Money Market V Account

Post on: 16 Март, 2015 No Comment

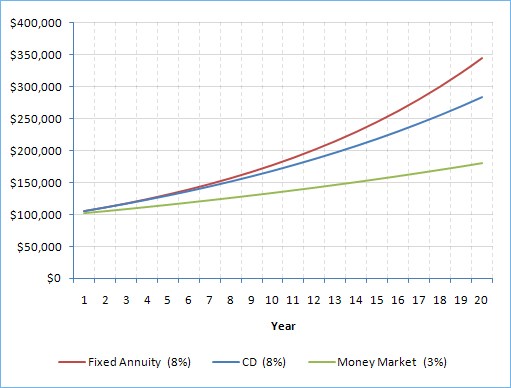

I f you have a personal finance book on your shelf at home, there is a good chance that the author recommends you put your emergency fund savings into a money market account. Historically, that was good advice as money market accounts have offered higher interest rates than either savings accounts or checking accounts.

However, for at least the last couple of years, the opposite is true.

Right now, some of the money market funds that are typically the best performers are averaging a 7 day yield of between .15% .05%. On the other hand, bank savings accounts are paying as much as 1.45% (Nationwide Bank) followed closely with a 1.39% from Ally Bank (rates current at time of publication, please see respective banks for current rates).

Personally, I think this trend is going to continue for some time. (See comments below about changes to rules for money market funds.)

Lets look at money market fund basics and savings account basics; then you should be able to determine which is best for your needs.

Money Market Fund Basics

Money in a money market is easy to access (liquid). This is important for money you keep in an emergency fund. Most money markets give you check writing privileges which makes it easier to access your money. In addition, with a little shopping, you should be able to find a money market fund without fees.

It is important to note that a money market account is different than a mutual fund. This is a common misconception among new investors, so it is important that you understand that the two are different. A money market deposit account is FDIC insured up to $250,000 which guarantees your emergency fund against a bank failure.

New rules for money market accounts. In January, the U.S. Securities and Exchange Commission updated rules for money funds . These changes make such investments more secure (theoretically), but also limit the potential yields of the money market funds. Thus, it seems likely that yields will be reduced by these changes.

With a money market fund, the Interest is a variable rate. This simply means it will change based on performance. The money market managers do their best to keep the cost at $1 per share and share any of the additional income through interest payments.

Advantages of a money market account: Safety and ease of access (liquidity).

Savings Account Basics

Money in a savings account is very easy to access, (liquid) which is important for an emergency fund. Depending on your bank, you can typically transfer those funds to a checking account or easily withdraw the money at the bank or using an ATM.

Interest rates at banks do change, but they are fixed in the sense that when they set a rate you know you will get that rate until the rate either increases or decreases. Many banks keep their interest rates for their savings accounts similar to competitors, which may give you more options for your emergency fund savings.

Money in a savings account is FDIC insured up to $250,000.

When it comes to shopping around for the best savings account. you can typically get the best interest rates from an online account. Here are some of the best savings interest rates .

Advantages of a savings account: Safe, easy to access (liquid), and competitive interest rates.

Current Money Market Owners Could Open A Savings Account, Too

If the hassle of changing banks and opening a savings account just to close it later if money market yields improve does not sound appealing, then you have options. Call your current money market fund holder and ask about the minimum required balance (without fees). Keep the minimum amount in your money market fund and then open a new savings account. If, in the future, the money market interest rates exceed savings account interest rates, all you need to do is keep the savings account open with the minimum balance and transfer the money back into a money market account.

This way you are in a position to easily be able to take advantage of some of the highest interest rates.

Should You Open A New Savings Account For Your Emergency Fund?

In my experience, opening a new savings account online takes about 20 minutes.

Here’s what you need to figure out when comparing money market account sand savings accounts:

What is your current interest rate on your money market account? How much more interest could you earn if you switched to a savings account? Based on your account balance, how much more money would you have at the end of one year. Take that number and ask if it is worth 20 minutes of your time.

In general, if you have an account balance of around $5,000 in a money market account, you will be better off making the switch to a savings account. But, be sure to do your own math.

In my case, I have my emergency fund in an account with Capital One 360 . This account is linked to a checking account with Capital One 360 so I can instantly transfer money from my savings account into the checking account and then write a check.

Do you think a money market or a savings account is the best place for an emergency fund?