Mortgage Rates Compare Current Home Loan Interest Rates

Post on: 28 Май, 2015 No Comment

Updated and reviewed Nov. 26, 2014

The factors driving the ebbs and flows of mortgage rates are largely unknown to the general population. You may be inclined to blame — or commend — your mortgage lender for the low or high rate she offers you; but, in actuality, it’s not her decision. Today, the true drivers of mortgage rates are the investors in the secondary market.

To the layman’s eye, mortgage rates seem to move up and down without explanation. But, just like the ocean tides that wash up and back by the pull of the moon’s gravity, mortgage rates have their own driving force, even if they have a less cosmic source.

Just like the ocean tides that wash up and back by the pull of the moon’s gravity, mortgage rates have their own driving force.

The mortgage lender that funds your loan is called the originator. A loan originator may be a bank, a credit union, or other type of financial institution. On the date of funding, the money flows out of the originator’s hands and into yours. You then turn that money over to the seller of the home.

Once the loan is funded, the originator has the option of keeping that loan in its portfolio or selling it on the secondary market. If the originator keeps the loan, it makes money by way of the interest you pay each month. If the loan is sold, the originator replenishes its funds, and can make more loans to other homebuyers. Basically, the secondary market investors keep funds circulating so that loan originators don’t run out of money for new mortgages.

Today’s secondary market investors include government-chartered companies like Fannie Mae and Freddie Mac, plus insurance companies, pension funds, and securities dealers. Although Fannie Mae and Freddie Mac are different organizations, they participate in similar activities. Both can buy mortgages, and both can group mortgages together for resale in what’s called mortgage-backed securities (MBS). These are highly liquid investments, meaning that they can be readily bought and sold.

How does the secondary market affect would-be homebuyers?

Investors want to earn the best return possible. The level of return is determined by the current and anticipated condition of the economy. When the economy is on an upswing, future yields are expected to be better than current yields. Investors, therefore, will hold off buying until higher yields materialize. This drives mortgage interest rates up, because lenders cannot sell their loans at lower yields.

Conversely, when the economy is in a downturn, investors buy up what’s available to avoid being stuck with lower yields later. This drives mortgage rates down, as investors are clamoring to buy before yields get too low.

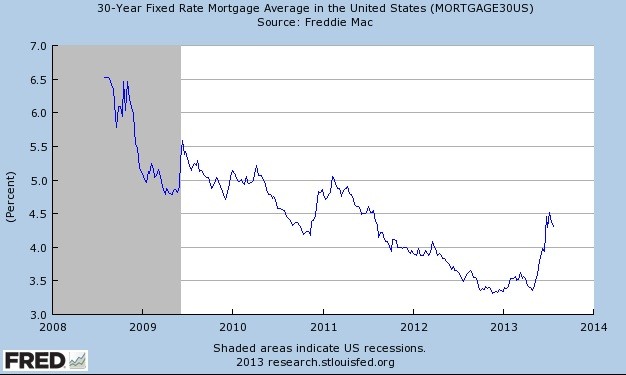

Historic Mortgage Rates

Mortgage rate trends dating back to 1973; slide the clear section in the bar at top to view different years. Click on colored boxes at bottom to view or remove particular loan types. Data source: Freddie Mac

Keeping your eye on mortgage rates

There are many factors that influence mortgage rates, including unemployment and inflation levels, trends in the stock and bond markets, and the federal funds rate. None of these alone will give you surefire insight into the future of rates, but by keeping your eye on all of them, you can have some sense where they are headed.

As mentioned earlier, the secondary mortgage market provides liquidity for the mortgage industry, by allowing investors to buy the aforementioned mortgage-backed securities, which pay a competitive yield relative to the risk involved. Treasury bonds are backed by the U.S. government and used as a benchmark, and are considered the safest debt securities available. The yields on mortgage-backed securities, therefore, need to be higher than intermediate-term Treasury bonds in order to make them desirable to investors, who are assuming a higher risk. Therefore, changes in Treasury bond yields can foreshadow changes in mortgage rates before they actually occur.

Mortgage rates are influenced by many factors, including the economy, inflation, unemployment, trends in stocks and bonds and the Federal Reserve.

