Modern Portfolio Theory

Post on: 16 Март, 2015 No Comment

google+

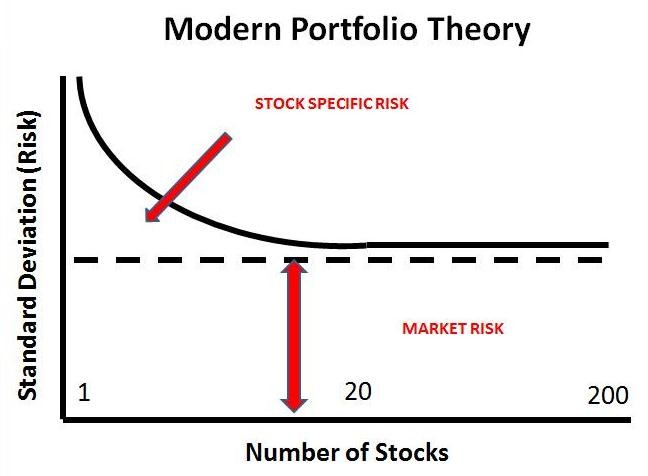

Modern portfolio theory (MPT) suggests how a rational investor can optimize his portfolio and price his/her risky assets. According to this theory, it is incorrect to consider the potential returns and risks of just a single stock. An investor is advised to build a portfolio of diversified investments in multiple asset classes, which should reduce overall risk.

Modern Portfolio Theory: Risks to Returns

Here are some risks to returns as indicated by the modern portfolio theory:

Systematic risks: Systemic risks, such as inflation, interest rate movements and economic slowdown, affect all assets simultaneously.

Unsystematic risks: These risks are specific to a financial asset but this can be minimized by reducing exposure to it and diversifying the portfolio.

Modern Portfolio: The Basic Concept

The modern portfolio theory considers that an investor takes the risk of generating lower-than-expected returns from an asset. So, the risk on each asset is a deviation from the average return from the asset. This variance from the expected return will be low if an investor is investing in a portfolio of diverse, uncorrelated financial assets.

For a well-diversified portfolio, the risks (or the average deviation from the mean) associated with each stock does not contribute significantly to the risks on the returns from a portfolio. Rather, the overall portfolio risk is determined by the difference between the levels of risk on the individual assets. So, investors benefit immensely from holding diversified portfolios instead of individual financial assets.

The Efficient Frontier of Modern Portfolio Theory

The modern portfolio theory assumes that investors are essentially risk averse and would opt for a less risky asset, if they are offered two assets that offer the same returns. Opting for higher risk can be pursued only if higher returns are expected from the investment. This means that a rational investor would never invest in a high-risk portfolio when given another option of having a portfolio with a more favorable risk-return profile.

A graph can be used to plot the risk-reward profile of various portfolios. It helps to depict the efficient frontiers too. While a portfolio on the upper part of the efficient frontier is efficient (offering high returns for specified level of risks), investors who aim for higher returns are likely to opt for a portfolio lying in the upper part of the efficient frontier.