Modern Portfolio Theory and The Efficient Frontier

Post on: 16 Март, 2015 No Comment

Harry Markowitz wrote an article titled Portfolio Selection that was published in 1952 and is the basis of Modern Portfolio Theory. In that paper, he laid out his mathematical arguments in favor of portfolio diversification. Markowitz shared the Nobel Prize in Economics in 1990 with two other scholars for their pioneering work in the theory of financial economics.

The Modern Portfolio Theory Perspective

Modern Portfolio Theory (MPT) approaches investing by examining the entire market and the whole economy. The theory is an alternative to the older method of analyzing each investments individual merits. When investors look at each investments individual merits, theyre analyzing one investment without worrying about the way different investments will perform relative to each other. On the other hand, MPT places a large emphasis on the correlation between investments. Correlation is the amount we can expect various investments and various asset classes to change in value compared with each other. Here is a simple example of correlation:

A company that sells wool products like sweaters and blankets is more profitable when the price of wool is lower. A company that is a wool wholesaler is generally less profitable when the price of wool is lower, unless they are able to sell a lot more wool. Though the companies work together, their profits have a low correlation. In other words, the profitability of one company does not follow the same lines as the profitability of the other company. And sometimes they are even inversely related.

Risk

One important thing to understand about Markowitzs calculations is that he treats volatility and risk as the same thing. In laymans terms, Markowitz uses risk as a measurement of the likelihood that an investment will go up and down in value and how often and by how much. The theory assumes that investors prefer to minimize risk. The theory assumes that given the choice of two portfolios with equal returns, investors will choose the one with the least risk. If investors take on additional risk, they will expect to be compensated with additional return.

According to MPT, risk comes in two major categories:

- systematic risk the possibility that the entire market and economy will show losses negatively affecting nearly every investment; also called market risk

- unsystematic risk the possibility that an investment or a category of investments will decline in value without having a major impact upon the entire market

Diversification generally does not protect against systematic risk because a drop in the entire market and economy typically affects all investments. However, diversification is designed to decrease unsystematic risk. Since unsystematic risk is the possibility that one single thing will decline in value, having a portfolio invested in a variety of stocks, a variety of asset classes and a variety of sectors will lower the risk of losing much money when one investment type declines in value.

The Efficient Frontier

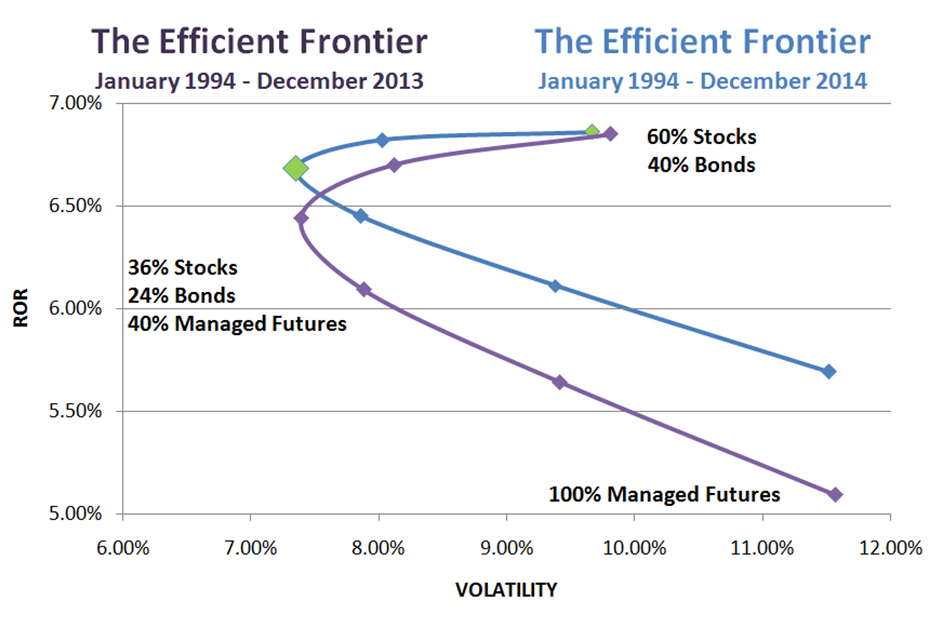

In order to compare investment options, Markowitz developed a system to describe each investment or each asset class with math, using unsystematic risk statistics. Then he further applied that to the portfolios that contain the investment options. He looked at the expected rate-of-return and the expected volatility for each investment. He named his risk-reward equation The Efficient Frontier. The graph below is an example of what the Efficient Frontier equation looks like when plotted. The purpose of The Efficient Frontier is to maximize returns while minimizing volatility.

Portfolios along The Efficient Frontier should have higher returns than is typical, on average, for the level of risk the portfolio assumes.

Notice that The Efficient Frontier line starts with lower expected risks and returns, and it moves upward to higher expected risks and returns. So people with different Investor Profiles (determined by investment time horizon, tolerance for risk and personal preferences) can find an appropriate portfolio anywhere along The Efficient Frontier line.

The Efficient Frontier flattens as it goes higher because there is a limit to the returns investors can expect.