Another metric to keep your eye on is the federal funds rate, which is the rate that banks charge when they make an overnight sale to other banks of the money that they keep deposited at the Federal Reserve. The fed funds rate is set during meetings of the Federal Open Market Committee (FOMC), which regulates the buying and selling of U.S. Treasuries and federal agency securities. The FOMC holds eight meetings each year, where they review economic and financial conditions, and decide the best course of action to take to set monetary policy and keep the economy stable. A decrease in the rate will stimulate growth, and an increase will slow growth. Therefore, in periods of high inflation, the FOMC may raise interest rates, and in a period where they need to stimulate the economy, they will lower them. At each meeting, they will either lower, raise, or maintain the fed funds rate. Their decision will impact mortgage rates.

The fed funds rate is intermeshed with the stock market, because stock market trends influence – and are influenced by – the fed funds rate. If the market is struggling and in a downward trend, the FOMC may opt to reduce the fed funds rate and free up the supply of money. Conversely, if the market is on a tear, the Fed may increase the rate in order to keep the economy from overheating.

Types of mortgage rates

There are two types of mortgage rates available for a home loan – fixed and adjustable. With a fixed-rate mortgage (FRM), the rate will stay the same over the entire length of the loan. The same goes for your monthly payment. People who choose fixed-rate mortgages have an easier time planning their budgets. They also have no exposure if interest rates go up.

An adjustable-rate mortgage (ARM) is based on an index, and the mortgage rate will fluctuate over the life of the loan. An ARM will likely have a lower interest rate at the beginning when compared to a fixed-rate mortgage; but over the life of the loan, that could drastically change, especially if the economy heats up, and interest rates begin to rise. ARMs are especially risky because you may end up owing more money than you borrowed, even if your payments are all made in a timely manner.

Finding the best mortgage rate

Once you determine which type of mortgage rate you want, it’s time to start shopping. Instead of shopping for a home and then applying for a mortgage, try reversing the order – talk to a few mortgage professionals for some advice on your qualifications, and then get pre-qualified for a loan or, even better, get pre-approved. If you have your mortgage in hand, you will be in a stronger negotiating position with the seller, because he will know that no financing contingencies will be required. Also, if mortgage rates are favorable, it will allow you to act quickly to lock in a preferred rate once you find the property that you would like to buy.

Mortgage rates are influenced by many factors, including the economy, inflation, unemployment, trends in stocks and bonds and the Federal Reserve.

To get the best mortgage rate available, you’ll want to show the bank that you are credit-worthy by having the best credit score possible. That’s why it’s imperative to check your credit report before you begin applying for a mortgage. Banks use credit scores to determine whether you’re a good risk, and if you’ll be someone who makes mortgage payments on time. If you have a pattern of paying your bills promptly, you’ll be in a great position, but that’s not something you can establish overnight. If you have a low credit score, there’s a higher risk that you’ll miss payments or, even worse, default on the loan completely.

Once you get a copy of your credit report, review it carefully for any errors. If you find them, contact the credit reporting agency and have it corrected as quickly as possible. If you can’t do that in time for your application, you can always let the bank know that there’s an error and you’re in the process of correcting it.

Another way to get the lowest mortgage rate available is to increase your down payment. Many lenders will allow down payments of as little as 3.5 percent down, but if you can pay more upfront, you’ll likely get a lower mortgage rate as well. Putting down 20 percent or more will also allow you to avoid paying mortgage insurance premiums, which can easily cost 0.5-1.35 percent of your loan amount each year. A larger down payment will also reduce the size of your monthly mortgage payment because you’ll be borrowing less money.

Ask your lender if you qualify for a loan that is backed by Fannie Mae orFreddie Mac. because these generally offer the best combination of low interest rates and fees. FHA home loans offer good rates and less-stringent credit requirements than Fannie Mae and Freddie Mac, but usually have higher fees as well. If you served in the military, you may be eligible for a home loan through the Veteran’s Administration (VA ), which offers quite favorable terms.

