More Volatility Ahead in 2015 Cinque Partners LLC

Post on: 20 Июнь, 2015 No Comment

The stock market’s sustained rally hasn’t been ideal for volatility-focused investors but, as a recent CNBC.com story suggests. the outlook may be shifting in their favor.

The Chicago Board of Exchange Volatility Index (VIX)—the so-called “investor fear gauge”—has traded far below its historical average of 20 for much of the past five years. Investors still appear confident: after spiking to the mid-20s in October, the VIX has returned to sub-15 levels.

But while most observers expect U.S. equities to head higher, many believe its path will become less predictable. (We wrote last week that the Federal Reserve has forecasted more market instability in the wake of planned short-term interest rate increases in 2015. )

As Mayur Saigal, Janus’s global head of fixed income risk management, said in the CNBC piece, ’The decade-low volatility numbers that we saw across asset classes (in June)—that was probably a good time to buy protection.’

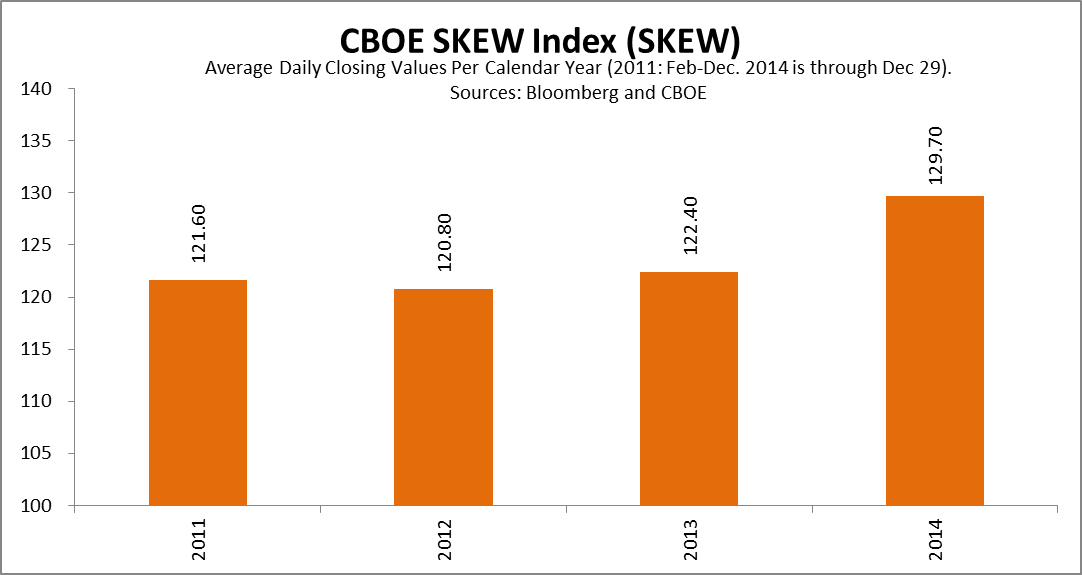

We believe that simply owning the Standard & Poor’s 500 Index ignores the increased risk in today’s markets of long-tail events. Recent history shows that volatility spikes happen quickly and unpredictably, causing potentially serious damage to portfolio principal.

There is a less risky way to participate in equities, in our view. Cinque Partners’ 10-year-plus strategy combines an active S&P 500-based portfolio with buy-write options and protected puts, targeting more upside capture and less downside loss.

For more details on our strategy and performance, including capture ratios and other portfolio characteristics, please contact us .

No statement is to be construed as a recommendation to purchase or sell a security, or to provide investment advice. This material contains the opinions of the author but not necessarily those of Cinque Partners LLC and such opinions are subject to change without notice. This material is for informational purposes only and should not be considered as investment advice or a recommendation of any particular account or strategy.

Options carry a high level of risk and are not suitable for all investors. An option holder runs the risk of losing the entire amount paid for the option in a relatively short period of time.

Index returns are presented for comparative purposes only. The returns are unmanaged and do not reflect the deduction of any fees or expenses. You cannot invest directly in an index.

An option writer may be assigned an exercise at any time during the period the option is exercisable. The writer of a covered call forgoes the opportunity to benefit from an increase in the value of the underlying interest above the option price, but continues to bear the risk of a decline in the value of the underlying interest. The writer of a put option bears a risk of loss if the value of the underlying interest declines below the exercise price, and such loss could be substantial if the decline is significant.

All investments in securities involve a risk of loss of capital. No guarantee or representation can be made that an investment will generate profits or that an investor will not incur loss of invested capital. There can be no assurance that the investment objectives of any account or fund managed by Cinque Partners will be achieved or that its historical performance is indicative of the performance it will achieve in the future. Individual investor performance may differ based on date of investment, security availability and price, and actual fees paid.

The Cinque Partners strategy uses options sales, both covered call writing and collateralized put writing, in an effort to generate income, manage risk, and support the rebalancing of the underlying long equity portfolio. From a portfolio perspective, the Cinque Partners policy target is to be 50% written. A combination of calls and puts is utilized to seek to achieve this policy target based on meeting specific criteria for the alignment of strike and target prices along with requirements for static returns, if exercised returns and probability of exercise.

No levels of dividends or income can be expected. There can be no assurance that this or any strategy, account, or the benchmark will be able to implement its investment objective or avoid substantial losses. Past performance is no guarantee of future results.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Please reference our Terms of Use for additional information.