Motif Investing Review Low Cost Investing

Post on: 20 Июнь, 2015 No Comment

Investing has come a long way over the years. In early stages, high commissions coupled with unnecessary third parties made investing a game for the rich. However, as technology evolves investing becomes something that everyone can take part in, no matter how rich or poor they may be. Because of technology, the cost of investing has been driven down quite a bit. Not to mention, technology has put investing in our hands without the need for third parties. Today, we’re going to review a product of this technology. Motif has used common sense and technology to make investing easier than it ever was before.

What Is Motif?

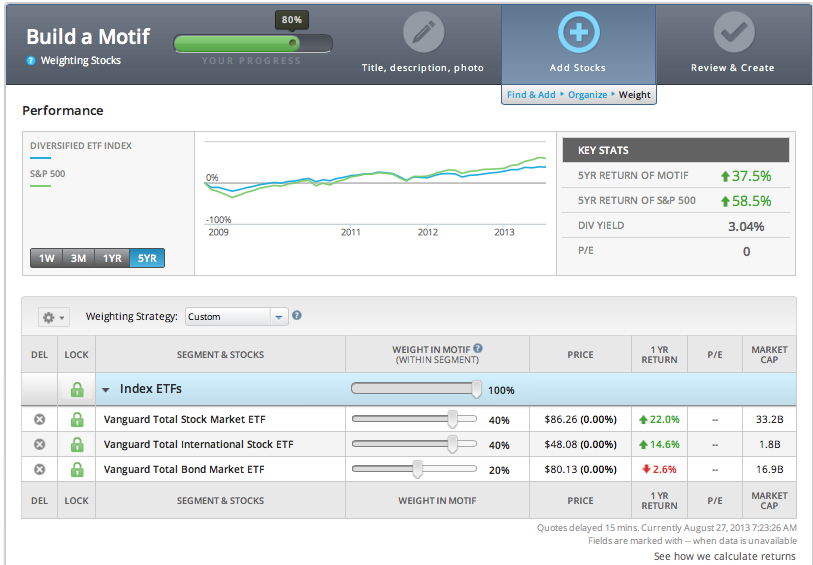

Motif is an investing tool that takes an unconventional approach. As investors, we naturally want to choose the best group of stocks, but before Motif, groups of stocks weren’t available to us. Instead, we had to dig through several different options and build our own group, or profile. With Motif, instead of having to deal with the time consuming headache of choosing stocks, you choose Motifs instead. Motifs are groups of up to 30 stocks that all fall in the same category. For instance, if you were interested in investing in emerging technology, chances are, you’d be able to find a motif with that theme.

Let’s Talk Money

Ever heard the phrase, “It takes money to make money”? Of course you have, and it’s true in every sense. Of course, you’re going to need to have money to invest, but beyond that, it’s important to think about the costs involved in investing. In the industry, you come across several fees or trade commissions. Keeping both sides of the coin in mind, here’s how it all works…

- Start-Up Funds – To start an account with Motif, you’re going to need to place a minimum investment of $250. When you look at competitors and the average minimum around $1,000.00, it’s easy to see that Motif is doing their best to make sure everyone has the opportunity to invest.

- Buy Or Sell A Motif – Motifs, as mentioned above, are groups of 30 or more stocks. The fee to buy or sell a Motif is a flat fee of $9.95, which really isn’t bad when you think that a single trade can cost almost that much with companies like E-Trade.

- Trade Individual Stocks – If you don’t like the way a stock in your Motif is performing, or you’d like to add a new stock to your motif, you can. The fee for the trade on individual stocks within Motifs is $4.95. Just be careful. For new investors, it can be easy to get carried away trading single stocks within your Motif. It’s important to remember that even low trade fees add up! With little capital, too many trades could eat into your principal investment even after gains.

Who Chooses The Stocks That Go Into Motifs?

Although it is possible to build your own Motif. if you’re like most investors, you’ll choose one that is already there and customize it to fit your needs. That leads to a huge question. Who chooses the stocks and how does the decision making process work?

The Motifs that are available were put together by experts hired by Motif themselves. These experts carefully research each and every stock and put them together in a portfolio that will maintain diversity and produce profits.

- Easy Investing – If you’re like me, you don’t have the time it takes to choose each and every stock in your portfolio. With Motif, you don’t have to worry about the research; it’s already done for you.

- Comprehensive App – Motifs app for cell phones and tablets provides all the tools that you would expect from their website. The app is available on just about all devices and very easy to use and understand.

- Risk Management – Motif makes risk management easy. First off, if you don’t like a stock in a motif, you’ve got ways to customize it to fit your needs. Beyond the customization of what stocks are included, you also have the ability to allocate funds within a Motif. Therefore, if you want to take part in a risky investment to test the waters, you don’t have to allocate the same amount of funds to that investment as the others. Instead, you can keep more of your money in safer areas while experimenting with more risky moves.

- Cost – We went over cost above, so I’m not going to get into too much detail here. Nonetheless, Motif trade fees are incredibly low and worth a second mention.

- Easy To Get Carried Away – I really like Motif, so it took some digging to think of something I didn’t like. The one thing I found was how easy it is to get carried away and start losing money. Because trade fees are so low, it’s easy to think something like “It only costs me about 5 bucks to trade, why not?” If you do this too much with little capital, you could trade all your profits away; or worse, the fees could cut into your principal investment. Therefore, if you’re new to investing, just remember not to get carried away.

Review Conclusion: Should I Motif?

Overall, Motif is a great company to work with. Their simplistic approach to investing has made investors like me plenty of money, and their services come at an incredibly low cost. If you’re looking to get into investing or diversify your portfolio by looking into new options, you should strongly consider working with Motif.

Where to learn more about Motif Investing:

Visit the Motif Investing website.