-term maturity periods. FIAMMs can also be used as the stability cornerstone of the portfolio.

FIMs have many more options and possibilities of investment. Not less than 80% of a fund’s assets have to be invested in equity or bond securities which need to be negotiable in an organised secondary market, either Spanish or belonging to a country member of the OECD. Because of the large number of investment possibilities that FIMs offer, they need to be split into several groups, depending on the kind of securities in which they invest:

Fixed income funds: they invest 100% of their total assets in short, medium or long term instruments. Their volatility or risk, is higher than that of the FIAMMs, but they also give bigger returns than those.

Mixed fixed income funds: they have to invest minimum 75% of their total assets in fixed income instruments, but the remaining 25% can be invested in higher risk securities.

Mixed equity funds: these invest between 25% and 70% of their total assets in equity. These funds are similar to the mixed fixed income one, but the proportion of assets invested in high-risk securities is larger.

Equity funds: those funds that invest more than 70% of their assets in equity. For these funds, risk is higher, but they usually offer higher returns in exchange. These funds are particularly suitable for stock market investors and are focused on the long term.

International funds: more different types of funds are created from the groups mentioned before when the portfolios invest in the same kind of assets and in the same established proportions, but in different countries. Their performance regarding risk and return will depend on the kind of securities and markets that they invest in given that, for instance, it is not as risky an investment made in the US market than one made in Thailand. Moreover, there is an additional element that has an influence on risk and return: the local currency.

Guaranteed funds: these use financial risk-hedging instruments so the investor does not have to assume any risk, mainly because in the given period of time, the initial investment and a certain return are guaranteed. Each mutual fund chooses its investments with the main goal of making sure the amount of money guaranteed is always available. This type of funds is convenient for conservative investors looking for a medium/long term commitment. The main problem with this kind of funds is the high commissions that companies charge, especially if they are not acquired when they are being offered to the investor.

Fondtesoros are a special kind of funds which seek income by investing almost exclusively in a variety of Government securities, including Treasury bills, Treasury bonds and other Government-backed issues. However, there are two different kinds of Fondtesoros: Fondtesoro FIAMM and Fondtesoro FIM. The first of the two claims that its total assets need to be invested in short-term Treasury securities. Thus, its assets are concentrated in Treasury bills, repos and Treasury bonds. The Fondtesoro FIM is a fund that invests in long-term Government debt. At least 50% of its total assets have to be invested in Treasury bills and/or bonds, or any other Government issues with a maturity period longer than 12 months. The rest of it assets will also be invested in Government bonds, but they can be short-term ones.

On the other hand, there are also two types of non-financial mutual funds available in the Spanish market. One type of those non-financial funds is called Real Estate mutual funds (FIIs). These are new generation funds where the management companies invest their total assets in the acquisition of real estate properties that are rented afterwards.

The second kind of non-financial mutual funds are the mortgage-backed ones. Through these funds, banks put together a large number of mortgages -which need to meet special requirements- so they can be sold to individuals as mortgage-backed securities which is the fund itself. This way, a mortgage that can be found in the assets side of a bank’s balance sheet, gets converted into a liability, and the bank will charge a risk-free commission for its role as a broker. The proprietor of the mortgages is no longer the bank, but the private investor who bought a stake of the fund. The return the investor gets is the average interest rate of the mortgages minus the bank’s commission charges, and the risk depends on the number of people with mortgages who can keep up with the payments.

5. COMMISSIONS

Basically, there are four kinds of commissions applicable to mutual funds:

Subscription commission: It is calculated over the total amount of money transferred each time a share of the fund is bought. Fondtesoro funds cannot legally establish this kind of commissions, and for the rest of the funds the maximum rate will be 5%. Except for Guaranteed funds, the majority of funds do not charge this sort of commissions.

Refund commission: This one is calculated over the total amount of money the investor gets back each time a share is sold. Again, except for guaranteed funds, the majority of funds remove this commission charge after one year of investment.

Management and deposit commission: This is used by the management company and the custodian bank to profit from the services they offer. They are included in the daily updated price of each fund share unit because the charges are automatically detracted from the fund’s total assets. The maximum commission charges for each kind of fund are as follow:

Subscription commission charge