Finding mortgage rates online

It is now as easy to find a mortgage lender online as it is to find one in a brick and mortar bank. Even if you want to go with a traditional banker, discover the interest rates that competitors are offering in your area. This way, if your local bank is a bit overpriced, you can use it as a negotiating tool. Or you may even prefer to go with an online lender if the difference in the mortgage rate offered is significant.

When searching for rates online, make sure that your finding rates specific to your area.

When searching rates online, it’s important to know exactly what you’re looking for – and take clear notes. You may find that the lowest rates available are all adjustable-rate mortgages, but have decided to go with a fixed-rate loan, because you prefer the stability that it offers. On the other hand, if you expect to move in a few years or don’t mind risking that you might pay a higher rate later on in return for a lower rate today, an ARM might be the right product for you.

Make sure that you’re finding rates specific to your area. You can do this by checking the rate details, which will be available at the top of the page. Rates will vary from locale to locale and state to state, and a national mortgage average may be irrelevant to your particular area. Also, check to see if the rate includes points, where each point equals a fee of 1 percent of the total loan. Each point that you pay will lower your interest rate, so it’s important to determine if the low rates you find online include them or not.

Finally, check to see when the site was last updated. If it’s been a week or more, the published rates may no longer be available. Or they may be available exclusively to people with the highest credit scores.

Locking in your mortgage rate

After your original mortgage application is accepted – but before your loan closes – you may be allowed to lock in a mortgage rate. This is a difficult decision to make, because you’re not psychic, and thus can’t really be sure the direction that rates will take over the next 30 to 60 days. If rates are in an upward mode, procrastinating could hurt, and cost you a lower rate. But if rates are trending downward, you could lock in a rate that will be higher by the time everyone is ready to sit down at the closing table. Even professional mortgage brokers, who have vast experience watching rates, can’t be depended upon to make the right call. They may be in a better position to make an informed decision, but no one really knows for sure.

Everyone – even lenders – likes low mortgage rates

If you’re confident that a rate lock is right for you, get it in writing. Some lenders have forms that will describe the exact terms of the lock. Don’t allow the agreement to be made orally – when the time comes to close, you don’t want to be dependent on somebody’s memory as to what you agreed upon.

Some lenders will charge you a fee if you decide you want to lock in a rate, along with the number of points that you’d like to pay. If the loan doesn’t close for any reason – even if it’s the bank’s fault – you may not be allowed a refund. The fee will vary from lender to lender, and will depend on the length of time of the lock-in period. You may even find a lender who charges no fee.

There are three different options for rate locks. The first is a locked-in interest rate, and locked-in points, which lets you lock in both for a period of 30 to 60 days. The second is where you lock in the interest rate, but float the points. If rates drop during the lock-in period, you may be able to lower your points. If they rise, the opposite will occur. The third choice allows you to float both the interest rate and points, with the option to lock it in sometime after you apply, but before you close.

As long as you close within the designated time period, your lock-in will take affect. But if you fail to close, you might lose the interest rate you agreed to, and will have to start the process all over again.

By staying on top of financial trends and planning accordingly, you can time your rate lock to get the best mortgage rate possible. In other words, when the tide is low, put a call into your lender and lock in that rate. You’ll enjoy waves of prosperity if you do.

How changing rates affect you

No one – not even lenders – likes high mortgage rates. Home sellers may have a tougher time attracting buyers who can’t afford the higher rates. And if you want to renovate your home with a home equity loan, it could be quite expensive, because second mortgages are also sensitive to rising interest rates.

Mortgage lenders generally don’t like high rates, because they’re bad for business. Mortgage lenders usually make their money by originating loans, so higher rates mean fewer loans and less earnings for them. Most lenders sell the mortgages they originate to investors, who are the ones who get the interest earnings, while the lenders get a fresh shot of cash to make more loans.

Everyone – even lenders – likes low mortgage rates. Buyers like them because they can lock in great rates for the long term, and sellers like them because buyers may be able to afford a more expensive home because interest rates are lower. When rates rise, it increases the cost of buying a home. For every $100,000 that you borrow, a 1 percent increase in rates will cost you about $64 more per month. That may not sound like a lot, but over the course of 30 years, it can really add up.

