Motif Investing Review Financial IndependenceFinancial Independence

Post on: 20 Июнь, 2015 No Comment

Introduction to Motif Investing

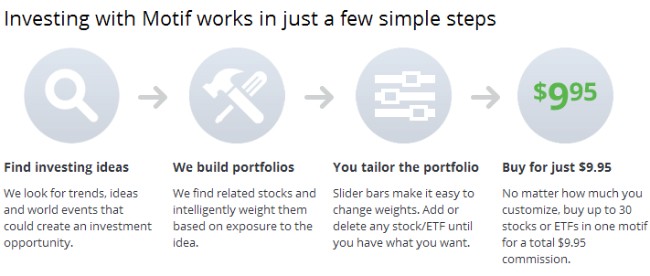

Motif Investing are a specialist stockbroking company. They focus on portfolios of up to 30 different stocks or ETFs (known as motifs) which are created by both employees and their community members. Each motif can be traded as a whole, or investors can trade each underlying stock individually. Unlike a mutual fund, investors directly own the stocks purchased through Motif investing and retain all of the associated benefits of stock ownership.

Each motif focuses on a specific sector or theme. Examples include Chinese solar, biotech research, companies who benefit from rising interest rates and even companies donating to specific political parties. If you arent 100% happy with a pre-made motif you can modify it before trading. If youre stuck for ideas you can even browse and trade motifs created by other members.

As well as acting as a broker, a major part of Motif Investing is the social aspect. You can choose to share your investments with everyone, your friends or keep it private. This allows for friendly competition amongst friends, creating the best performing motif amongst your social circle.

The company is a FINRA registered broker dealer, complying with state and national regulation.

Motif Investing: An Example

After signing up for a free account, I chose to test Motif Investing by creating my own custom motif. Sticking to my love of index ETFs, I quickly put together a motif consisting of the Vanguard Total Stock Market ETF (VTI), the Vanguard Total International Market ETF (VXUS) and the Vanguard Total Bond Market ETF. The whole process was extremely simple I simply named my motif, chose the stocks and specified their weightings. The system provided historic returns, information on dividend yield and even compared performance to the S&P 500. From start to finish it took under five minutes!

Building a custom portfolio is simple and takes under five minutes with Motif Investing

Motif Investing Fees

A $250 minimum investment is required to purchase a motif investment. Due to the nature of investing into multiple stocks at once, you may end up with some fractions of shares. For example, if $100 of your funds go towards a stock worth $3, you will end up with 33 ⅓ shares. This is an alternative to not having your money fully invested, but fractional stocks are unlikely to come with voting rights.

To buy or sell a motif investment there is a fixed cost of $9.95. This cost covers the transaction costs for the whole motif containing up to 30 stocks or EFTs. You can also trade the single stocks which make up a motif for $4.95 each . It makes more sense to adjust multiple stocks at once (at $9.95) a perfect opportunity to rebalance. Margin lending is offered, with prices dependant on the margin balance.

There are no ongoing account keeping or management fee with motif investing. If you choose to hold EFTs within your investment, the standard management cost associated with each ETF will apply. This ETF MER fee is not charged by Motif Investing but the ETF provider directly.

Advantages of Motif Investing

The major benefit of motif investing lies in discount brokerage. Being able to custom build a portfolio of 30 stocks or EFTs and pay less than $10 to trade the whole lot is extremely cost effective. By contrast, E*Trade charge the same price for trading a single stock.

The social aspect of Motif Investment is also interesting. There is the potential to network and learn from other users. Motif Investing put a strong focus on member created motifs, including the reason for their creation. There are hundreds of pre-made motifs covering areas I would have never otherwise considered. As previously mentioned, the option of competition between friends could also be a motivating factor to improve your portfolio.

Motif investing appears to be an attractive option for those wishing to build a diversified portfolio as opposed to taking the risks associated with individual stocks. Instead of picking one stock to buy at a time, you can build an entire portfolio at once. As well as reducing risk, this also prevents paying multiple brokerage fees. For this reason it is well suitable for investors just starting their portfolios providing cost effective diversification from day one.

Disadvantages of Motif Investing

Motif Investing does not allow for the automatic reinvestment of cash dividends. Instead, cash dividends are paid directly to your accounts cash balance. You can manually reinvest this dividend, however you will incur a trading fee to do so. In the event a stock pays a dividend in additional units, the stock are automatically credited to your portfolio as you would expect.

Auto-rebalancing of your motif is also not possible. Motif Investing will contact you to inform you of additions, removals or weighting changes to motifs you own. What they wont do is rebalance for you instead you have to log into your account and make the changes yourself. This rebalancing counts as a transaction so the standard fees apply.

It is also important to note that while Motif Investing offer pre-made motifs build by investment professionals, many of the motifs offered are build by other investors. The peer-built options are disclosed as such, but there is the potential that many of these portfolios may actually be poorly diversified. This negates one of the major advantages of Motif Investing. For this reason Id recommend sticking to building your own motifs as opposed to choosing pre-made ones. That said, I did appreciate the option to search for motif investments based on a large range of criteria (industry, volatility, even how many other people had invested in it).

Finally, cash held in your Motif Investing cash account does not accrue any interest. I cant see anyone ever holding a large cash balance however I feel they could have offered at least a token interest rate on cash.

Proposed future features

Custom made motifs can be bought by other investors imagine getting paid each time someone trades a motif youve created. This is a concept proposed by Motif Investing for future release. Given the social nature of motifs, this has the potential to really take off. Additionally, this could provide an incentive for professional investment advisors to use the platform. No time frame has been provided, nor have the details of exactly how this feature will work. It is unclear if this payment will come from existing fees or if extra costs will apply for the purchaser.

Another concept proposed by Motif Investing is copy trading. This involves assigning part of your portfolio to emulate the actions of other community members you choose. This would allow followers of successful investors to gain financially when their idols do well. It is unclear any reimbursement for the followed member will occur.

Conclusion

Im actually quite excited about Motif Investing. I can see the potential for people to enjoy the social aspect, however this isnt the main reason I like it. For me, the real benefit of Motif Investing lies in being able to construct an entire diversified portfolio from scratch and buy it without incurring large brokerage fees. This makes Motif Investment ideal for those just starting out or investing additional funds without effecting your portfolio balancing. Despite some limits around automatic dividend reinvestment and auto-rebalancing, this is a tool which I believe is suitable for beginner or casual investors.