In a period of rising interest rates, owners of adjustable-rate mortgages may feel a significant sting as they watch their monthly interest rate and payment adjust higher and higher. If you made the conservative choice and went with a fixed-rate loan, during these times, you simply smile and pat yourself on the back for making a wise financial move.

How Are Mortgage Rates Set?

When you look at mortgage rates, do you ever wonder how they come up with the numbers? It isn’t as mysterious as it seems. The Federal Open Market Committee uses market conditions to help determine the rates that you’ll pay for mortgage loans .

When you’re considering a mortgage loan, a primary factor in your decision is the mortgage rate that you’ll pay. If you’re opting for an adjustable-rate mortgage, you’ll want to be sure that you can meet your commitment, even if interest rates rise. That’s why it’s important to understand how mortgage rates are determined.

The Federal Reserve Bank

When people talk about America’s monetary policy, they’re referring to the actions taken by the Federal Reserve Bank that affect the availability and cost of money and credit. The Federal Reserve’s job is to keep the economy on an even keel. To accomplish this, it works through subdivisions, one of which is the Federal Open Market Committee (FOMC). The FOMC regulates open market operations, which is the buying and selling of U.S. Treasury and federal agency securities. By buying securities, extra reserves are added to the banking system, so interest rates fall. By selling, reserves are lowered and interest rates rise.

The FOMC and mortgage rates

The FOMC is made up of twelve members, which include the seven members of the Board of Governors of the Federal Reserve System, the president of the Federal Reserve Bank of New York, and four of the remaining eleven Reserve Bank presidents, who each serve a one-year term on a rotating basis. The FOMC holds eight meetings each year. The purpose of these meetings is for the Committee to review current economic and financial conditions, and then decide the best course of action to take when setting monetary policy. Their policy goals are always to keep prices stable and the economy growing.

One way they accomplish these goals is by establishing the federal funds rate. (This is the rate that banks charge when they make an overnight sale to other banks of the money they keep deposited at the Federal Reserve.) At each meeting, the FOMC raises, lowers, or keeps the fed funds rate the same. This has a direct impact on mortgage rates.

If you want to know where interest rates are headed, keep your eye on the Federal Reserve. Their decisions are reported in the business section of all major newspapers.

What’s the Best for You?

There are so many decisions to make when shopping for a home mortgage loan. Should you choose a fixed or adjustable rate? Should you pay interest-only for a period of time? How much money should you put down? One of the simpler, but absolutely crucial decisions that will confront you is the choice of term. How long a mortgage is right for you?

While the most popular terms are still 15- or 30-years, you can find a range of variations, including 10-, 20-, 25-, or even 40-year home loans. In order to find the perfect match, ask yourself the following questions:

- How long do I plan to stay in the house?

- How much money can I afford to pay for my mortgage each month and still have enough to save for retirement and other important financial matters?

- How does the pay-off date fit in with my financial goals and dreams?

Advantages of 30-Year Mortgages

Like your father’s Oldsmobile, the 30-year mortgage is the granddaddy of home loans. It will have lower monthly payments than a comparable shorter-term loan. As a result, you’ll have more disposal income for your living expenses, or to funnel towards saving for retirement, college tuition, or whatever goals are important to you. In addition, when you have access to extra cash, you can use it to pay down the balance of your mortgage, which will automatically shorten the term of your loan. Because the term is longer, it’s often easier to get approval, and you may be able to afford a larger house. If you plan to stay in the home for a long time, the longer term makes sense.

Advantages of 15-Year Mortgages

This mortgage can be shorter and sweeter than its longer counterpart. You can snag a lower interest rate, and build up your home equity more rapidly. However, your monthly payment will be higher than its longer-term counterpart. And a huge perk is that you’ll pay less interest over the life of the loan, which ultimately will result in more money in your pocket.

Whichever term you choose, you always have the option to do a home refinancing if your financial situation changes. If there’s too much pressure meeting your monthly payments on your 15-year loan. you can refinance for a longer term. If interest rates drop, you can take advantage of them by opting for a shorter-term.

The ultimate decision will be based on your cash flow and how you want to spend it, as you work towards the ultimate goal of the American dream: owning your home free and clear.

Interested in what rate you could get?

Click HERE to compare mortgage rates from top lenders in our network.